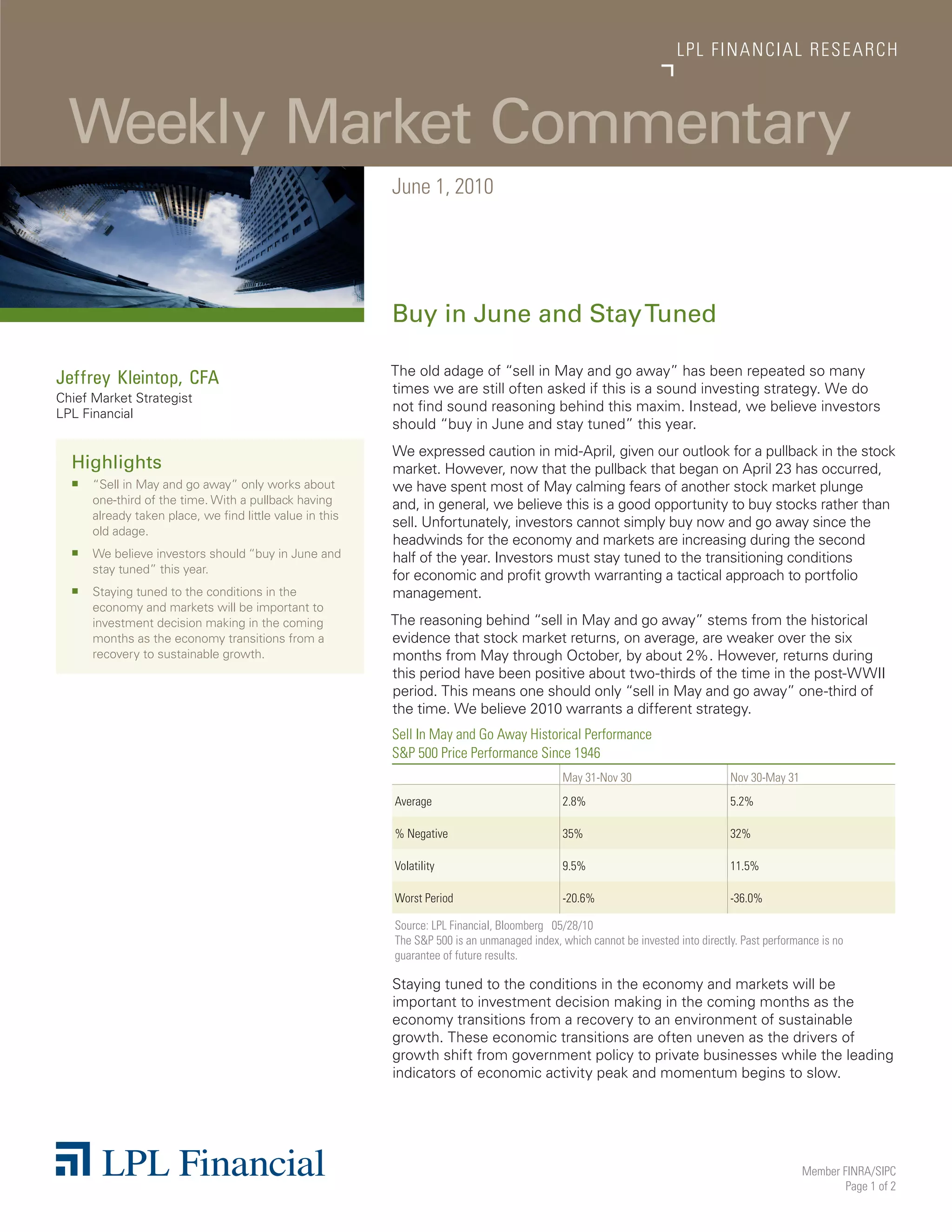

The document discusses the old adage of "sell in May and go away" and argues that investors should instead "buy in June and stay tuned" in 2010. It notes that while stock returns have historically been weaker from May to October, returns are still positive about two-thirds of the time. Given that a pullback has already occurred, the author believes investors should buy stocks now rather than sell. However, investors need to "stay tuned" to changing economic conditions in the coming months as headwinds may increase volatility.