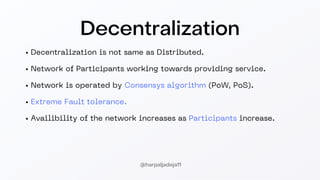

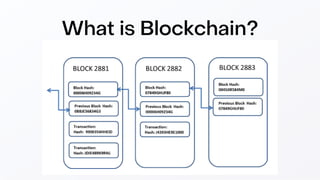

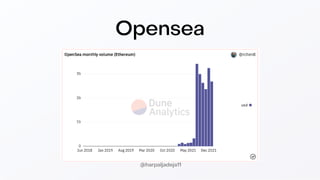

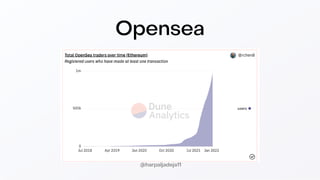

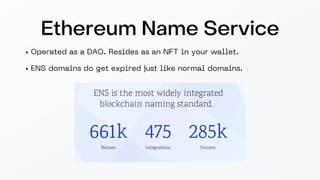

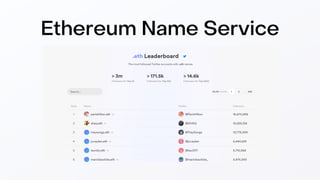

The document provides an overview of Web3, including its key characteristics of decentralization, trustlessness, and permissionlessness. It discusses blockchain technology and popular applications like Ethereum, DeFi protocols like Uniswap and Compound, and NFT marketplaces like OpenSea. Emerging areas covered include the metaverse, zero-knowledge proofs, and bringing real-world assets onto blockchain networks. The document also outlines the typical technology stack used to build decentralized applications on Web3.