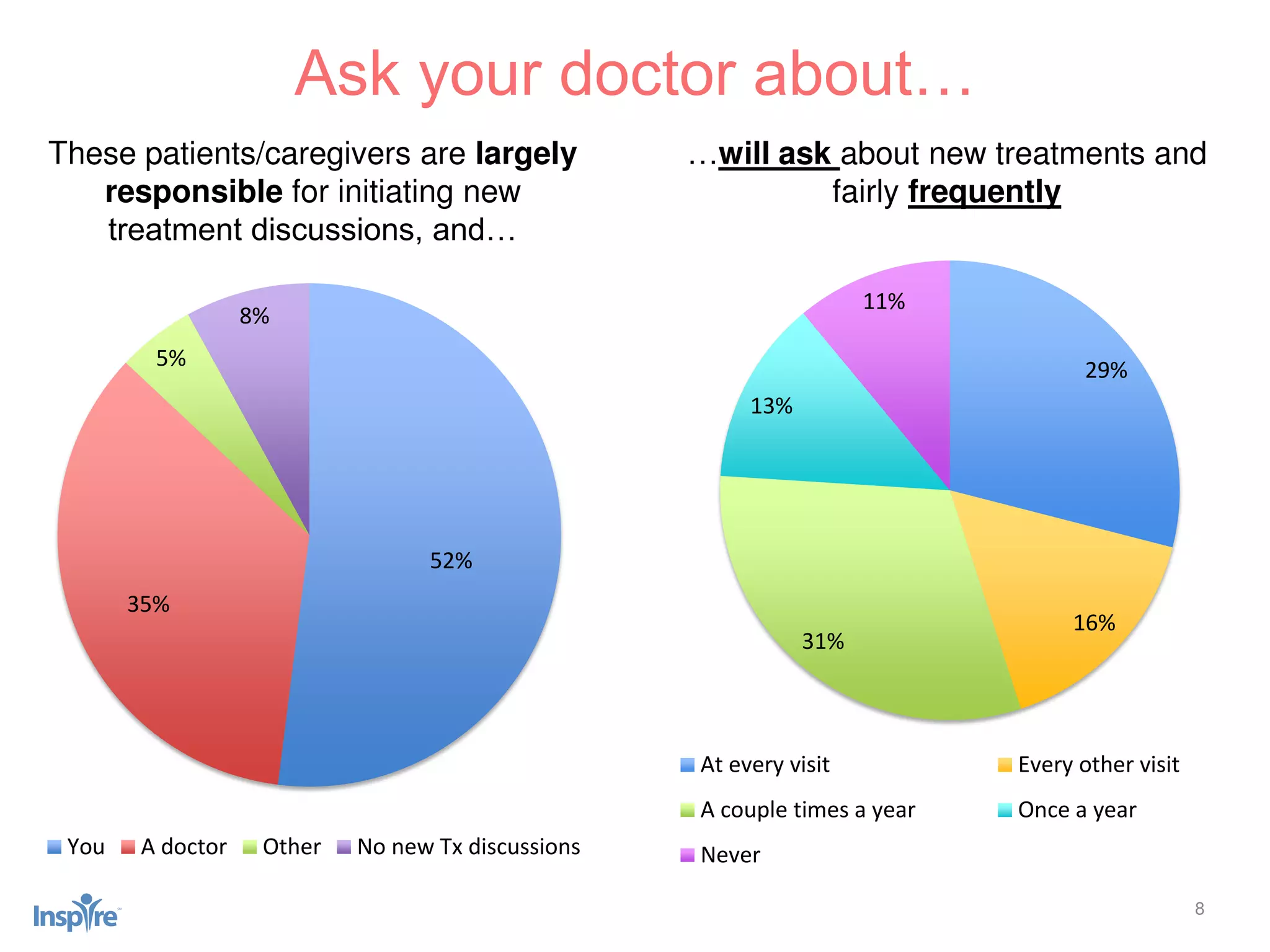

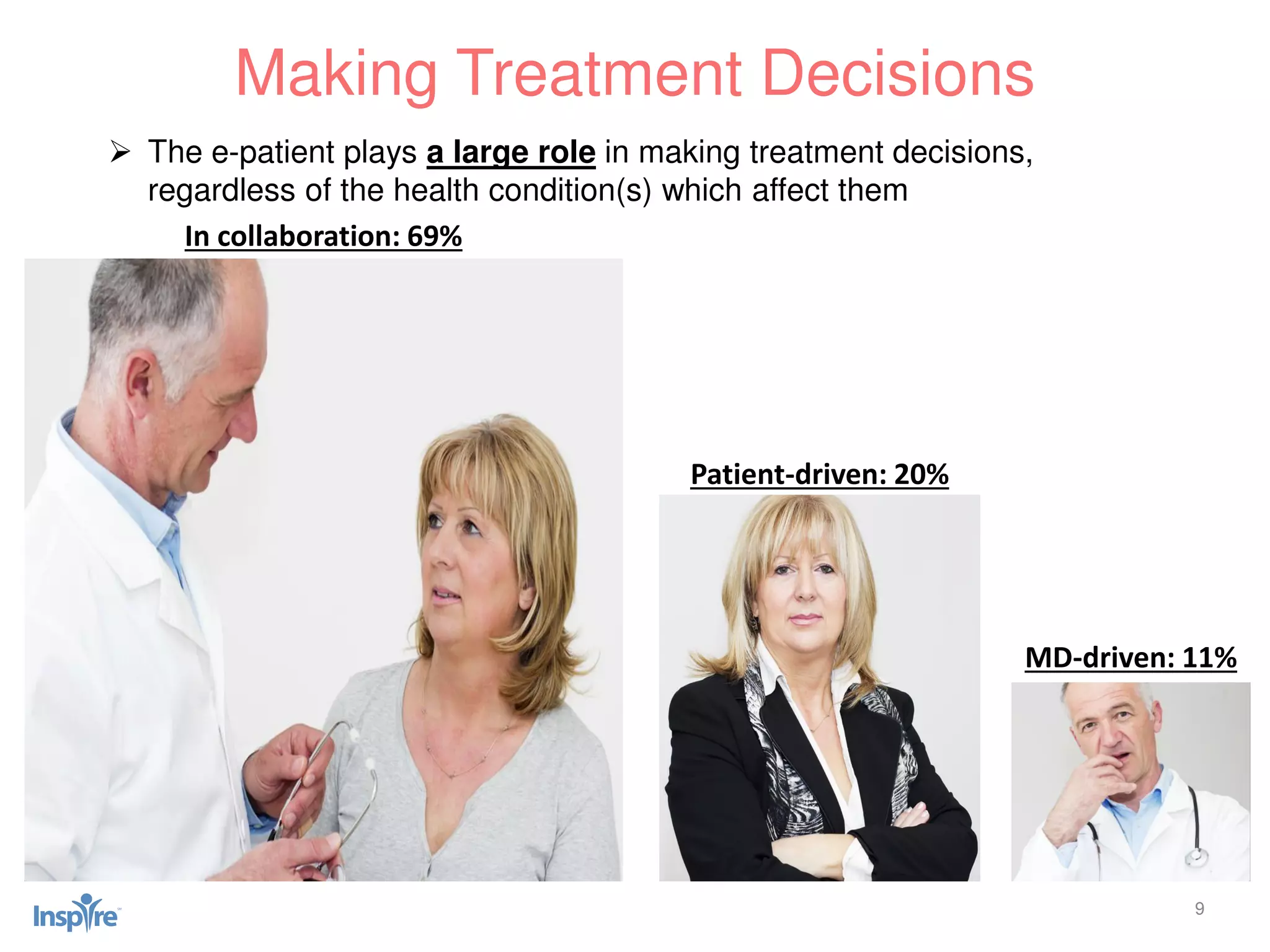

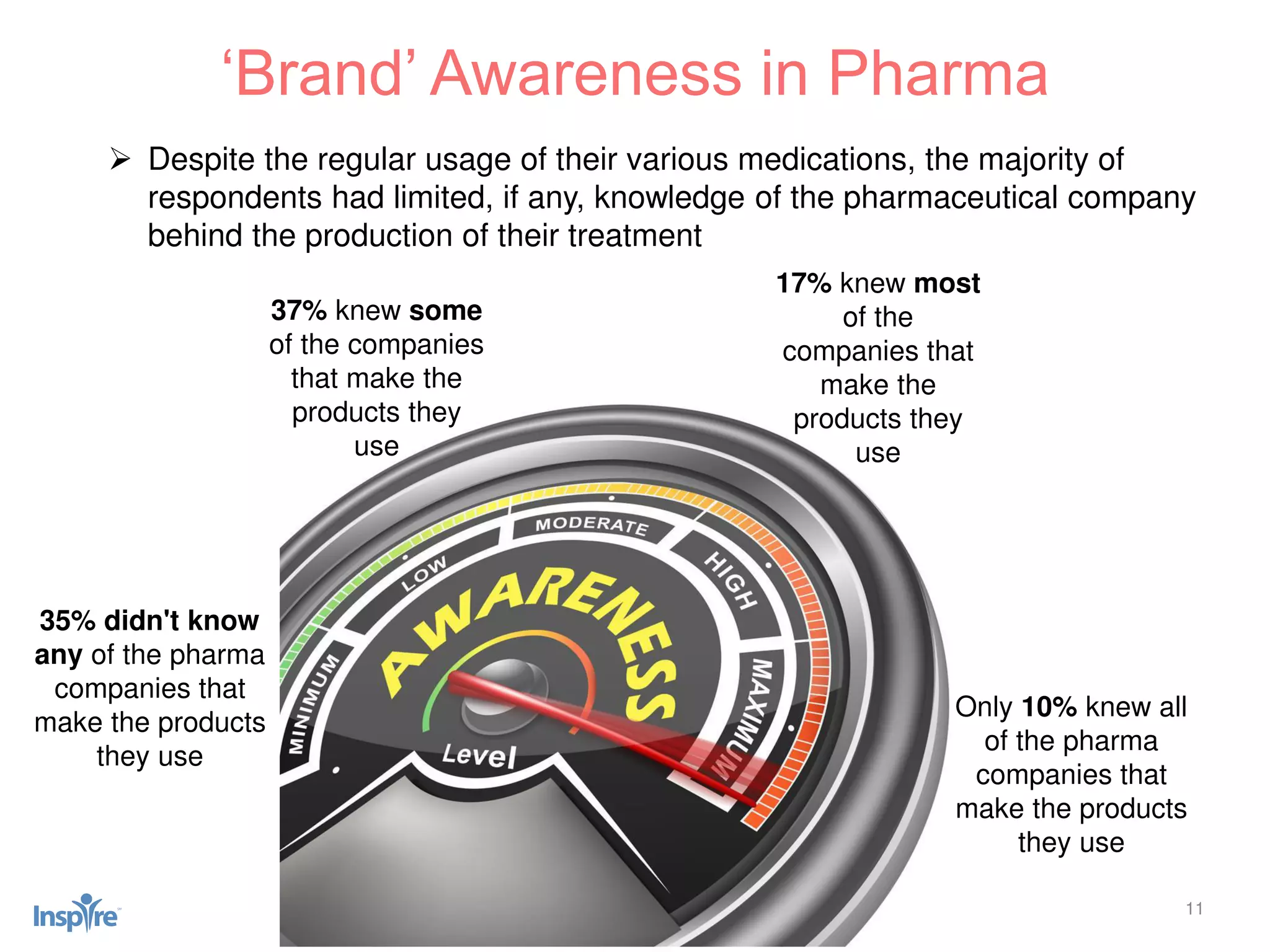

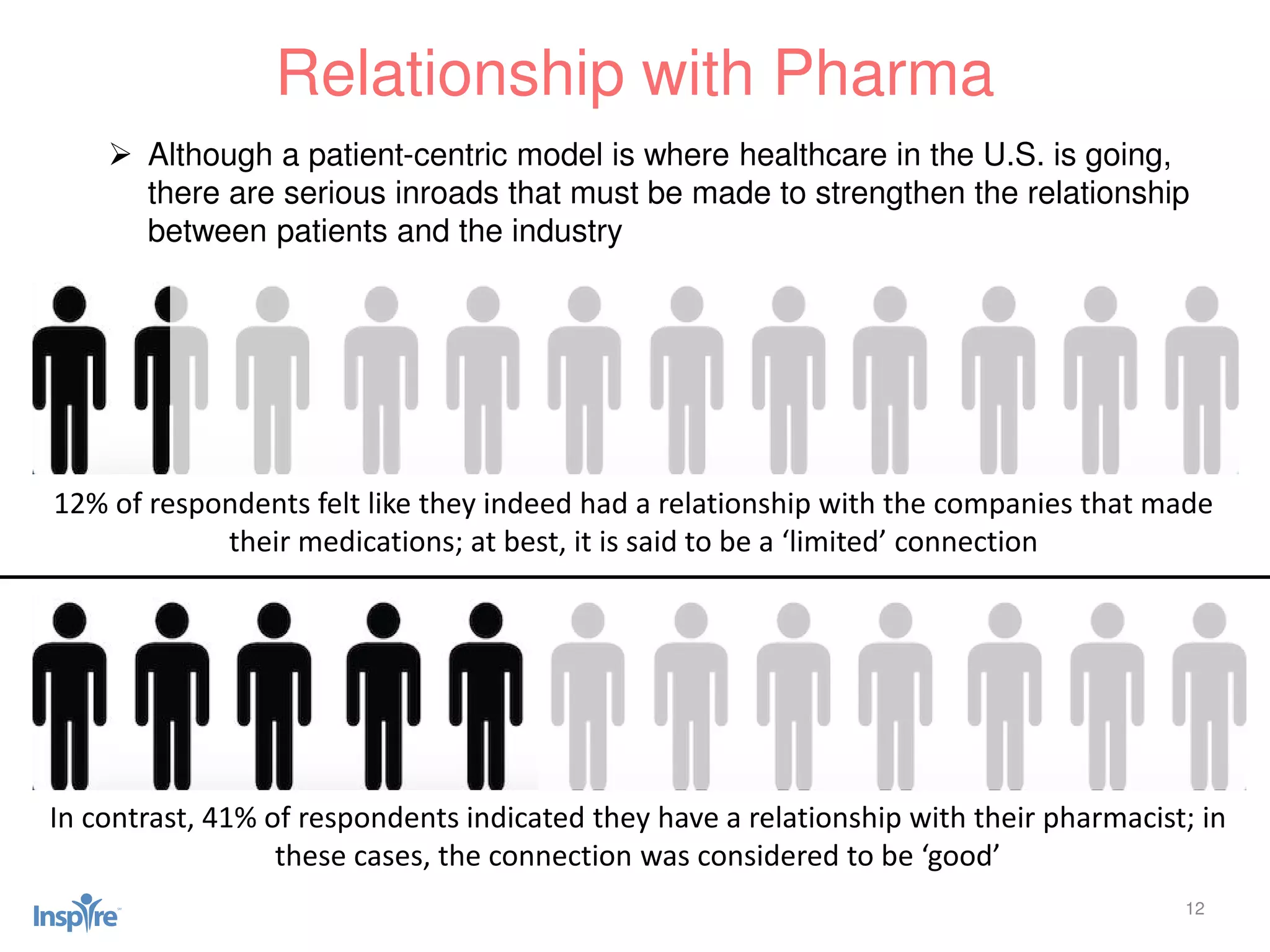

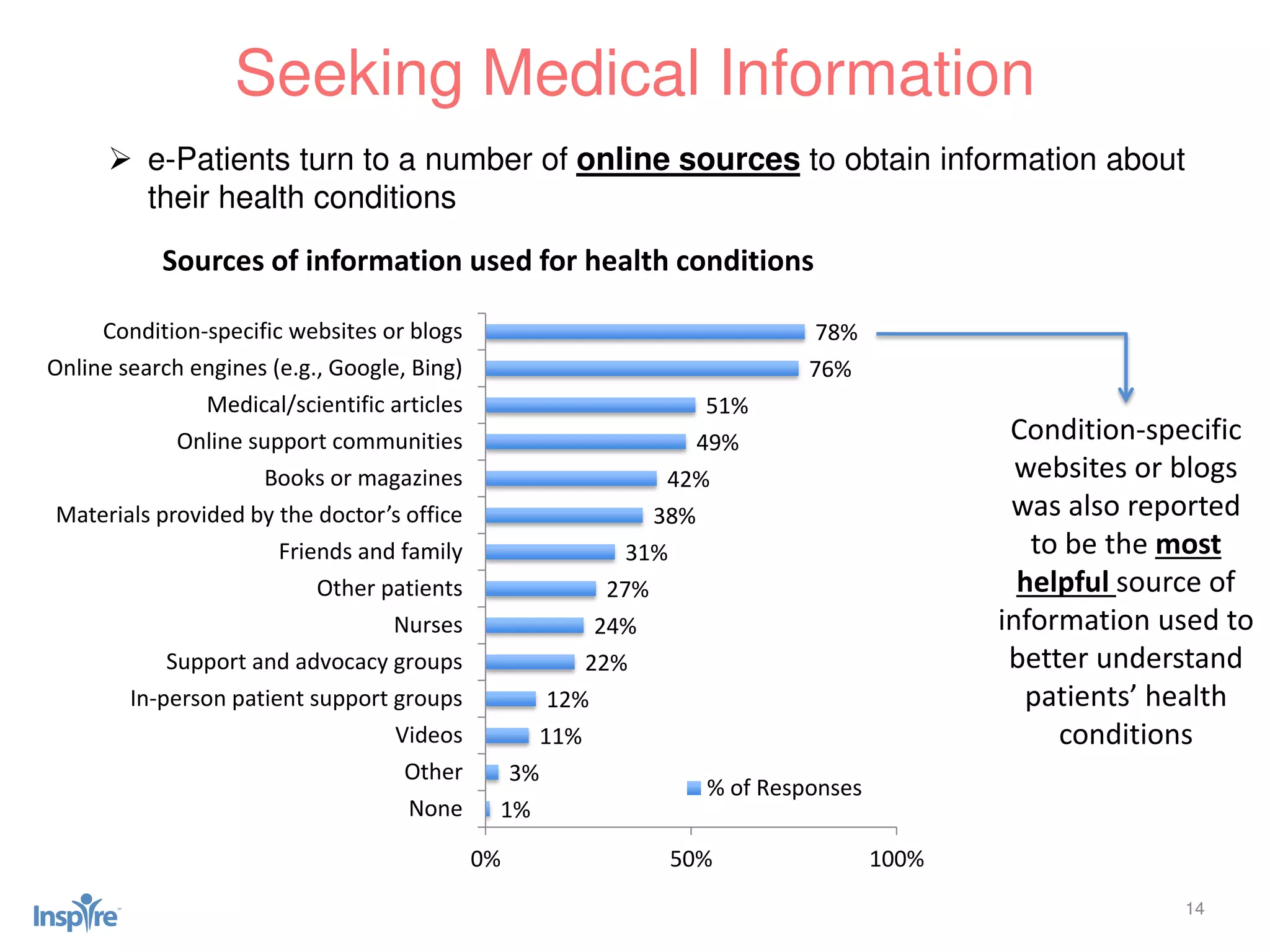

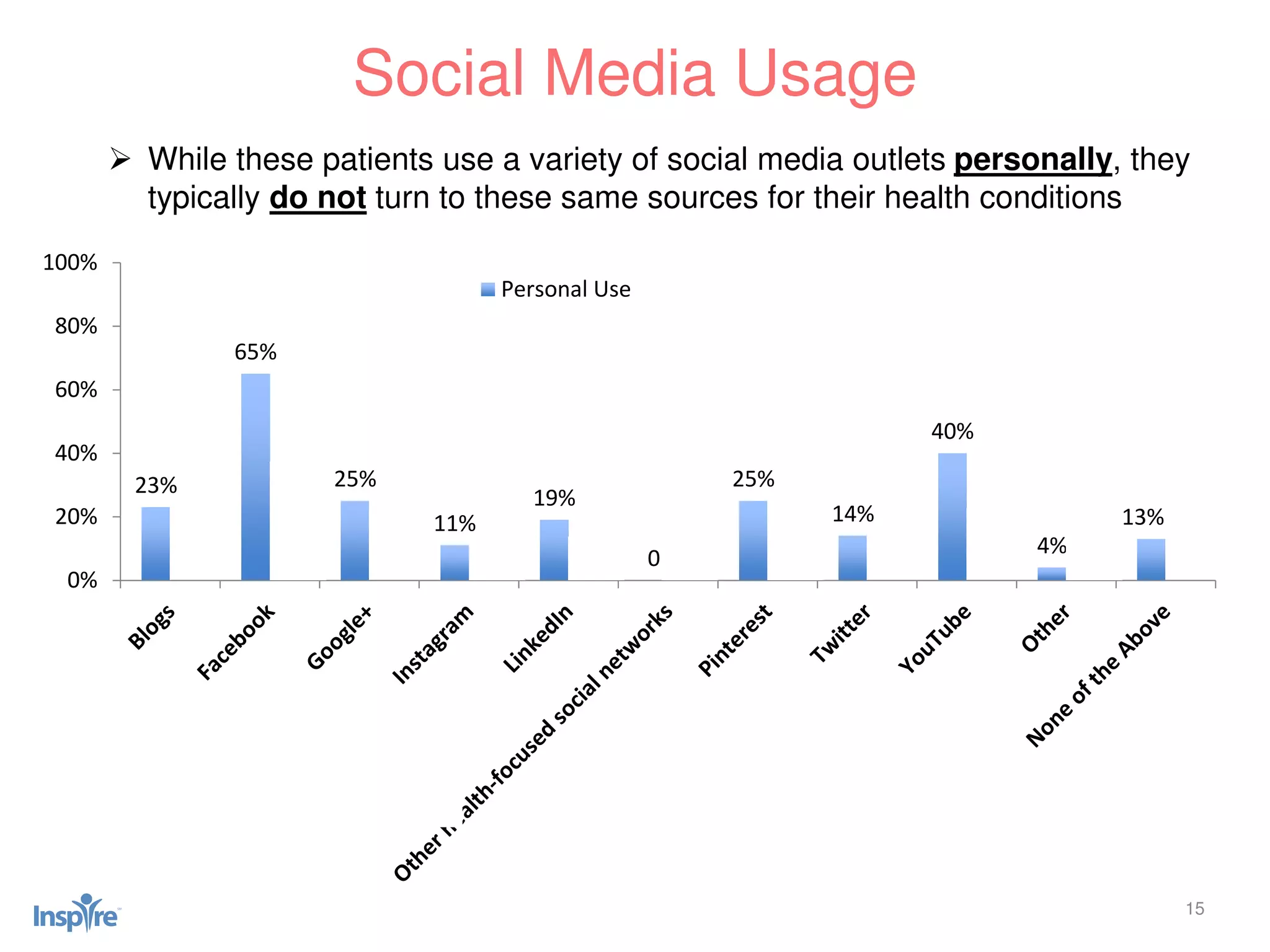

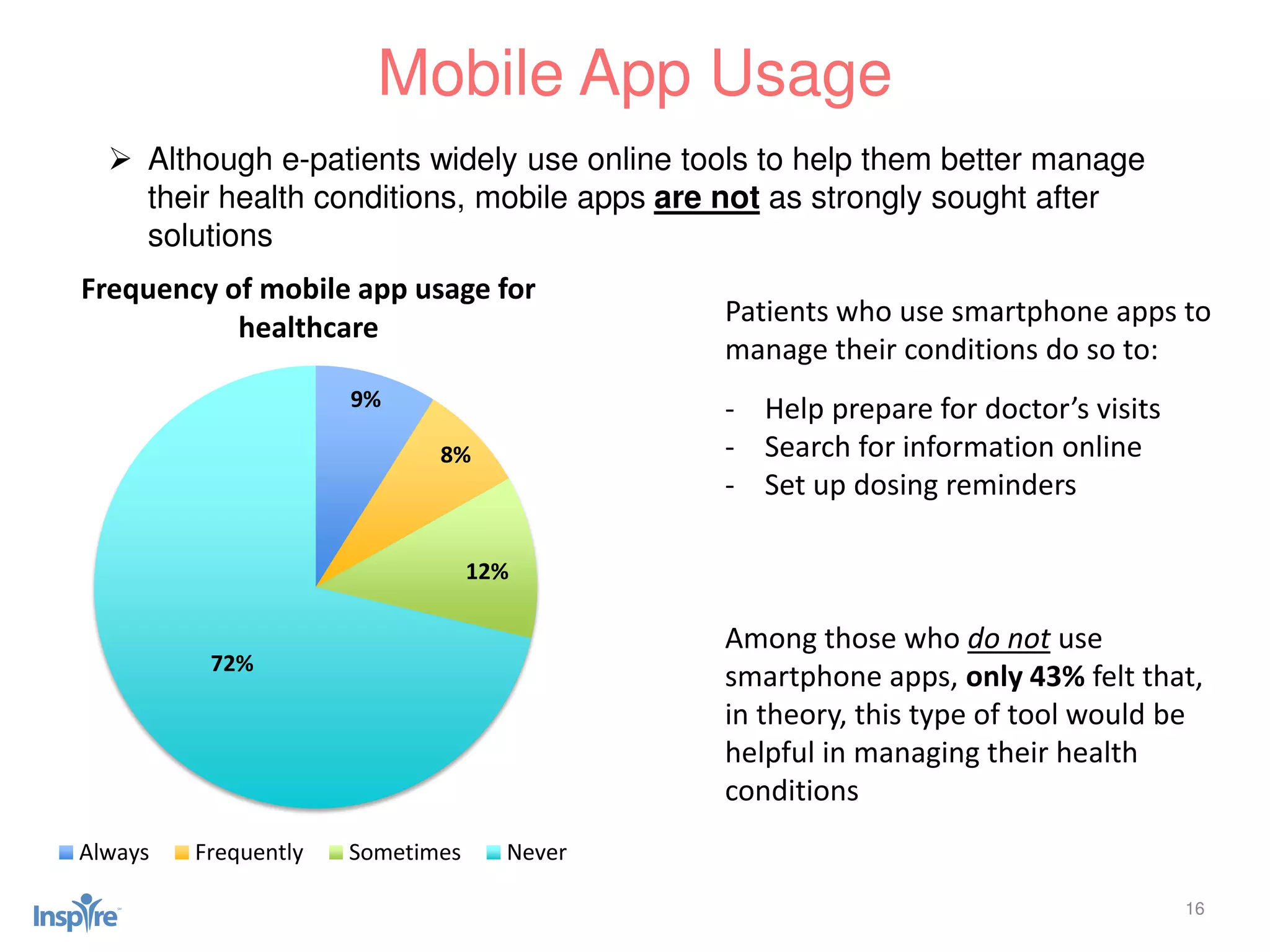

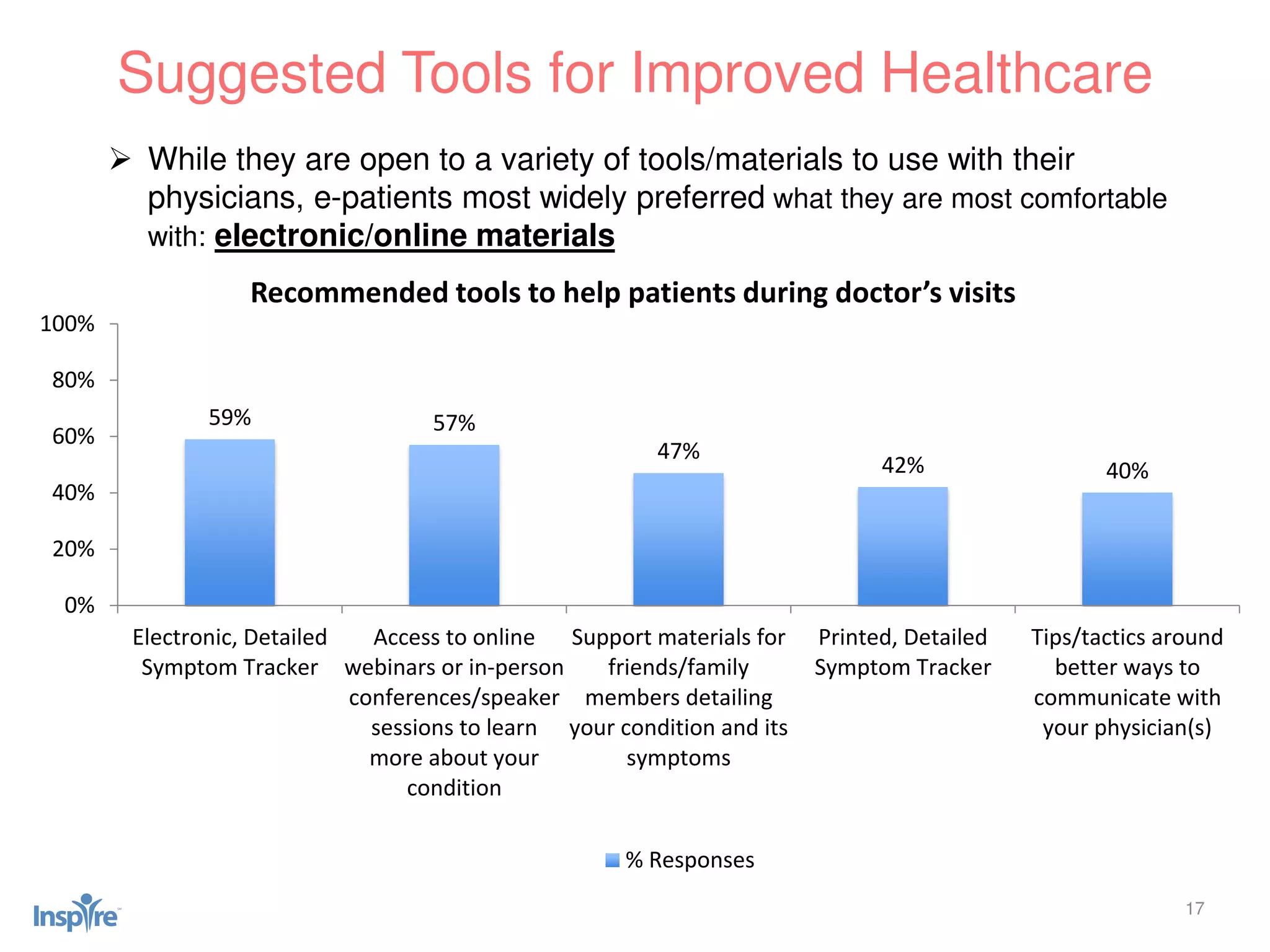

The 2014 Inspire Annual Patient and Caregiver Survey highlights the perspectives of e-patients, revealing significant gaps in their knowledge of pharmaceutical companies and their engagement with the healthcare industry. The survey, which collected responses from over 13,000 participants across 100 countries, indicates that while e-patients are actively involved in treatment decisions, they often feel a limited connection to the companies behind their medications. Additionally, the survey explores various sources where e-patients seek information about their health, emphasizing the importance of condition-specific websites and the lesser role of social media in their healthcare management.