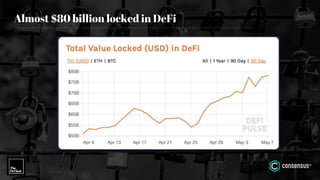

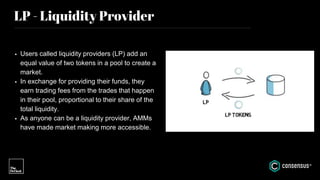

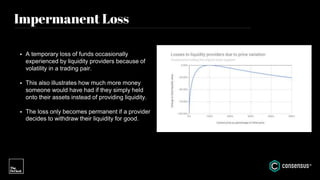

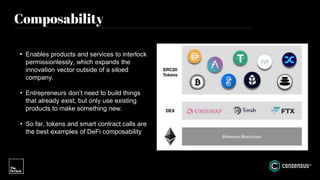

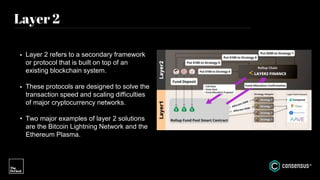

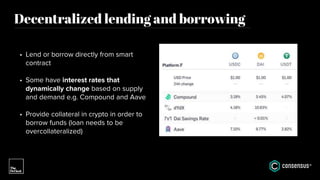

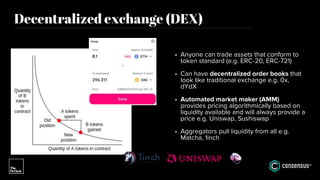

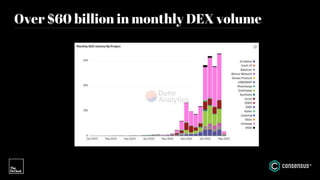

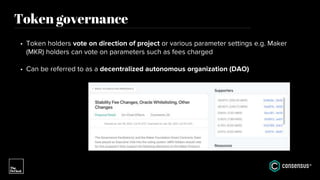

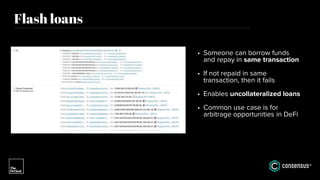

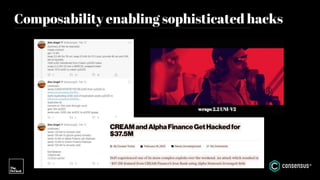

The document provides an overview of decentralized finance (DeFi) including common terms and applications. It discusses how DeFi allows for lending, borrowing, and farming of crypto assets using smart contracts in a permissionless and trustless manner. Specific DeFi applications mentioned include stablecoins, automated market makers, liquidity pools, yield farming, lending platforms, decentralized exchanges, flash loans, and the composability of combining different DeFi building blocks.