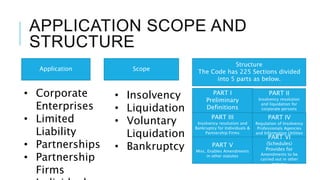

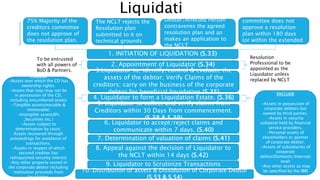

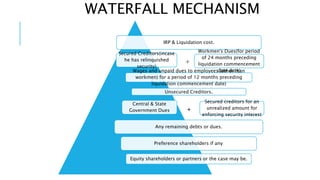

The Insolvency and Bankruptcy Code 2016 outlines terms related to financial and operational creditors, the moratorium period, and the process for insolvency resolution and liquidation for corporate entities and individuals. It details the application structure, sections concerning liquidation, and the definitions of debt types, alongside procedures for claims, repayments, and bankruptcy. The code serves to regulate insolvency professionals, oversee liquidation processes, and establish a framework for the repayment and discharge of debts.

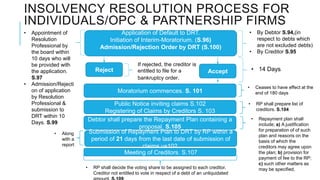

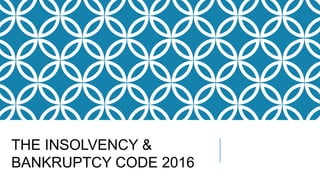

![INSOLVENCY RESOLUTION

PROCESS FOR COMPANIES & LLP

Application of Default to NCLT

REJECTED

ACCEPTED

(Insolvency

commencem

ent date)

Initiation of Moratorium (S.13 & S.14 )

Appointment of Interim Resolution Professional by NCLT

(30 Days Term) (S.16). Public Announcement (S.15) (14

Days)

Submission of Plan

to NCLT

Implementation of

Plan

Liquidation [S.33]

Constitution of Committee of Creditors by Interim RP (S.21)

which shall appoint the Resolution Professional (S.22)

within 7 Days

Plan Rejected/No Resolution Plan

[S.31 (2)]

Plan Accepted [S.31

(1)]

Application of aggrieved party after contravention of

Withi

n 30

Days

By financial Creditor

(S.7), operational

creditor(S.9)/corporate

debtor itself (S.10)

Within 14

Days

Within 180

Days

(Extended

up to

further 90

Days)

[S.12]

Fast Track;

Within a

period of

90 Days

which may

extend to

not more

than 45

Days.

Minimum 75%

Vote

Minimum threshold 1

Lakh

Moratorium shall

cease to have

effect.

Submission of Resolution plan by Resolution applicant to

the Resolution Professional. (S.30)

Resolution Professional shall present it to Committee of

Creditors for Approval [S.30 (4) ]

NCLT may

give notice

to rectify

the defects

within 7

days](https://image.slidesharecdn.com/ibc1-170208073303/85/Insolvency-Bankruptcy-Code-2016-6-320.jpg)

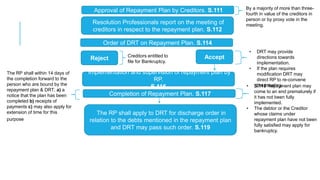

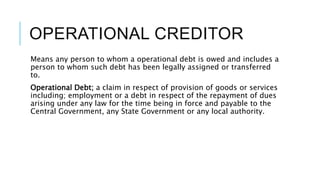

![Application for Initiating Fresh Start Process.

Eligible debtor* personally/through IRP can

apply to the DRT for discharge of Qualified

debts**.(S.80)

Eligibility.*

a) Gross annual

income does not

exceed 60k.

b) The agg. Value

of assets does

not exceed 20k.

c) The agg. Value

of qualifying

debts does not

exceed 35k.

d) Not an

undischarged

bankrupt.

e) Does not own a

dwelling unit,

irrespective of

whether it is

encumbered or

not;

f) A fresh start or

IRP or

bankruptcy

process is not

subsisting.

g) No fresh start

order has been

made in the

preceding 12

months of the

FRESH START – Individuals/One Person

Company

Initiation of Interim-Moratorium. (S.81)

Appointment of Resolution Professional. S.82

Qualified Debts**. a) A debt to the extent it

is secured. c) Debt incurred 3 months prior

to the application c) an excluded debt.

Liability to pay for; [a) fine imposed by a

tribunal/court. b) damages for negligence,

nuisance or breach of statutory

contract/other legal obligation. c)

maintenance under any law for the time

being in force. d) student loan e) any other

debt as may be prescribed.]

Examination of Application by RP and

Submission to DRT. S.83

Within 10 days of

appointment

Order of Admission/Rejection of Application by

DRT. Within 14 Days. S.84

Commencement of

Moratorium. S.85

Application of Objection by Creditor &

Examination by RP. S.86

May object on; a)

inclusion of debt as

qualifying debt.

b) Incorrectness of

details of the QD

specified in the order.

Application against decision of RP by

Creditor/Debtor. S.87

Application for Revocation of Order u/s 84 by

RP.

(S.91)

Grounds: a) change in

financial circumstances of the

debtor, the debtor is ineligible

for a fresh start process. b)

non compliance by debtor

under moratorium.

Discharge from a) penalties in respect from QD from the

DOA till DOO. b) interest including penal interest in respect

of QD from the DOA till DOO. c) any other sums owed

under any contract in respect of QD from DOA till DOO.

Order. U/S.92

180

Days.

Unless

revoked

under

S.91](https://image.slidesharecdn.com/ibc1-170208073303/85/Insolvency-Bankruptcy-Code-2016-10-320.jpg)