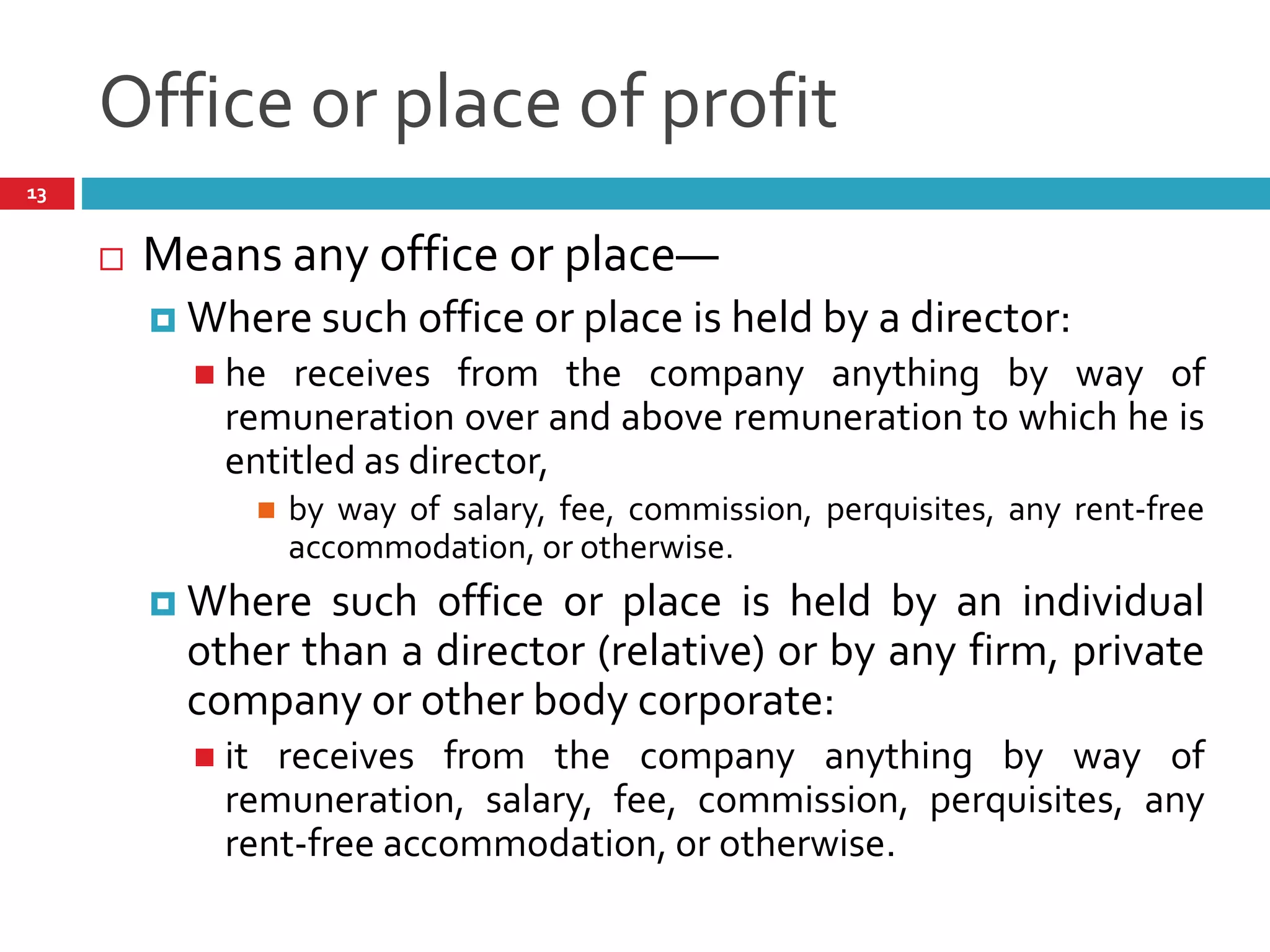

This document outlines the regulations surrounding related party transactions as per the Companies Act, 2013, highlighting definitions, thresholds for member approval, and the roles of the audit committee. It specifies how related parties are defined and outlines the necessary disclosures, approvals, and consequences of non-compliance with the legal provisions. Key points also include the amendments from the Companies (Amendment) Bill, 2016, which affect voting rights and the processes of transaction approvals.

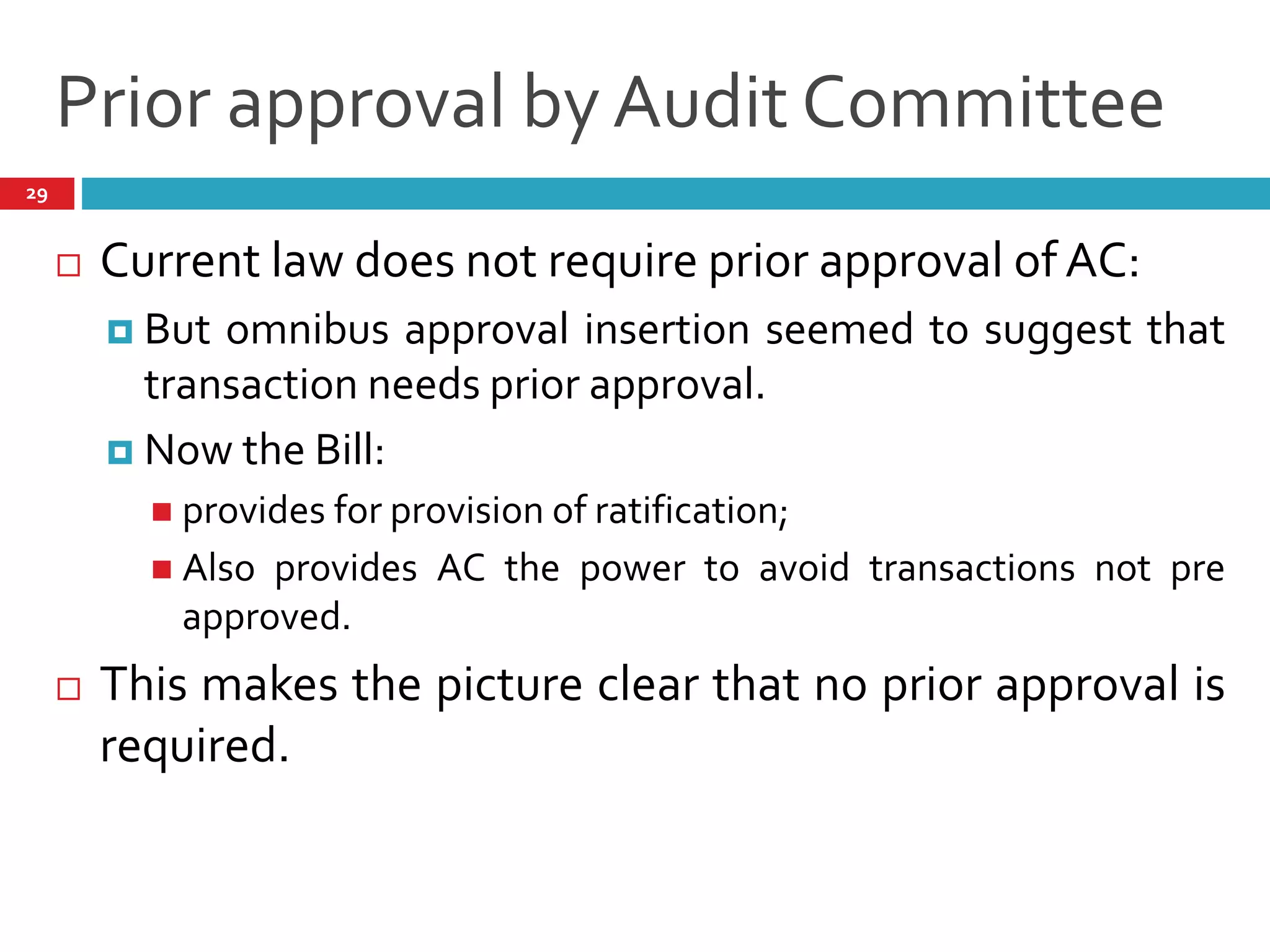

![Who is a Related Party? [Section 2(76)]

(1/2)

Directors and KMPs

including their relatives

A firm in which a director,

manager and their relative

Director (excluding IDs) or

KMPs of holding company

and their relative

Private company in which a

director or manager or his

relative is a member or

director

Related

Party

6](https://image.slidesharecdn.com/pptreatedpartytransactions-office-170321061538/75/Related-Party-Transactions-6-2048.jpg)

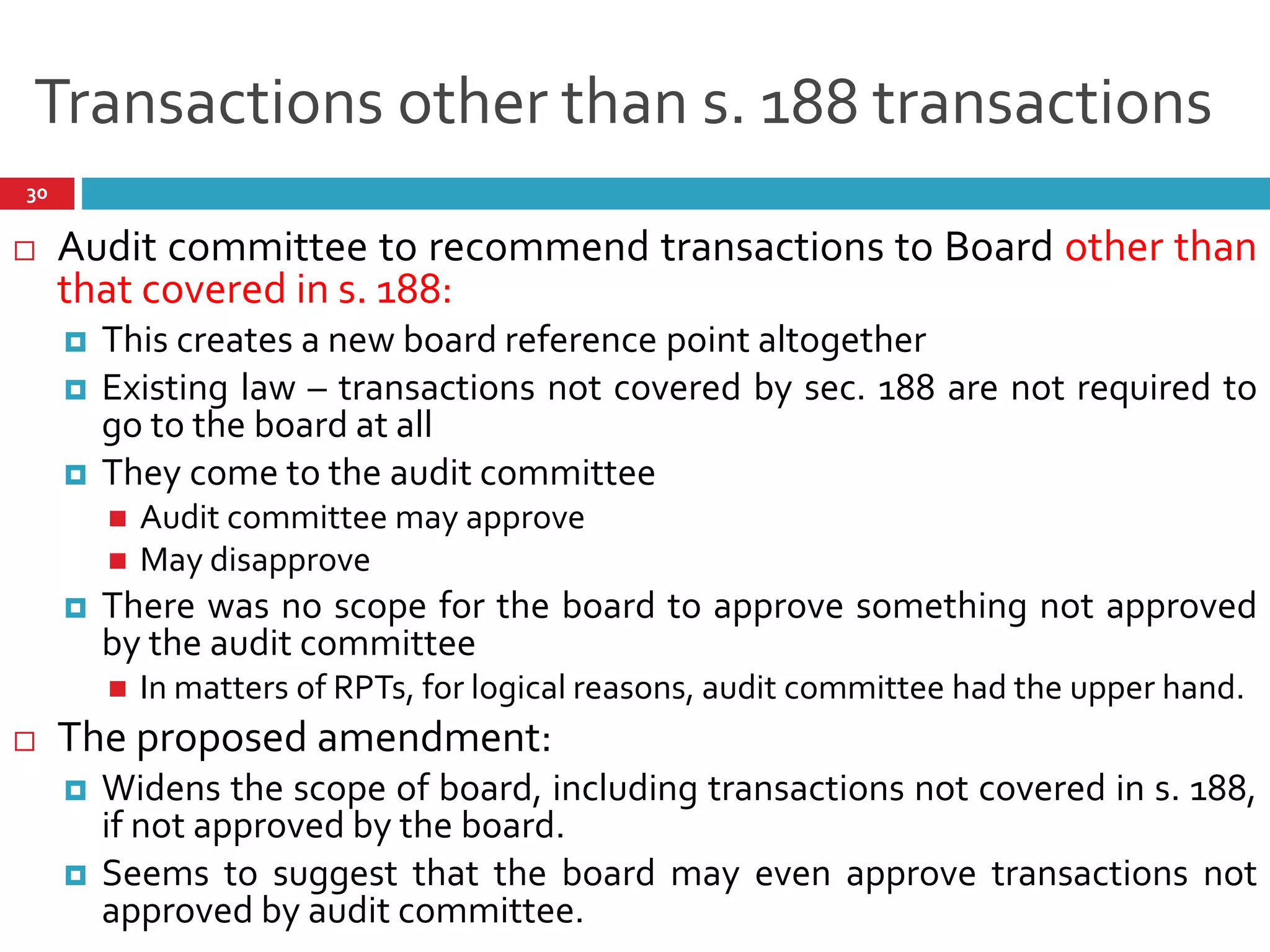

![Who is a Related Party? [Section 2(76)]

(2/2)

Public company in which a

director or manager is a director

and holds along with his

relatives, more than 2% of its

paid-up share capital

body corporate Board, MD or

manager is accustomed to act in

accordance with the advice of a

director or manager

any person on whose advice,

directions or instructions a

director or manager is

accustomed to act

company which is—

(A) a H / S / AC of such company;

or (B) subsidiary of holding

company to which it is

subsidiary*

Related

Party

*does not apply to a private company.

7](https://image.slidesharecdn.com/pptreatedpartytransactions-office-170321061538/75/Related-Party-Transactions-7-2048.jpg)

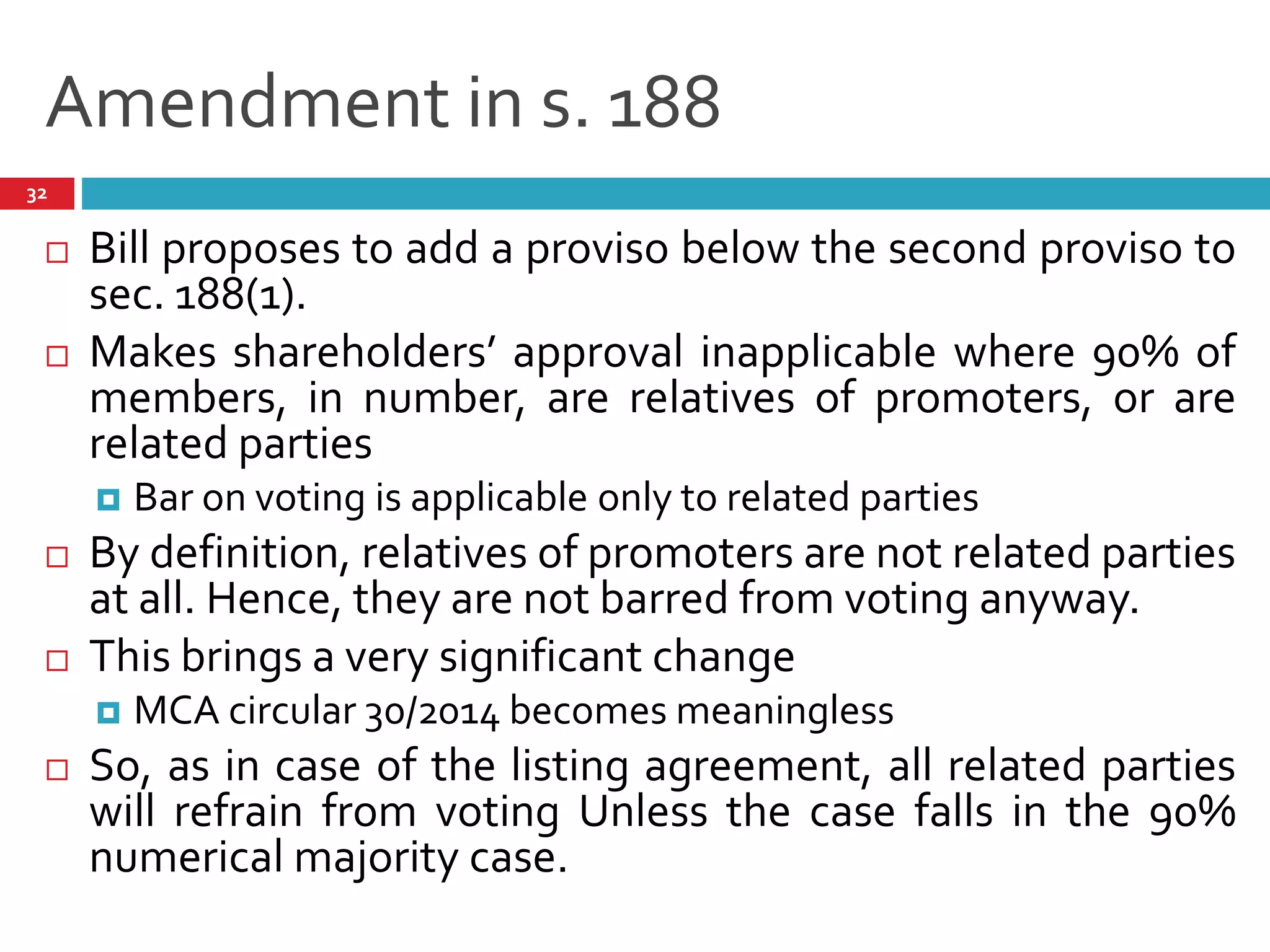

![Relative [Section 2(77)]

read with Rule 4 of Chapter I Rules

Members of HUF;

Spouse;

Father – including step-father;

Mother – including step-mother;

Son – including step-son;

Son’s wife;

Daughter;

Daughter’s husband;

Brother – including step-brother;

Sister – including step-sister.

8](https://image.slidesharecdn.com/pptreatedpartytransactions-office-170321061538/75/Related-Party-Transactions-8-2048.jpg)

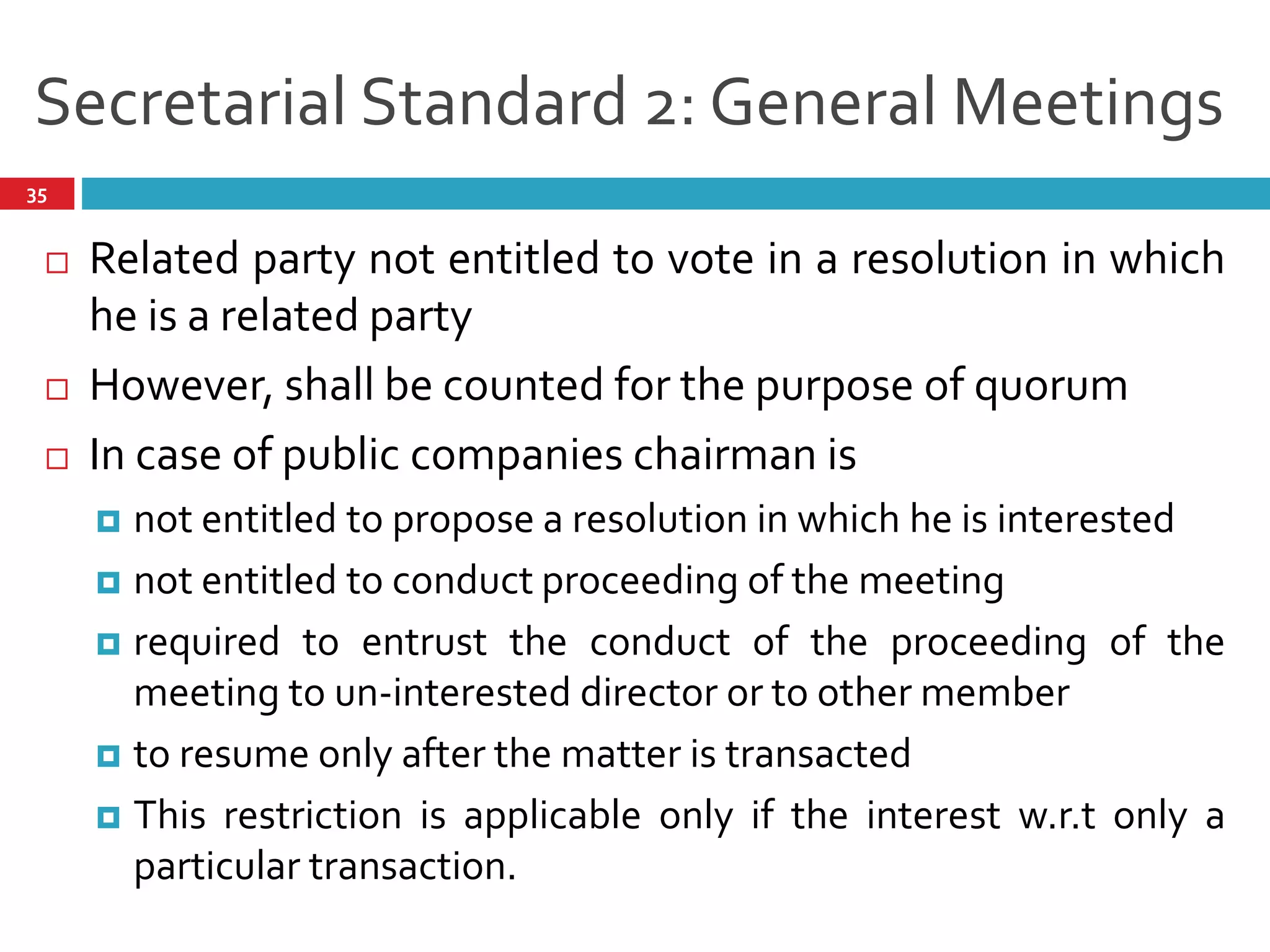

![What is ordinary course of business?

Ordinary course of business will not cover what is the object of

the company as defined in memorandum of association.

As per general understanding, “ordinary course of business” will

cover the usual / routine transactions, customs and practices of

a business and of a company.

Reference may be drawn to the judicial interpretation of the

term “ordinary course of business”, whereby the Allahabad

court in its ruling in the case of Kalapnath Singh vs. Surajpal

Singh and others [AIR 1949 ALL 425] has given interpretation

to term like ‘regular course of business’; ‘common course of

business’; ‘usual course of business’.

15](https://image.slidesharecdn.com/pptreatedpartytransactions-office-170321061538/75/Related-Party-Transactions-15-2048.jpg)