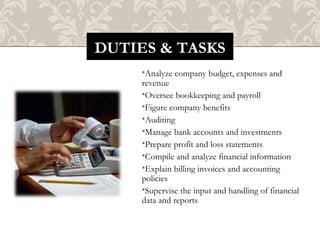

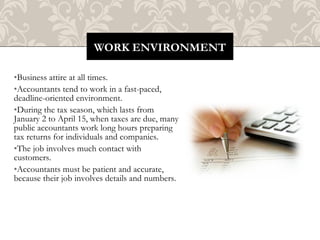

This document provides an overview of the career of a certified public accountant (CPA). It describes the job duties, required education and training, work environment, earnings potential, and job outlook for CPAs. CPAs analyze financial reports, manage bookkeeping and accounting tasks, and ensure compliance with financial regulations. The career offers a growing job market, average salaries of $48,000-$70,000, and opportunities across many industries and business types. Becoming a CPA requires at least a bachelor's degree with accounting credits and passing the CPA exam.