- The Indian paint industry is over 100 years old and has experienced significant growth and restructuring over the past decades.

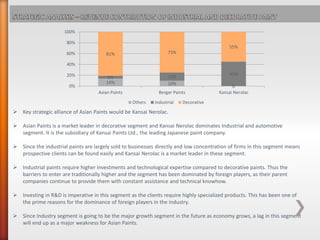

- Currently, the organized sector accounts for 65% of the market, with the top five players controlling over 80% of the organized market.

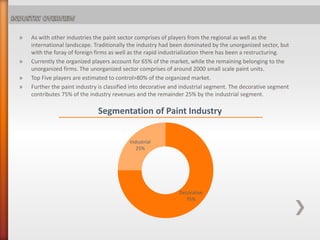

- The paint industry is split between the decorative paint segment, which contributes 75% of revenues, and the industrial paint segment, which contributes the remaining 25%.

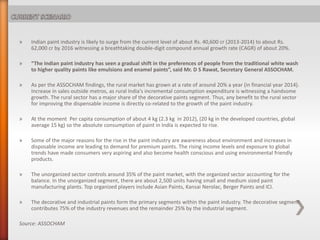

- Key drivers of growth include rising incomes, rapid urbanization, and increased commercial construction. The industry is projected to continue strong double-digit growth in the coming years.