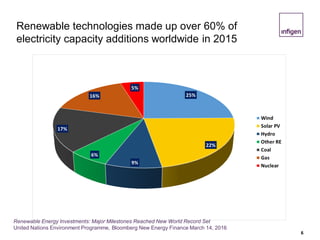

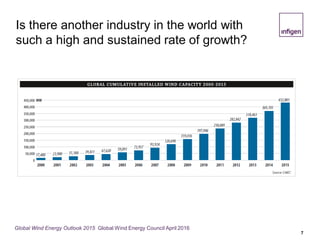

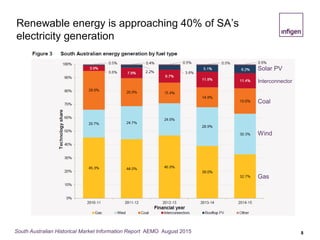

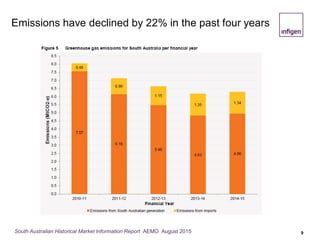

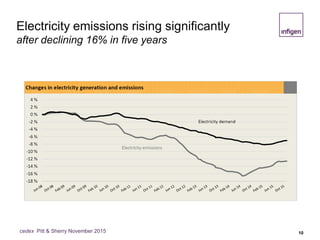

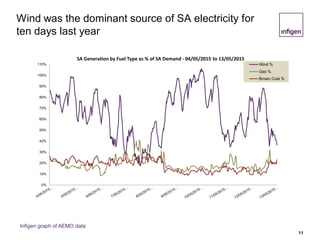

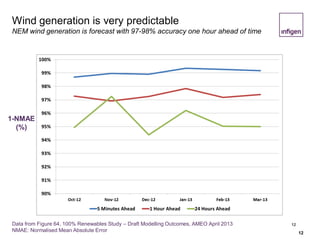

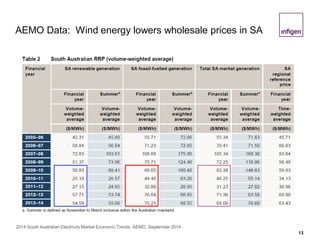

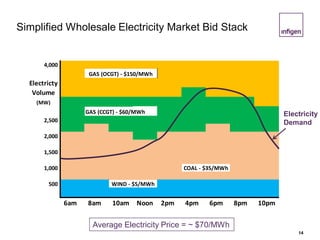

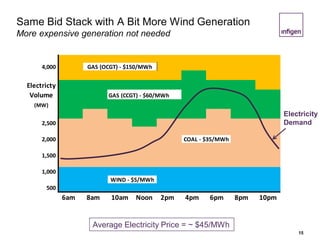

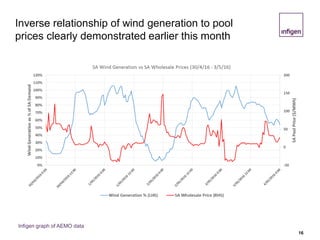

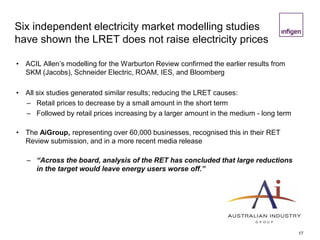

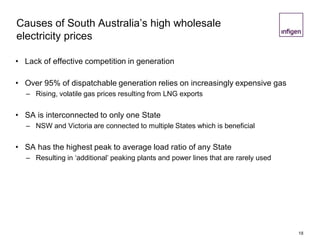

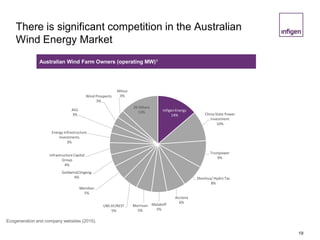

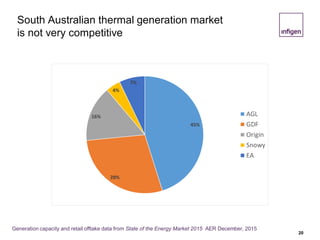

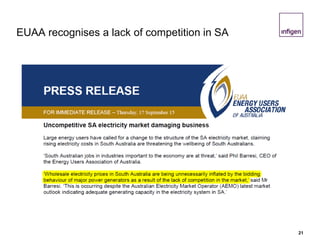

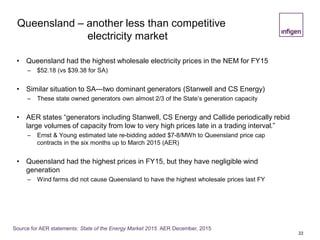

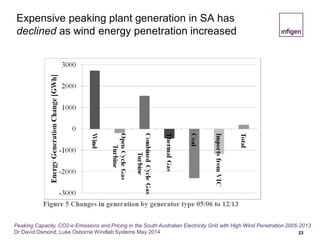

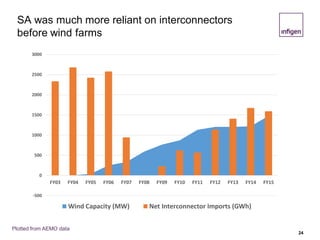

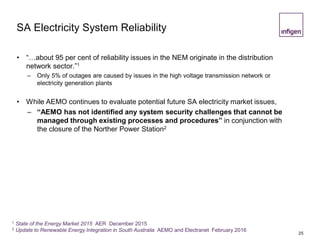

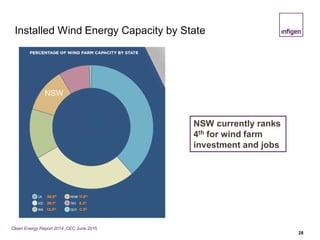

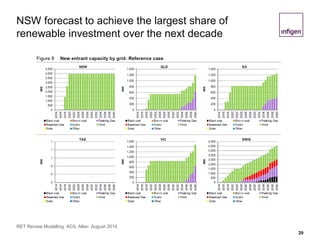

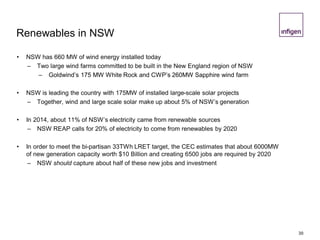

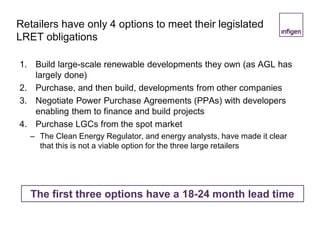

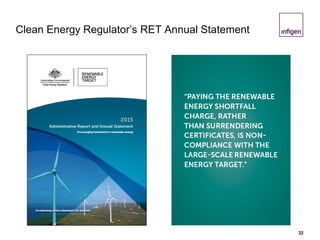

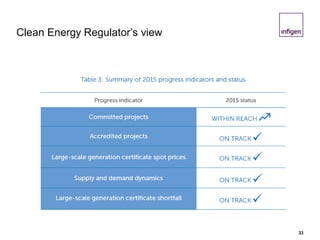

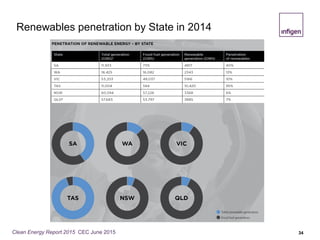

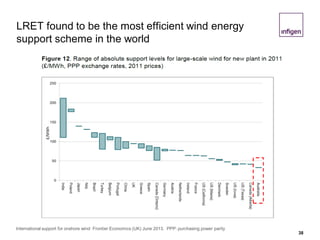

This document provides an overview of renewable energy in Australia, with a focus on developments in South Australia and New South Wales. It discusses the growth of the global and Australian renewable energy markets. It notes that South Australia has seen renewable energy penetration approaching 40% of electricity generation, with accompanying declines in emissions and wholesale electricity prices. It also discusses policy options to facilitate further modernization and decarbonization of Australia's electricity system. The presenter concludes that there is significant momentum worldwide to decarbonize electricity, and that higher levels of renewable energy can be reliably achieved in Australia through emerging technologies.