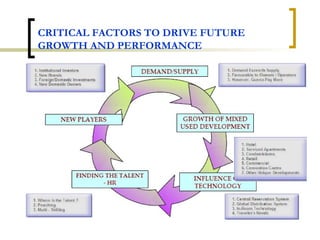

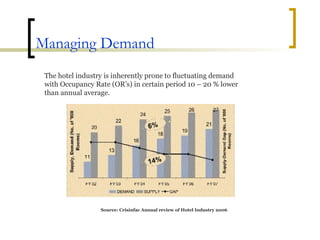

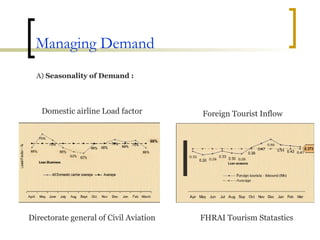

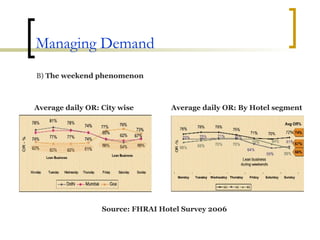

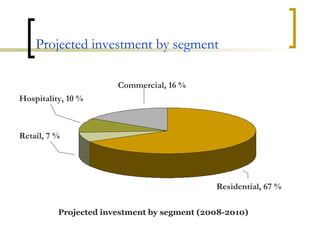

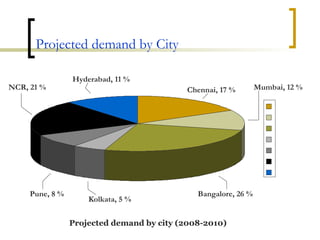

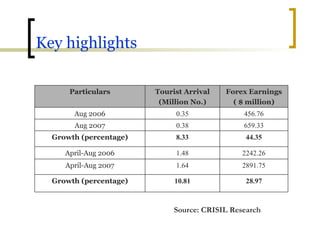

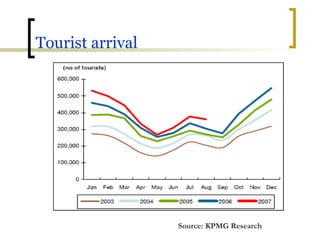

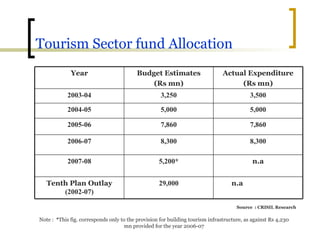

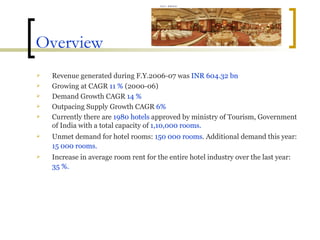

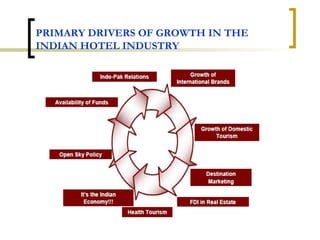

The document discusses the Indian hospitality industry. It notes that the tourism and hospitality sectors are growing rapidly, driven by factors like a booming economy, low cost airlines, and globalization. The hotel industry is experiencing unprecedented growth, with demand increasing faster than supply. While the industry is growing, it faces challenges around managing seasonal and weekday demand fluctuations and optimizing customer and sales channels. The real estate sector is also large and growing rapidly due to increased demand for housing, offices, and other commercial and industrial infrastructure.

![Service Apartments This concept is slowly gaining ground in the industry. They mainly target emigrant & long duration visitors [business & leisure]. Service apartments are preferred to hotels for the following reasons : Business executives find them safe, convenient, affordable & well maintained. They are larger than hotel rooms No rental deposits required in this case. They are beneficial for SME for their roving representatives.](https://image.slidesharecdn.com/indianhospitalityindustry-123980208986-phpapp02/85/Indian-Hospitality-Industry-20-320.jpg)