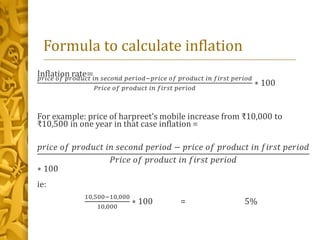

Inflation is defined as a sustained increase in the general price level of goods and services over time, which decreases the purchasing power of currency. There are three main causes of inflation: cost-push inflation occurs when business costs rise and are passed onto consumers; demand-pull inflation happens when consumer purchasing power increases, driving prices up; and money supply inflation results from increased money in circulation decreasing the value of currency. Deflation is the opposite of inflation, defined as a decrease in the general price level, and can be caused by debt deflation, lower money supply, credit contraction, or lower production costs.