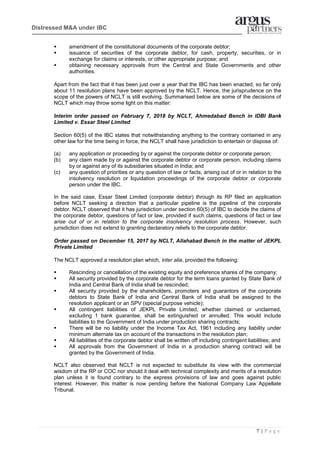

The document provides an overview of distressed M&A under the Insolvency and Bankruptcy Code of India. It discusses the key aspects of the resolution process including initiation, moratorium, appointment of the resolution professional, formation of the committee of creditors, preparation of an information memorandum, invitation of resolution plans subject to certain eligibility criteria, and timelines for completion of the process within 270 days.