The document provides a quarterly review and outlook for Jefferies TMT Equity Capital Markets group. Some key points:

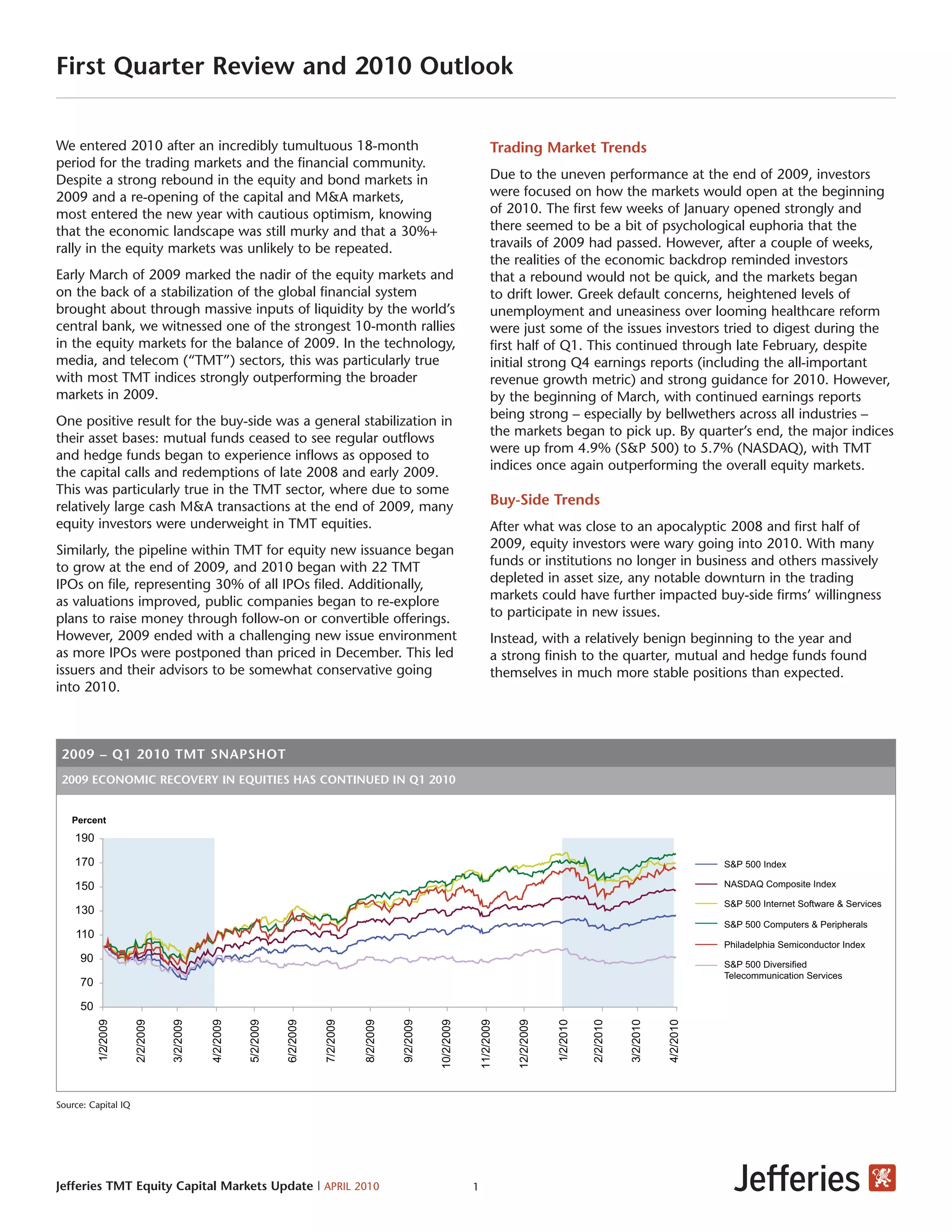

- The markets stabilized in Q1 2010 with the S&P 500 and NASDAQ up around 5%, and TMT indices outperforming.

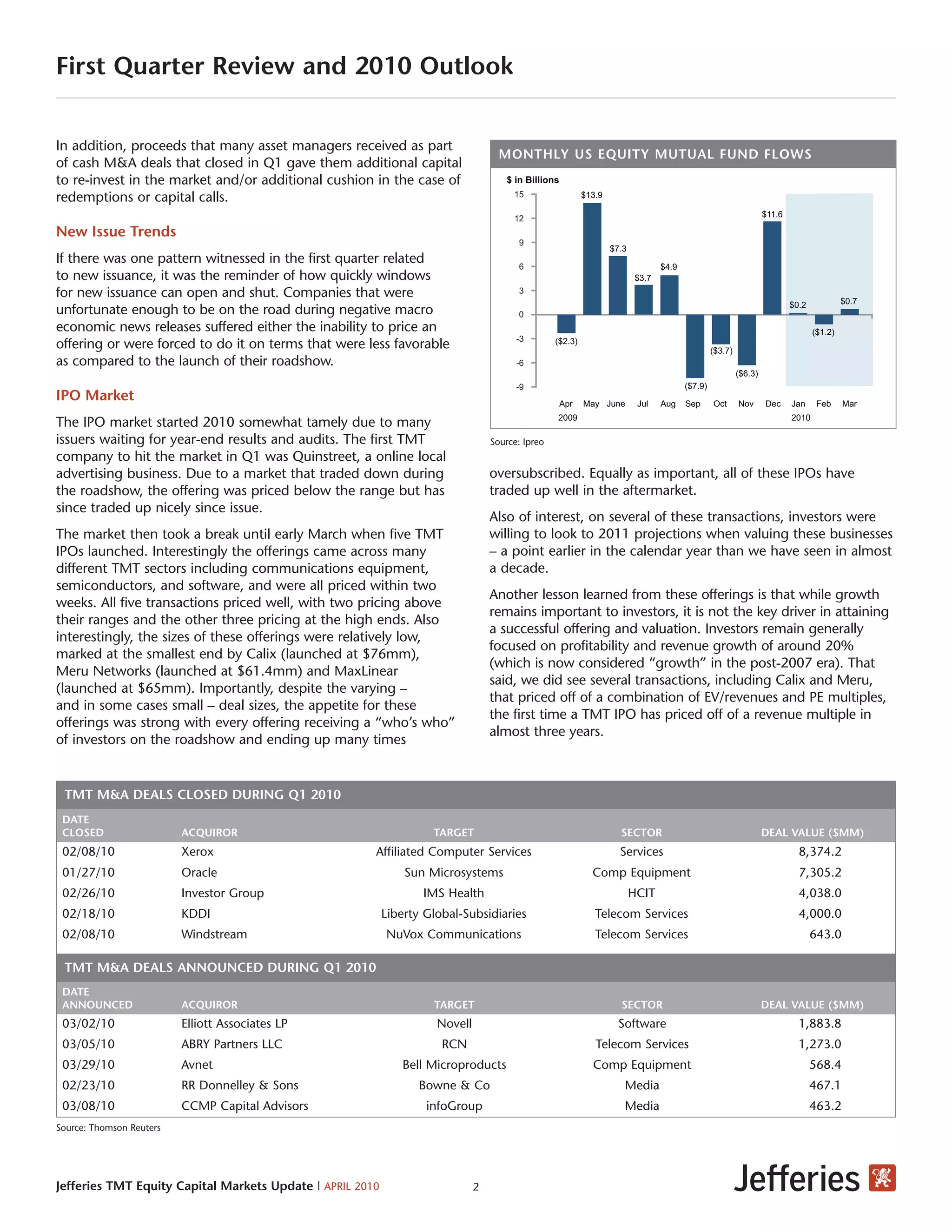

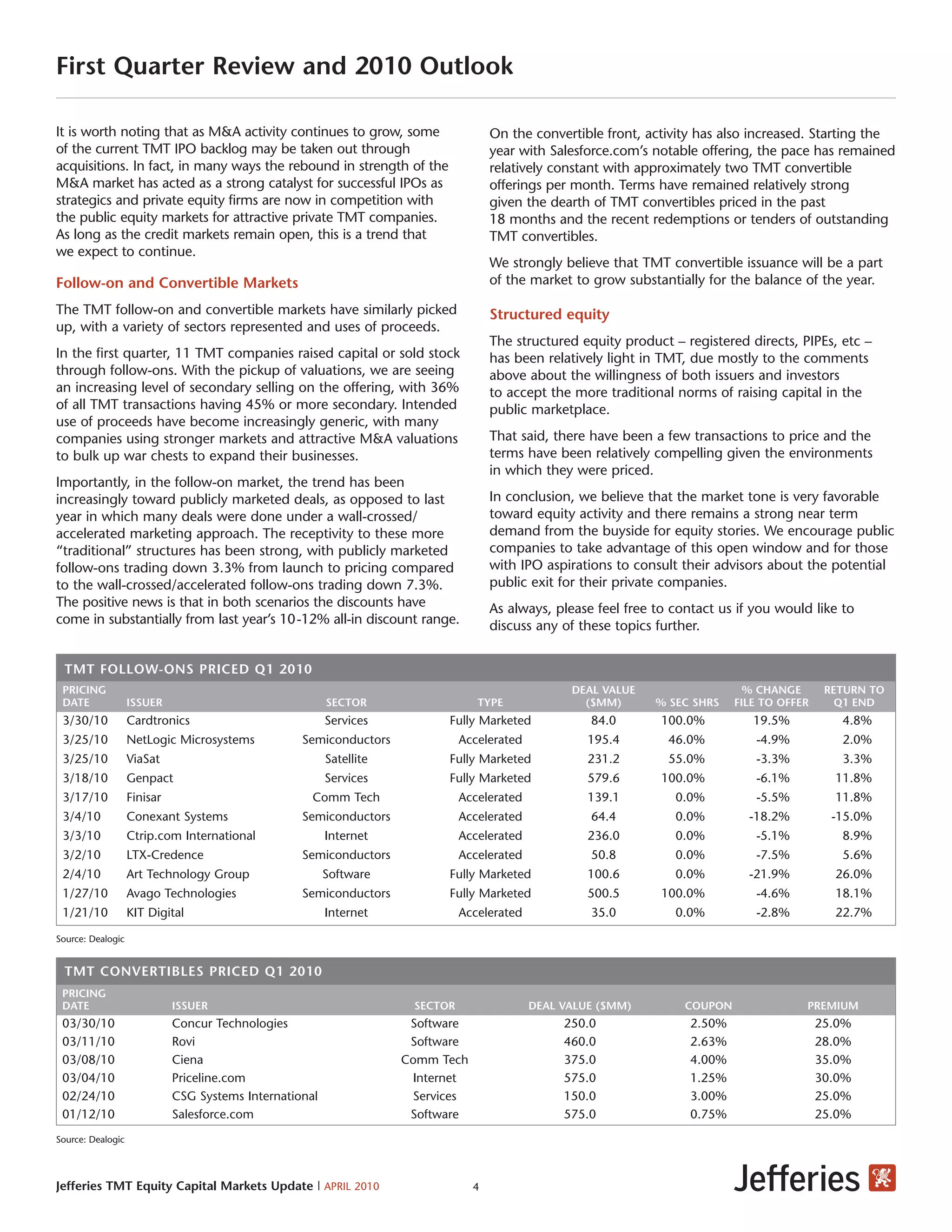

- Investor appetite increased as valuations improved, leading to growth in the IPO pipeline and M&A activity.

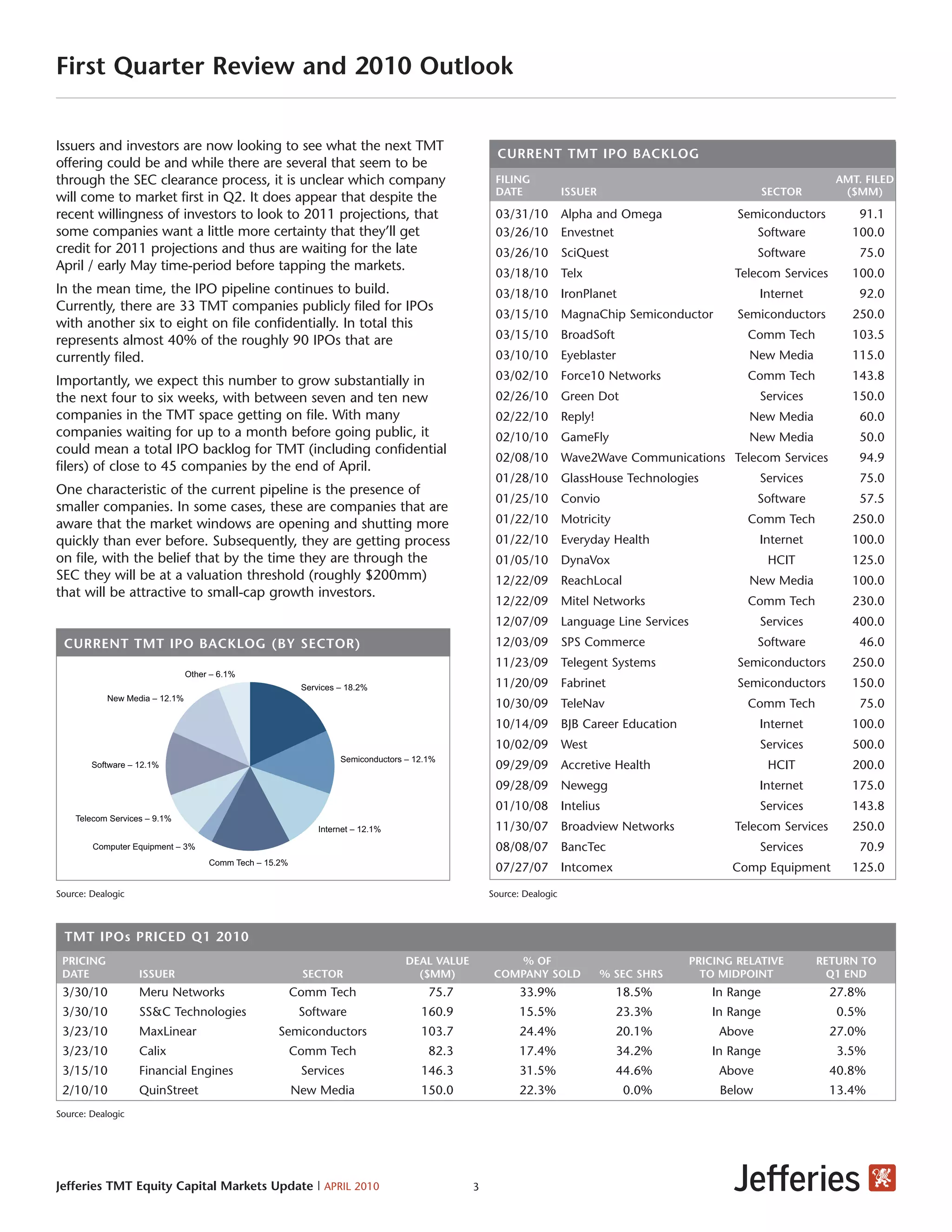

- Several successful TMT IPOs priced in Q1, with offerings across sectors receiving strong demand. The IPO pipeline continues growing.