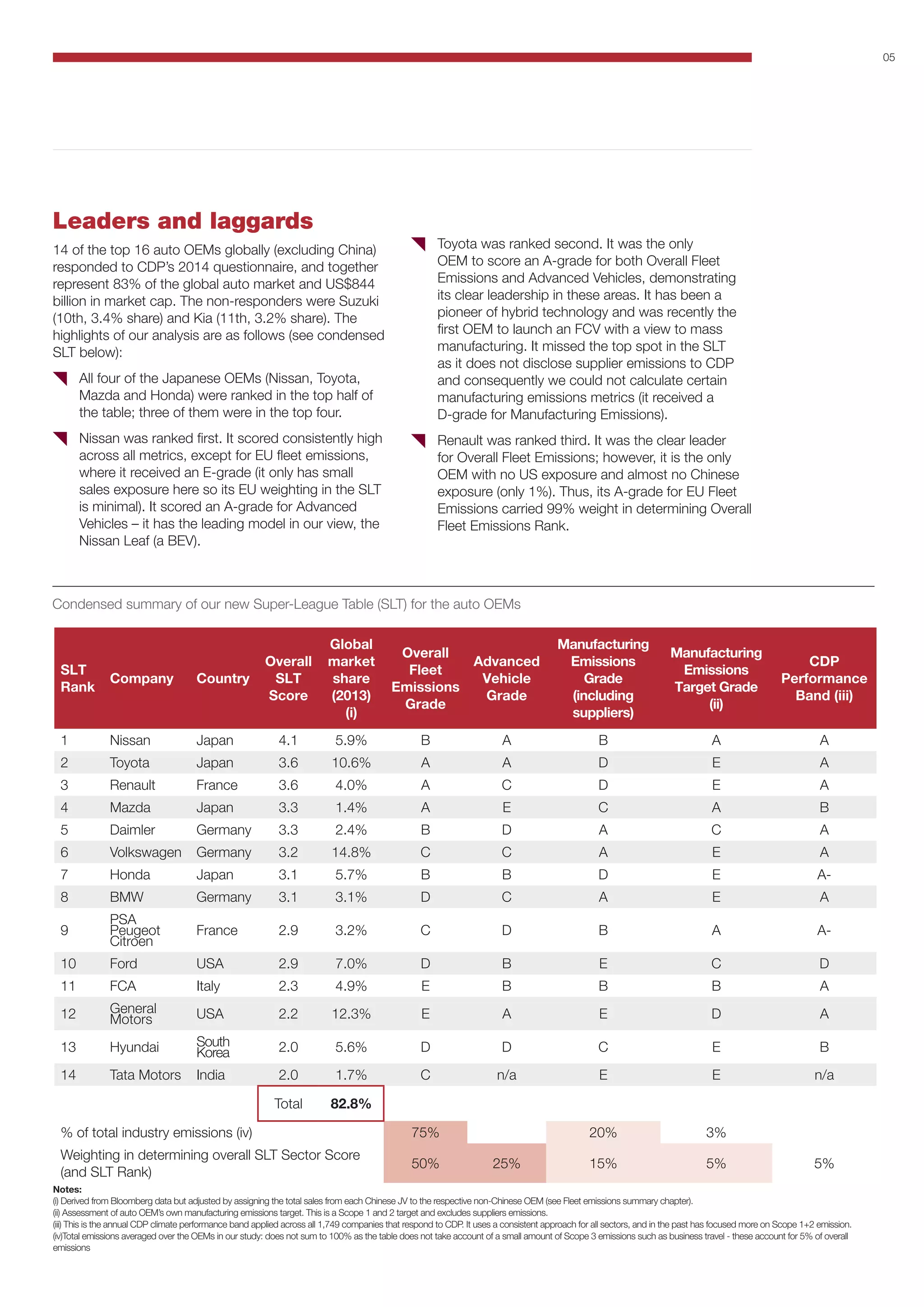

The document analyzes automotive companies' emissions performance and positions them in a "Super-League Table" ranking. It finds that Japanese automakers like Nissan, Toyota, and Mazda rank highly due to strong fleet emissions reductions and investments in advanced vehicles. German automakers also perform well overall. American automakers GM and Ford rank towards the bottom due to the high-emitting vehicles demanded in their home US market. The analysis suggests companies towards the top of the ranking are lower-risk investments as tightening emissions regulations could financially penalize laggards.