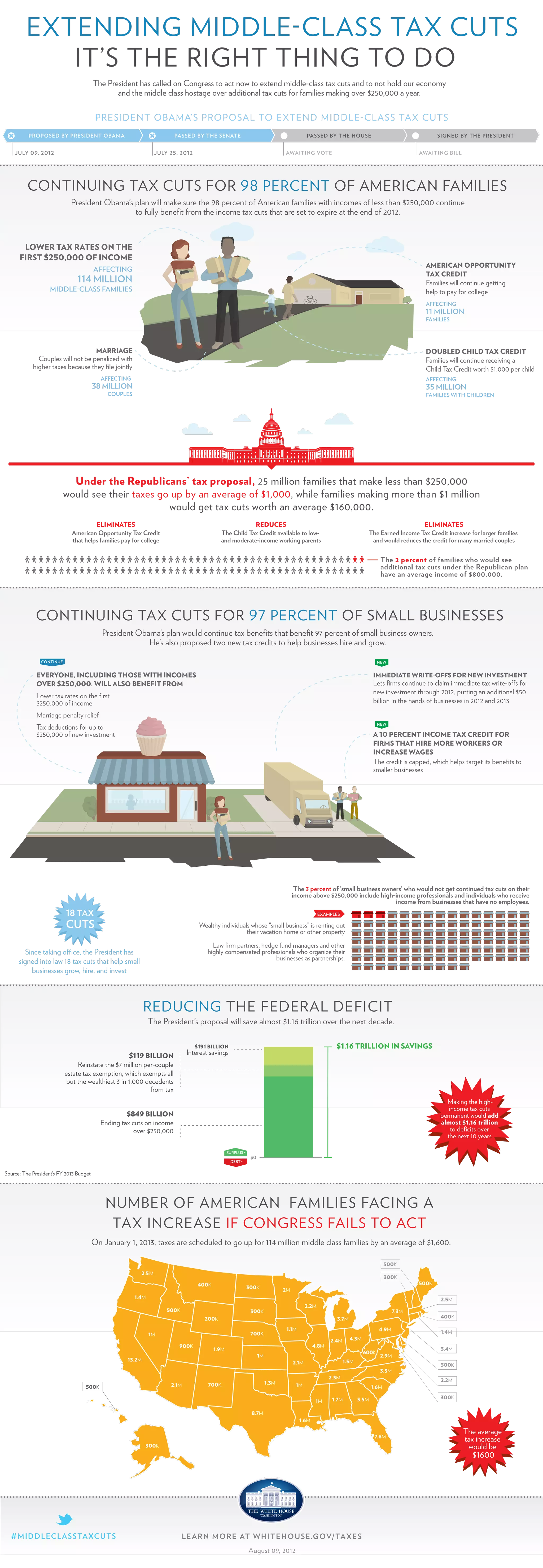

The document discusses President Obama's proposal to extend middle-class tax cuts. It proposes extending tax cuts for families making under $250,000 per year. This would benefit 114 million middle-class families. Failing to extend the cuts would increase taxes by an average of $1,600 for each of these families. The plan aims to reduce the federal deficit by $1.16 trillion over 10 years by not extending high-income tax cuts for those making over $250,000 annually.