Embedding Risk Management into Business Operations through Internal Controls

In today’s complex and competitive business environment, effective internal controls are no longer a compliance formality. They are a core management tool that supports risk management, operational efficiency, and sustainable growth. Organizations that embed internal controls into daily operations are better positioned to prevent losses, respond to risks, and achieve strategic objectives.

Internal control is best understood as the set of policies, procedures, and behaviors through which management ensures that operations are conducted efficiently, assets are safeguarded, financial information is reliable, and laws and regulations are complied with. Strong internal controls translate risk awareness into practical actions across all levels of the organization.

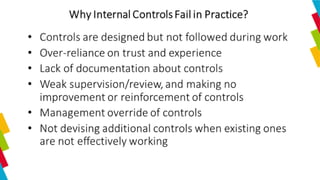

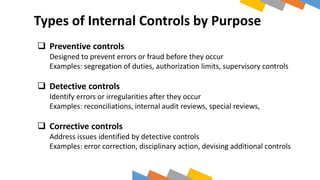

Risk management and internal controls are closely linked. Risk management identifies what can go wrong and assesses its potential impact, while internal controls define how those risks are mitigated in practice. When controls are weak or poorly implemented, risks materialize in the form of fraud, errors, inefficiencies, and reputational damage. When controls are well designed and consistently applied, they act as preventive and detective mechanisms that protect the organization and support informed decision-making.

Management plays the central role in designing, implementing, and operating internal controls. Controls are not owned by auditors. Internal audit provides independent assurance on the adequacy and effectiveness of controls, but accountability rests with management. A strong control environment is driven by leadership tone, ethical culture, clear responsibilities, and ongoing supervision.

Effective internal controls must cover the full business cycle, including procurement, inventory, sales, payroll, fixed assets, and financial reporting. They should be practical, risk-based, and aligned with business realities. Tools such as control self-assessment encourage ownership within business units and help identify weaknesses before they escalate into significant issues.

Ultimately, robust internal controls deliver measurable value. They reduce fraud and errors, improve operational discipline, enhance governance, and build stakeholder confidence. Organizations that treat internal controls as an integral part of business operations, rather than a checklist exercise, are better equipped to manage uncertainty and achieve long-term success.