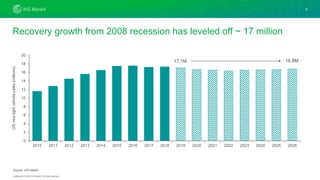

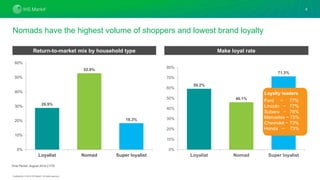

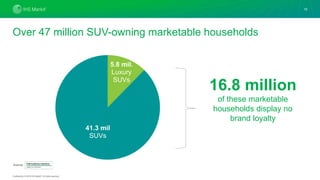

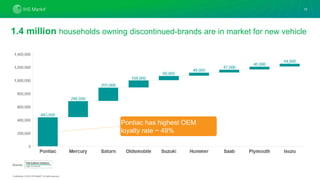

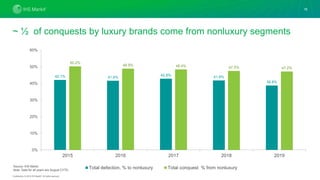

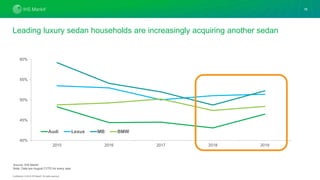

The document outlines five key industry trends impacting marketing in the automotive sector for 2020, including a plateau in market growth, increased loyalty among consumers, competition in the SUV segment, opportunities from discontinued brands, and an expansion of the luxury market. It highlights that loyalty is at an all-time high and suggests that brands must adapt to changing market dynamics to sustain sales. The data references consumer behavior and market forecasts to support these trends.