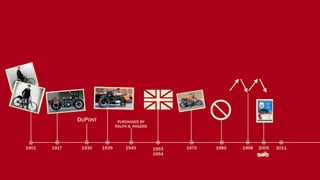

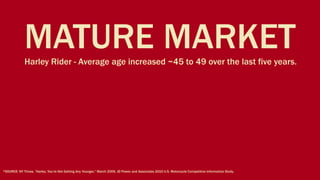

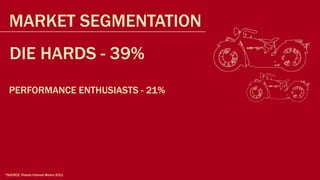

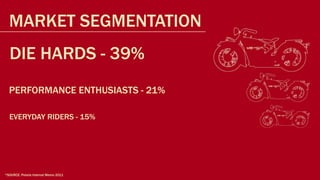

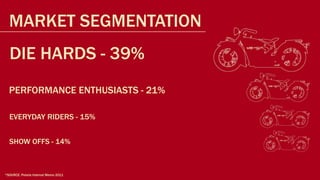

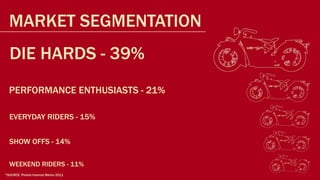

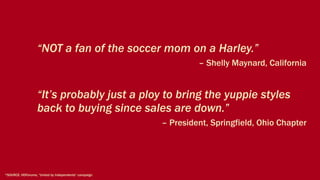

The acquisition of the Indian Motorcycle Company by Polaris Industries focuses on gaining a significant brand with a passionate history that resonates with motorcycle enthusiasts. The document discusses market insights and challenges, emphasizing Polaris's potential to succeed by leveraging resources and understanding market segmentation. Recommendations include strategies for premium branding and dealer development to enhance market presence.