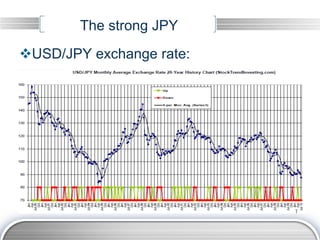

The document discusses why the Japanese yen is currently strong. It notes that Japan has a trade surplus and exports more than it imports, keeping demand for the yen high. Additionally, low interest rates and a safe-haven status have led to net capital inflows into Japan, further strengthening the currency. However, a strong yen threatens Japanese exporters by making their goods more expensive overseas and could weaken global demand. The document concludes by suggesting Japan should raise interest rates to reduce capital inflows and address its public debt problem.