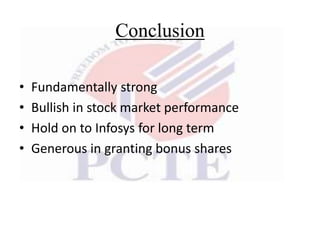

1) Infosys is a global consulting and IT services company established in 1981 with a market capitalization of $72.2 billion and major presence in the US, China, Australia, Japan, Middle East and Europe.

2) Infosys operates in the software development sector and markets internationally, with 100% FDI allowed in data processing. Major players include TCS, Wipro, HCL, Tech Mahindra, and Accenture.

3) Factors affecting Infosys include economic factors like recessionary global GDP trends and low IT spending, and political factors like India's budget aimed at boosting the technology sector with $31 billion allocated to new schemes