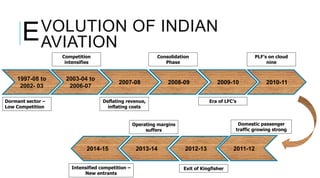

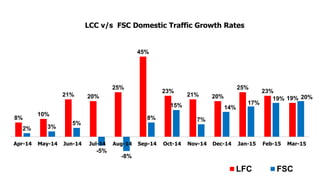

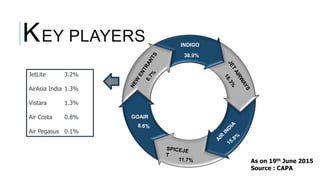

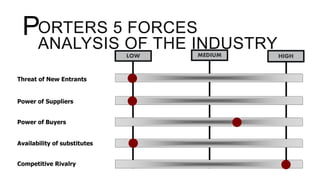

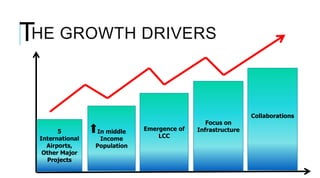

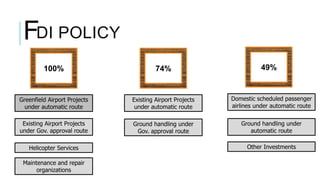

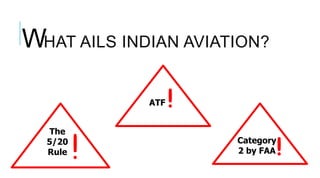

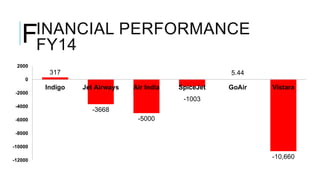

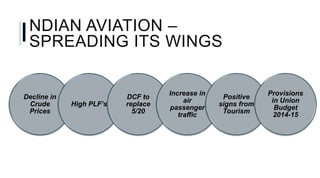

The document provides an overview of the Indian aviation industry, including its evolution, key players, growth drivers, challenges, and investment opportunities. It discusses how the industry has grown from a dormant sector with low competition in 1997-2008 to seeing intensified competition from new entrants today. While certain carriers like Indigo have seen financial growth, the industry overall is facing challenges like the 5/20 rule and high aviation turbine fuel costs. Looking ahead, continued growth in air passenger traffic and declines in crude oil prices are expected to provide positive signs for the Indian aviation industry.