This document is the annual Global Venture Capital and Private Equity Country Attractiveness Index for 2009/2010 published by Alexander Groh and Heinrich Liechtenstein. It measures and ranks countries based on their attractiveness for venture capital and private equity investments. The index analyzes over 300 data points for many countries and calculates scores based on factors like market size, economic activity, capital market development, taxation, and legal protections. It finds the United States to be the most attractive country, followed by Canada, the UK, Israel, and India. The report also includes analysis of VC/PE activity and conditions in different global regions.

![The Global VC/PE Country Attractiveness Index

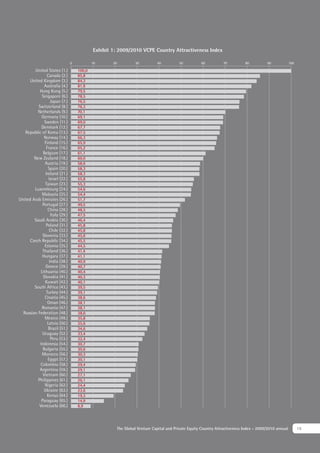

Historic comparison – improvements Exhibit 8 underscores what we are used

of VCPE investment conditions to learning from daily news about China,

We can calculate back the index to the and India. Additionally, Poland impro-

past, as far as 2005/2006. Thereby, we ved its attractiveness for limited partners

should note that some of the data series quite substantially during the last four

used (e.g., the General Innovation Index years. For details, we refer to the indivi-

[GII]) do not date back to 2005. However, dual country analyses in the appendix of

we assume that indicators like this one this index. On the left axis of Exhibit 8, we

did not change to a large extent over the find the countries’ current ranks and the

period of interest, and hence, keep them bars document the rank changes between

constant. The calculation of the 2005/2006 the 2005/2006 and the 2009/2010 index

index allows interesting insights, and re- versions. Kuwait, Latvia, and Oman are

veals the development and rank changes the countries that decreased remarkably

of particular countries. in their rankings. Kuwait lost many ranks

because of a tax reform with increasing

corporate tax rates and deteriorating

conditions regarding the protection of in-

vestors and corporate governance. Latvia

and Oman were both exposed to worse-

ning economic conditions with high in-

flation during the observed period. Howe-

ver, it should be stressed that the index

scores are always calculated relative to

the other countries. That means that all

the countries that lost ranking positions

did not necessarily deteriorate their in-

vestment conditions in absolute terms.

They might just have been outperformed

by others in the international competition

for capital resources.

26 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-25-320.jpg)

![Regional and country profiles

Africa

Basic Facts VCPE-Ranking Details

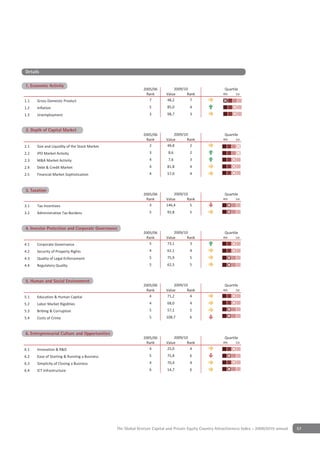

2005/06 2009/10 Quar le

1 VCPE Ranking

Rank Value Rank

8 33,2 8

4th 1st

2 4 y

1. Economic Activity

2005/06

Rank

2009/10

Value Rank

Quartile

4th 1st

Econom c Ac 8 53,9 8 8 31,5 8

1.1 Gross Domestic Product

Depth of Cap. Market 6 10,9 6 8 65,7 8

1.2 Inflation

Taxa on 7 103,6 7 8 75,7 8

1.3 Unemployment

In . Prot. & Corp. Go . 7 53,6 7

Hum. & Soc. En . 8 48,5 7

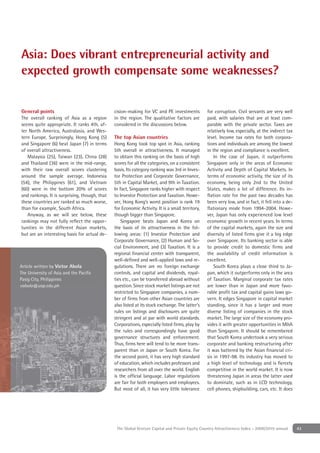

2 Depth of Capital Market

2. Depth of Capital Market

Quar le

4th 1st Entrepr. Culture & Opp. 8 22,2 8 2005/06 2009/10 Quartile

GDP 613 [bn USD] IPO Volume Rank Value Rank 4th 1st

Popul on 271 [mn] M&A Volume

GDP Growth VC 2.1 Size and Liquidity of the Stock Market 6 19,1 6

'02 '08

Pop. Growth '02 '08 PE Key Factors Performance 8 1,4 8

2.2 IPO Market Activity

Econom c 2.3 M&A Market Activity 7 1,6 8

Ac t

125 2.4 Debt & Credit Market 7 67,2 7

SWOT Analysis 100

2.5 Financial Market Sophistication 5 54,4 6

Entrepr. Culture 75 Depth of Cap.

Strengths & Opp. 50

Market

• Continued economic growth across the continent 25

Depth of Capital Market

3 Taxation

3. Taxation

• Increased stability and favorable policies shifted perceptions of 0 2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

the region

3.1 Tax Incentives 7 122,7 6

• Before the financial crisis, investor confidence in Africa was Hum. & Soc.

Taxa on

increasing, as was Africa's understanding of the VC/PE offering En ronment 3.2 Administrative Tax Burdens 6 87,4 7

Weaknesses Afr ca

In . Prot. & 4 Investor Protection and Corporate Governance

• Large geographical region characterized by significant differences Corp. Go .

Worl 4. Investor Protection & Corporate Governance

United States = 100 Points 2005/06 2009/10 Quartile

in culture, language, legal and regulatory systems across the

Rank Value Rank 4th 1st

continent

Separate VC and PE Indices 4.1 Corporate Governance 4 71,5 5

• Small number of pan-African funds competing with larger

number of regional specialists 4.2 Security of Property Rights 7 46,4 7

0

• Transaction activity is driven by a few countries, mainly South

Africa and Nigeria

• VC/PE is dependent on foreign investors who often prefer other

1

2

3 4.3

4.4

Quality of Legal Enforcement

Regulatory Quality

7

8

52,4

47,5

7

8

3

emerging markets

Index Rank

• Preference of debt and public equity markets over VC/PE funding 4 5 Human & Social Environment

5. Human and Social Environment

5 2005/06 2009/10 Quartile

Opportunities 6

Rank Value Rank 4th 1st

• Historical underinvestment in infrastructure and resources, and 5.1 Education & Human Capital 7 48,9 7

7

growing adoption of PPPs by African governments 5.2 Labor Market Rigidities 5 64,5 5

8

• Under-banked population with rising incomes, improved access to 8 31,3 8

9 5.3 Bribing & Corruption

credit and increasing spending tendencies

2005/06 2006/07 2007/08 2008/09 2009/10 5.4 Costs of Crime 8 56,2 8

Threats VC PE VCPE

• A protracted global recovery could limit growth across the

continent and restrict financing and fund raising initiatives Comparison within Peer Group 6 Entrepreneurial Culture and Opportunities

6. Entrepreneurial Culture & Opportunities

2005/06 2009/10 Quartile

• Political risk, lack of transparency and immature regulatory and Rank Value Rank 4th 1st

legal systems are likely to continue to act as barriers to VC/PE 2005/06 2009/10 Quar le

6.1 Innovation & R&D 7 10,5 7

activity Rank Value Rank 4th 1st

North Amer ca 1 96,9 1 6.2 Ease of Starting & Running a Business 6 73,4 7

Outlook 6.3 Simplicity of Closing a Business 5 58,2 7

Austr a 2 76,4 2

• Recovery from recession in Africa may lag global recovery 8 5,4 8

Western Europe 3 67,5 3 6.4 ICT Infrastructure

• PE investment activity expected to increase again in 2010

As a 4 53,5 4

Graham Stokoe, Associate Director, Ernst & Young South Africa M e East 5 45,9 5

Eastern Europe 6 41,9 6

n Amer ca 7 34,9 7

Afr ca 8 33,2 8

54 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual 55

The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual 53](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-52-320.jpg)

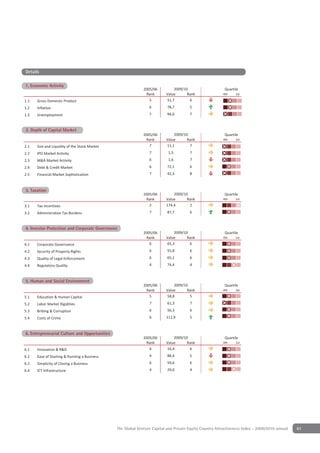

![Regional and country profiles

Africa

Basic Facts VCPE-Ranking

2005/06 2009/10 Quar le

Rank Value Rank 4th 1st

VCPE Ranking 8 33,2 8

Econom c Ac 8 53,9 8

Depth of Cap. Market 6 10,9 6

Taxa on 7 103,6 7

In . Prot. & Corp. Go . 7 53,6 7

Hum. & Soc. En . 8 48,5 7

Quar le

4th 1st Entrepr. Culture & Opp. 8 22,2 8

GDP 613 [bn USD] IPO Volume

Popul on 271 [mn] M&A Volume

GDP Growth '02 '08 VC

Pop. Growth '02 '08 PE Key Factors Performance

Econom c

Ac t

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

Strengths & Opp. 50

Market

• Continued economic growth across the continent 25

• Increased stability and favorable policies shifted perceptions of 0

the region

• Before the financial crisis, investor confidence in Africa was Hum. & Soc.

Taxa on

increasing, as was Africa's understanding of the VC/PE offering En ronment

Weaknesses Afr ca

• Large geographical region characterized by significant differences In . Prot. & Worl

Corp. Go . United States = 100 Points

in culture, language, legal and regulatory systems across the

continent

• Small number of pan-African funds competing with larger Separate VC and PE Indices

number of regional specialists 0

• Transaction activity is driven by a few countries, mainly South

1

Africa and Nigeria

2

• VC/PE is dependent on foreign investors who often prefer other

3

emerging markets

Index Rank

4

• Preference of debt and public equity markets over VC/PE funding

5

Opportunities 6

• Historical underinvestment in infrastructure and resources, and

7

growing adoption of PPPs by African governments

8

• Under-banked population with rising incomes, improved access to

9

credit and increasing spending tendencies

2005/06 2006/07 2007/08 2008/09 2009/10

Threats VC PE VCPE

• A protracted global recovery could limit growth across the

continent and restrict financing and fund raising initiatives Comparison within Peer Group

• Political risk, lack of transparency and immature regulatory and

legal systems are likely to continue to act as barriers to VC/PE 2005/06 2009/10 Quar le

activity Rank Value Rank 4th 1st

North Amer ca 1 96,9 1

Outlook

Austr a 2 76,4 2

• Recovery from recession in Africa may lag global recovery

• PE investment activity expected to increase again in 2010 Western Europe 3 67,5 3

As a 4 53,5 4

Graham Stokoe, Associate Director, Ernst & Young South Africa M e East 5 45,9 5

Eastern Europe 6 41,9 6

n Amer ca 7 34,9 7

Afr ca 8 33,2 8

54 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-53-320.jpg)

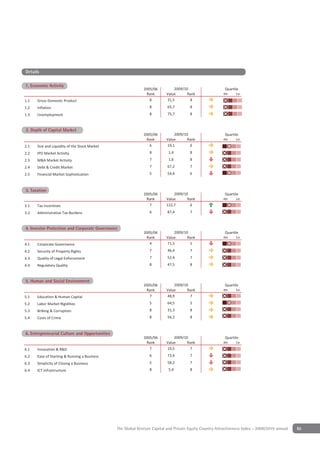

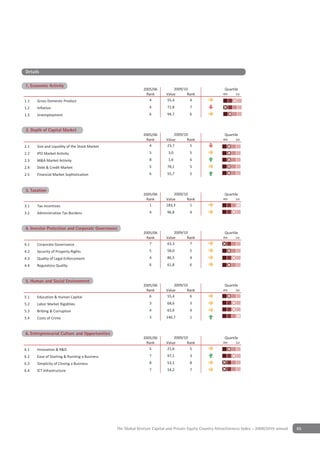

![Regional and country profiles

Asia

Basic Facts VCPE-Ranking

2005/06 2009/10 Quar le

Rank Value Rank 4th 1st

VCPE Ranking 4 53,5 4

Econom c Ac t 5 73,9 4

Depth of Cap. Market 4 27,3 3

Taxa on 5 116,5 4

In . Prot. & Corp. Go . 4 68,1 4

Hum. & Soc. En . 5 74,0 5

Quar le

4th 1st Entrepr. Culture & Opp. 4 37,4 5

GDP 14941 [bn USD] IPO Volume

Popula on 3379 [mn] M&A Volume

GDP Growth '02 '08 VC Ac t

Pop. Growth '02 '08 PE Ac t Key Factors Performance

Econom c

Ac t

125

100

SWOT Analysis

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

• Very large and powerful economic region 25

• Market leading technologies in many sectors, cost leadership in others 0

• Comparative advantages in terms of labor costs and productivity

• Abundance of natural resources, well-educated workforce and Hum. & Soc.

Taxa on

En ronment

skilled labors

Weaknesses As a

In . Prot. & Worl

• Persistent administrative inefficiencies Corp. Go .

United States = 100 Points

• VC/PE investors are seen critically regarding their commitment to

the companies’ interests

• Relatively weak corporate governance compared to Western standards Separate VC and PE Indices

• Export-driven economies 0

• Cultural challenges in achieving control of private enterprises

1

Opportunities

• Succession issues in family owned businesses foster VC/PE

Index Rank

2

investment

• Several fragmented industries with potential for consolidation 3

• Relatively large, young and growing middle-income population in

emerging urban centers 4

Threats

• Increasingly negative sentiment towards the asset class if VC/ 5

2005/06 2006/07 2007/08 2008/09 2009/10

PE investors are not regarded appropriately supporting investee

VC PE VCPE

companies in the current economic climate

• Inadequate power and transport infrastructure in selected areas

• Cultural, ethnical, religious, or even terroristic turmoil in certain regions Comparison within Peer Group

Outlook 2005/06 2009/10 Quar le

• Progress towards greater transparency and global economic integration Rank Value Rank 4th 1st

• Many companies will find it increasingly hard to obtain access North Amer ca 1 96,9 1

to additional capital and will need to deploy their capital more Australas a 2 76,4 2

effectively Western Europe 3 67,5 3

• Many companies will be forced to divest non-core businesses As a 4 53,5 4

• Continuing strong global position in high-tech sector

M le East 5 45,9 5

• Continuing relaxation of restrictions of capital flows

Eastern Europe 6 41,9 6

a n Amer ca 7 34,9 7

Afr ca 8 33,2 8

56 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-55-320.jpg)

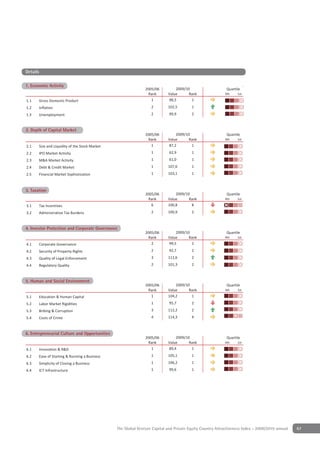

![Regional and country profiles

Australasia

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 2 76,4 2

Economic Activity 2 95,5 2

Depth of Cap. Market 2 29,7 2

Taxation 8 104,1 6

Inv. Prot. & Corp. Gov. 1 107,4 1

Hum. & Soc. Env. 1 114,5 1

Quartile Entrepr. Culture & Opp. 2 85,8 2

4th 1st

GDP 1106 [bn USD] IPO Volume

Population 25 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Innovation-driven economies with pioneering scientific research

0

institutions and world class R&D facilities

• Strong economy and sound banking/capital/financial market

Hum. & Soc.

systems Environment

Taxation

• Democratic and stable political, regulatory and legal environment

Australasia

Weaknesses Inv. Prot. & World

• Low tax incentives Corp. Gov.

United States = 100 Points

• Performance of VC/PE investee companies facing tough market

conditions

Separate VC and PE Indices

• Slow recovery from the recessionary environment predicted

0

Opportunities

• Strong M&A market with international targets and sound

prospects for exits

1

• Strong stock market culture, providing good IPO opportunities

Index Rank

Threats

• High interest rate environment making current debt raisings 2

difficult

Outlook

• Investment funds are likely to restrict allocation to PE, but the 3

industry will continue to attract capital from other sources 2005/06 2006/07 2007/08 2008/09 2009/10

including sovereign wealth funds and high net worth individuals VC PE VCPE

• Business models and margins continue to be under pressure

• Increasing pressure from LPs to exit less successful investee Comparison within Peer Group

companies

• Financing and acquisition opportunities are expected to increase 2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

North America 1 96,9 1

Australasia 2 76,4 2

Western Europe 3 67,5 3

Asia 4 53,5 4

Middle East 5 45,9 5

Eastern Europe 6 41,9 6

Latin America 7 34,9 7

Africa 8 33,2 8

58 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-57-320.jpg)

![Regional and country profiles

Eastern Europe

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 6 41,9 6

Economic Activity 6 72,6 6

Depth of Cap. Market 7 9,6 8

Taxation 2 123,6 2

Inv. Prot. & Corp. Gov. 6 64,8 6

Hum. & Soc. Env. 6 69,0 6

Quartile

4th 1st Entrepr. Culture & Opp. 5 39,8 4

GDP 2466 [bn USD] IPO Volume

Population 228 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• High tax incentives among most of the Eastern European

0

countries

• Strong stock market in Poland

Hum. & Soc.

Taxation

Weaknesses Environment

• The financial crisis affected strongly the generally weak capital Eastern Europe

market structure World

Inv. Prot. &

• Lack of experience in connection with structuring and completing Corp. Gov.

United States = 100 Points

complex transactions

• Lack of management teams for MBO situations

Separate VC and PE Indices

Opportunities 0

• Catching-up entrepreneurial culture and opportunities for venture

1

capital investors

• Privatization projects are still going on 2

• Reform of legal systems provides increasing security and

Index Rank

3

attractive environment for VC/PE.

4

Threats

5

• Financial crisis may make funding difficult for local GPs

• Increasingly unstable regulatory and enforcement environment if 6

financial crisis continues for more than two years

7

Outlook 2005/06 2006/07 2007/08 2008/09 2009/10

• Increasing VC/PE focus on privatizations VC PE VCPE

• Continuing regime of tax incentives

• Increasing experience in leverage transactions should these Comparison within Peer Group

reappear post crisis

2005/06 2009/10 Quartile

Dr. Dubsky, Partner, DLA-Piper, Austria Rank Value Rank 4th 1st

North America 1 96,9 1

Australasia 2 76,4 2

Western Europe 3 67,5 3

Asia 4 53,5 4

Middle East 5 45,9 5

Eastern Europe 6 41,9 6

Latin America 7 34,9 7

Africa 8 33,2 8

60 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-59-320.jpg)

![Regional and country profiles

Latin America

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 7 34,9 7

Economic Activity 7 73,6 5

Depth of Cap. Market 8 10,0 7

Taxation 6 112,6 5

Inv. Prot. & Corp. Gov. 8 45,8 8

Hum. & Soc. Env. 7 48,2 8

Quartile

4th 1st Entrepr. Culture & Opp. 7 29,1 7

GDP 3846 [bn USD] IPO Volume

Population 471 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• The Latin American region has seen a strong increase of economic

0

activity even during the financial crisis

• Strong tax incentives contribute comprehensively to the region’s

appreciation Hum. & Soc.

Taxation

Environment

Weaknesses Latin America

• The dimensions in which the region is most fragile are the capital World

Inv. Prot. &

markets with respect to the small number of listed domestic Corp. Gov.

United States = 100 Points

companies, IPO opportunities, and the low dynamic of the M&A

markets

Separate VC and PE Indices

• Lacking entrepreneurial culture hinders the developed of new

0

companies

1

Opportunities

2

• Some countries have followed Brazil’s lead in cultivating domestic

sources of institutional capital for private equity firms and a 3

Index Rank

number of new funds have been raised with commitments from 4

domestic pension funds 5

• Improvements with respect to law and enforcement bring more

6

security to investors

7

Threats

8

• Investor protection and corporate governance structures are still 2005/06 2006/07 2007/08 2008/09 2009/10

an import issue revealing room for development VC PE VCPE

• Many countries are perceived to have high levels of corruption

Outlook Comparison within Peer Group

• While many economies grow strongly, some others remain under

populist governments 2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

• Lack of basic infrastructure hinders the development on one side,

one the other, this provides investment opportunities North America 1 96,9 1

Australasia 2 76,4 2

Western Europe 3 67,5 3

Asia 4 53,5 4

Middle East 5 45,9 5

Eastern Europe 6 41,9 6

Latin America 7 34,9 7

Africa 8 33,2 8

62 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-61-320.jpg)

![Regional and country profiles

Middle East

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 5 45,9 5

Economic Activity 4 72,2 7

Depth of Cap. Market 5 13,8 5

Taxation 1 133,3 1

Inv. Prot. & Corp. Gov. 5 66,6 5

Hum. & Soc. Env. 4 76,4 4

Quartile

4th 1st Entrepr. Culture & Opp. 6 35,5 6

GDP 1270 [bn USD] IPO Volume

Population 119 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

150

125

SWOT Analysis 100

Entrepr. Culture Depth of Cap.

& Opp. 75 Market

Strengths 50

25

• Sufficiently diversified cash rich economies 0

• Relatively robust economic growth

• Steady growing population with "real demand" Hum. & Soc.

Taxation

• Government’s commitment to continuous growth Environment

Middle East

Weaknesses

Inv. Prot. & World

• Weak corporate governance as most businesses are still controlled by Corp. Gov.

families United States = 100 Points

• Underdeveloped legal framework to support VC/PE activity

• Highly dependent on volatile oil prices Separate VC and PE Indices

0

Opportunities

1

• Ideal time to focus on distressed companies with good business

models 2

Index Rank

• Focus on businesses wishing to transform from family business to

3

corporate structure

• Availability of assets at attractive valuations 4

Threats 5

• Economic growth to slow down due to decrease in global tourism

6

industry

2005/06 2006/07 2007/08 2008/09 2009/10

• Managing expectations of existing shareholders/family members a VC PE VCPE

key challenge

• Size and liquidity of stock markets may affect exits

Comparison within Peer Group

• Decrease in availability of private funds as a result of the crisis

• Lack of liquidity impacting setting up new funds 2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Outlook North America 1 96,9 1

• Global economic downturn to slow down activity in the short term Australasia 2 76,4 2

• Potential for acquiring assets at attractive valuations

Western Europe 3 67,5 3

• Transformations from family run businesses to corporate structures

Asia 4 53,5 4

• IPO markets to re-open as a result of a gradual recovery

Middle East 5 45,9 5

Phil Gandier, Partner, Ernst & Young Middle East Eastern Europe 6 41,9 6

Latin America 7 34,9 7

Africa 8 33,2 8

64 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-63-320.jpg)

![Regional and country profiles

North America

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 1 96,9 1

Economic Activity 1 100,3 1

Depth of Cap. Market 1 82,0 1

Taxation 4 100,8 8

Inv. Prot. & Corp. Gov. 2 101,1 2

Hum. & Soc. Env. 2 106,3 2

Quartile

4th 1st Entrepr. Culture & Opp. 1 99,9 1

GDP 15984 [bn USD] IPO Volume

Population 342 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. Market

Strengths 50

• Strong innovation and entrepreneurship culture 25

• Strong US VC/PE market and financial community 0

Weaknesses

Hum. & Soc.

• Financial services have a very large stake of the overall economic Environment

Taxation

output, making the region especially vulnerable to the financial North America

crisis

Inv. Prot. & World

Opportunities Corp. Gov.

United States = 100 Points

• Innovations and fast growth segments such as cleantech, cloud

computing, wireless and security Separate VC and PE Indices

Threats 0

• Succession planning in some funds

• Impact of lack of exits on the ability to raise new or follow on funds

Outlook

Index Rank

• Strong industry with new investment and growth opportunities 1

• The number of players will continue to shrink: less funds will be able

to raise follow-on funds

2

2005/06 2006/07 2007/08 2008/09 2009/10

VC PE VCPE

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

North America 1 96,9 1

Australasia 2 76,4 2

Western Europe 3 67,5 3

Asia 4 53,5 4

Middle East 5 45,9 5

Eastern Europe 6 41,9 6

Latin America 7 34,9 7

Africa 8 33,2 8

66 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-65-320.jpg)

![Regional and country profiles

Western Europe

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 3 67,5 3

Economic Activity 3 93,8 3

Depth of Cap. Market 3 23,3 4

Taxation 3 121,1 3

Inv. Prot. & Corp. Gov. 3 90,5 3

Hum. & Soc. Env. 3 93,3 3

Quartile

4th 1st Entrepr. Culture & Opp. 3 80,2 3

GDP 17763 [bn USD] IPO Volume

Population 403 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Large sample of companies and still smaller private capital share

0

than in the USA, which reveals some catch up potential

Weaknesses Hum. & Soc.

Taxation

• There is an ongoing discussion about a new regulatory framework, Environment

which causes uncertainty and might burden investors with Western Europe

additional costs and efforts World

Inv. Prot. &

Corp. Gov.

Opportunities United States = 100 Points

• Europe might recover from the crisis earlier and better than

expected, leaving investors with two “buyers’ years” (2010/2011) Separate VC and PE Indices

similar to 2002/2003

0

Threats

• Regulation together with reputation damages from 2007/2008 1

investments and a deeper crisis than expected might cause a real

Index Rank

shakeout in the industry and damage the VC/PE market for a

longer period 2

Outlook

• It is more likely that we will see something like the 2002/2003 3

activity very soon and Western Europe maturing similar to US

market 15 years ago. Coupled with all the infrastructure and 4

expertise, deals will get sourced and done efficiently 2005/06 2006/07 2007/08 2008/09 2009/10

VC PE VCPE

Florian Huber, Senior Manager, Ernst & Young Germany

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

North America 1 96,9 1

Australasia 2 76,4 2

Western Europe 3 67,5 3

Asia 4 53,5 4

Middle East 5 45,9 5

Eastern Europe 6 41,9 6

Latin America 7 34,9 7

Africa 8 33,2 8

68 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-67-320.jpg)

![Regional and country profiles

Argentina

Capital: Buenos Aires ++ Official Language: Spanish ++ Currency: Argentine Peso

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 59 29,1 59

Economic Activity 51 74,3 42

Depth of Cap. Market 60 6,5 59

Taxation 54 113,7 37

Inv. Prot. & Corp. Gov. 61 30,4 64

Hum. & Soc. Env. 62 44,9 53

Quartile

4th 1st Entrepr. Culture & Opp. 48 29,6 51

GDP 303 [bn USD] IPO Volume

Population 40 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Tax advantages on dividends and share transfers

0

Weaknesses

• Many regulatory hurdles to overcome to develop a stronger Hum. & Soc.

Taxation

industry Environment

• Legal framework for fund formation and operation presents Argentina

difficulties, particularly for foreign funds Latin America

Inv. Prot. &

• Corporate governance standards and enforcement remains Corp. Gov.

United States = 100 Points

lengthy and cumbersome

Opportunities Separate VC and PE Indices

• Strength of entrepreneurial dynamism and quality of Argentina’s 52

accounting standards 53

Threats 54

• With the pension system re-nationalisation, institutional 55

Index Rank

investment is now effectively barred from the PE/VC industry 56

• High perception of corruption 57

58

Outlook 59

• The country is underperforming relative to its size and level of 60

development 61

• Improvement in the VC/PE business environment does not appear 62

to be a major near-term priority 2005/06 2006/07 2007/08 2008/09 2009/10

VC PE VCPE

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Chile 27 45,8 32

Mexico 51 35,8 49

Brazil 56 34,6 51

Uruguay 50 33,4 52

Peru 54 32,4 53

Colombia 55 29,4 58

Argentina 59 29,1 59

Paraguay 66 14,9 65

Venezuela 65 8,9 66

70 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-69-320.jpg)

![Regional and country profiles

Australia

Capital: Canberra ++ Official Language: English ++ Currency: Australian Dollar

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 6 81,9 4

Economic Activity 15 96,7 7

Depth of Cap. Market 5 42,9 4

Taxation 39 106,9 41

Inv. Prot. & Corp. Gov. 10 99,0 11

Hum. & Soc. Env. 6 112,3 5

Quartile

4th 1st

Entrepr. Culture & Opp. 13 86,1 13

GDP 980 [bn USD] IPO Volume

Population 21 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Strong economy and sound banking/capital/financial market

0

systems

• Democratic and stable political, regulatory and legal environment

• Government support for foreign investors Hum. & Soc.

Taxation

Environment

• Significant number of VC/PE investments currently under

Australia

management

Inv. Prot. & Australasia

Weaknesses Corp. Gov.

United States = 100 Points

• Competition from both local and overseas investors

• Tax rates are comparatively high

Separate VC and PE Indices

• Performance of VC/PE investee companies facing tough market

conditions 2

• Slow recovery from the recessionary environment predicted

3

Opportunities

• Strong M&A market with international targets and sound

Index Rank

4

prospects for exits

• VC/PE investors have a significant amount of dry powder to make

5

new investments

• Strong stock market listed culture, providing good opportunities

6

for IPO

Threats 7

2005/06 2006/07 2007/08 2008/09 2009/10

• High interest rate environment making current debt raisings

VC PE VCPE

difficult

• Liquidity issues continue to restrict the level and availability of

leverage Comparison within Peer Group

• P2P’s and PIPES are proving more difficult in finding support 2005/06 2009/10 Quartile

from boards/shareholders Rank Value Rank 4th 1st

• Refinance of existing senior debt packages in the next two years Australia 6 81,9 4

Outlook Hong Kong 4 79,5 5

• Business models and margins continue to be under pressure Singapore 5 78,5 6

• Increasing pressure from LPs to exit less successful investee Japan 7 76,5 7

companies Republic of Korea 15 67,5 13

• Financing and acquisition opportunities are expected to increase

New Zealand 18 60,0 18

Bryan Zekulich, Partner, Ernst & Young Australia Taiwan 25 55,3 23

Malaysia 23 54,4 25

China 42 48,5 28

72 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-71-320.jpg)

![Regional and country profiles

Austria

Capital: Vienna ++ Official Language: German (official nationwide); Slovene, Croatian, Hungarian (each official in one region) ++

Currency: Euro

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 20 58,6 19

Economic Activity 17 96,3 8

Depth of Cap. Market 31 11,8 37

Taxation 38 114,7 36

Inv. Prot. & Corp. Gov. 15 93,0 16

Hum. & Soc. Env. 11 103,9 9

Quartile

4th 1st Entrepr. Culture & Opp. 17 76,1 19

GDP 411 [bn USD] IPO Volume

Population 8 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. Market

Strengths 50

• Still a niche market which is not as crowded as Germany, while 25

offering a similar, but smaller sample of companies and industries 0

Weaknesses

Hum. & Soc.

• Almost a “closed shop”, which takes a lot of effort to enter for a Environment

Taxation

little deal flow and transactions of smaller size Austria

Opportunities Inv. Prot. & Western Europe

• Austria has a lot of hidden champions and family owned Corp. Gov.

United States = 100 Points

companies with succession problems

Separate VC and PE Indices

Threats

• Regulation together with reputation damages from 2007/2008 15

investments and a deeper crisis than expected might cause a real 16

shakeout in the industry and might damage the VC/PE Market on 17

a longer term 18

Index Rank

19

Outlook

20

• Will stay a niche, but might be used as base for Eastern European 21

acquisitions as Austria offers good resources with respect to the 22

necessary language skills and the cultural understanding. 23

24

Florian Huber, Senior Manager, Ernst & Young Germany 25

2005/06 2006/07 2007/08 2008/09 2009/10

VC PE VCPE

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Norway 11 66,3 14

Finland 12 65,9 15

France 17 65,2 16

Belgium 19 61,1 17

Austria 20 58,6 19

Ireland 16 58,3 21

Luxembourg 24 54,6 24

Portugal 28 49,5 27

Greece 44 40,7 39

74 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-73-320.jpg)

![Regional and country profiles

Belgium

Capital: Brussels ++ Official Language: Dutch, French, German ++ Currency: Euro

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 19 61,1 17

Economic Activity 26 91,1 16

Depth of Cap. Market 20 15,2 27

Taxation 61 102,8 47

Inv. Prot. & Corp. Gov. 16 92,0 17

Hum. & Soc. Env. 13 101,8 11

Quartile

4th 1st

Entrepr. Culture & Opp. 15 79,4 16

GDP 501 [bn USD] IPO Volume

Population 11 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

100

SWOT Analysis Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Attractive taxation for investors with limited taxation on capital 0

gains and on patent income

• Strong education system resulting in highly skilled workforce and

Hum. & Soc.

important R&D activity Environment

Taxation

Weaknesses Belgium

• Due to the limited size of the deals, takeover opportunities are still Inv. Prot. & Western Europe

fundable from a bank perspective Corp. Gov.

United States = 100 Points

• Prominent role of government backed VC's

Opportunities Separate VC and PE Indices

• Most SMEs are still in private hands

15

• More and more private SMEs are open to external investors

Threats 16

• Available funds within PE sector, predominantly used for add-on

17

investments

Index Rank

• Stock exchange: liquidity on small caps is very limited 18

Outlook 19

• Increasing number of strategic deals

• The new tax/legal framework favors R&D investments (tax 20

incentives for researchers, patent income deduction, notional

21

interest deduction), importantly decreasing the corporate effective 2005/06 2006/07 2007/08 2008/09 2009/10

tax rate VC PE VCPE

Marc Guns, Partner, Ernst & Young Belgium Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Germany 9 69,1 10

Denmark 10 67,7 12

Finland 12 65,9 15

France 17 65,2 16

Belgium 19 61,1 17

Austria 20 58,6 19

Ireland 16 58,3 21

Italy 32 47,5 29

Greece 44 40,7 39

76 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-75-320.jpg)

![Regional and country profiles

Brazil

Capital: Brasília ++ Official Language: Portuguese ++ Currency: Brazilian Real

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 56 34,6 51

Economic Activity 48 79,9 34

Depth of Cap. Market 29 19,3 18

Taxation 66 39,2 65

Inv. Prot. & Corp. Gov. 52 45,4 54

Hum. & Soc. Env. 54 42,0 56

Quartile Entrepr. Culture & Opp. 65 22,7 57

4th 1st

GDP 1537 [bn USD] IPO Volume

Population 194 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Strong government support programs for start-ups, technology

0

ventures and SMEs

• Number of companies listed on the Brazilian stock exchange

increased remarkably in the past years Hum. & Soc.

Taxation

Environment

• An initial framework for VC activity, focused on smaller firms and

Brazil

start-ups, was provided by FIEs

Inv. Prot. & Latin America

Weaknesses Corp. Gov.

United States = 100 Points

• Fighting the perception of corruption remains a serious challenge

• The process of registering and enforcing patents and other

Separate VC and PE Indices

intellectual property remains slow and cumbersome

30

Opportunities

• Favourable legislation on fund formation and operation, 35

permissive regulations on institutional investors and strong

40

entrepreneurship

Index Rank

Threats 45

• Corruption is pervasive throughout the public sector and there

50

have only been a few sanctions against those involved in illegal

campaign financing activities 55

Outlook 60

• Brazil leads the region in the development of a local PE/VC 2005/06 2006/07 2007/08 2008/09 2009/10

industry VC PE VCPE

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Chile 27 45,8 32

Mexico 51 35,8 49

Brazil 56 34,6 51

Uruguay 50 33,4 52

Peru 54 32,4 53

Colombia 55 29,4 58

Argentina 59 29,1 59

Paraguay 66 14,9 65

Venezuela 65 8,9 66

78 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-77-320.jpg)

![Regional and country profiles

Bulgaria

Capital: Sofia ++ Official Language: Bulgarian ++ Currency: Bulgarian Lev

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 48 30,6 55

Economic Activity 54 63,6 53

Depth of Cap. Market 56 4,4 64

Taxation 13 138,1 8

Inv. Prot. & Corp. Gov. 47 46,2 53

Hum. & Soc. Env. 50 49,4 49

Quartile

4th 1st

Entrepr. Culture & Opp. 41 38,5 37

GDP 51 [bn USD] IPO Volume

Population 8 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

150

125

SWOT Analysis 100

Entrepr. Culture Depth of Cap.

& Opp. 75 Market

Strengths 50

• Growing market 25

0

• Increasing number of investment opportunities

• Return has been higher than in mature markets

Hum. & Soc.

Taxation

Weaknesses Environment

• Deal size is relatively small Bulgaria

• Quality of target information below standard Inv. Prot. & Eastern Europe

Corp. Gov.

Opportunities United States = 100 Points

• Market expects higher than average growth

• Current low penetration of the service sector: existence of growth Separate VC and PE Indices

opportunities

40

Threats

• Continuing impact of crisis 45

• Small market

Index Rank

• Slow recovery of foreign markets

50

Outlook

• Following the crisis, the VC/PE market in Bulgaria could be

expected to become active with a six-month delay compared to 55

developed markets. Opportunities will arise from smaller size deals

60

Diana Nikolaeva, Partner, Ernst & Young Bulgaria 2005/06 2006/07 2007/08 2008/09 2009/10

VC PE VCPE

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Poland 41 45,8 31

Czech Republic 33 45,5 34

Estonia 30 44,5 35

Hungary 34 41,1 37

Lithuania 37 40,4 40

Croatia 47 38,6 45

Romania 52 38,1 47

Latvia 39 35,6 50

Bulgaria 48 30,6 55

80 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-79-320.jpg)

![Regional and country profiles

Canada

Capital: Ottawa ++ Official Language: English, French ++ Currency: Canadian Dollar

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 2 85,8 2

Economic Activity 13 95,3 10

Depth of Cap. Market 3 49,8 3

Taxation 17 100,2 52

Inv. Prot. & Corp. Gov. 11 100,8 9

Hum. & Soc. Env. 5 111,9 6

Quartile

4th 1st

Entrepr. Culture & Opp. 5 94,7 7

GDP 1491 [bn USD] IPO Volume

Population 33 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Many similarities with the US

0

• Canada benefits from the “facilities” and the deal supporting

institutions of the US

• Government support to spur the asset class (tax credits, indirect Hum. & Soc.

Taxation

Environment

investments)

Canada

Weaknesses North America

Inv. Prot. &

• Canada’s original VC/PE industry is still young, and little developed Corp. Gov.

United States = 100 Points

• Generated returns remain disappointing, so far

Opportunities Separate VC and PE Indices

• Political desire to turn the resource-based economy into a 0

knowledge-based economy

• Massive public investments into R&D

1

Threats

Index Rank

• Reduction of public support of R&D and VC/PE industry

2

Outlook

• The activities of the Canadian government to spur innovation and

growth should yield to a much stronger VC/PE market 3

4

2005/06 2006/07 2007/08 2008/09 2009/10

VC PE VCPE

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

United States 1 100,0 1

Canada 2 85,8 2

United Kingdom 3 84,3 3

Switzerland 8 76,3 8

Netherlands 14 70,1 9

Germany 9 69,1 10

Sweden 13 69,0 11

Denmark 10 67,7 12

Norway 11 66,3 14

82 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-81-320.jpg)

![Regional and country profiles

Chile

Capital: Santiago ++ Official Language: Spanish ++ Currency: Chilean Peso

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 27 45,8 32

Economic Activity 32 72,7 44

Depth of Cap. Market 32 12,6 34

Taxation 18 112,8 39

Inv. Prot. & Corp. Gov. 24 80,2 22

Hum. & Soc. Env. 27 77,0 27

Quartile

4th 1st

Entrepr. Culture & Opp. 36 35,2 42

GDP 190 [bn USD] IPO Volume

Population 17 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Law establishes corporate governance norms like the formation of

0

audit committees and strengthens management responsibility for

ensuring fair market prices for transactions

• Lower incidences of perceived corruption in the region Hum. & Soc.

Taxation

Environment

• There is considerable entrepreneurial dynamism

Chile

Weaknesses Latin America

Inv. Prot. &

• Low levels of market capitalization and high costs of meeting Corp. Gov.

United States = 100 Points

listing requirements mean that IPO exits are not accessible to the

vast majority of SMEs

Separate VC and PE Indices

• Value-added tax on fund administrator commissions for foreign

participants in funds 25

• Foreign investors from a majority of countries still face double- 26

taxation 27

28

Opportunities

Index Rank

29

• Law stimulates PE/VC activity through a new form of corporate 30

organization, the share-issuing limited-liability company, which 31

provides a more flexible instrument to receive venture capital 32

33

Threats

34

• The cost of protecting trademarks and patents is high, and the

35

country remains on the US Special 301 Watch List for intellectual

2005/06 2006/07 2007/08 2008/09 2009/10

property violations.

VC PE VCPE

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Chile 27 45,8 32

Mexico 51 35,8 49

Brazil 56 34,6 51

Uruguay 50 33,4 52

Peru 54 32,4 53

Colombia 55 29,4 58

Argentina 59 29,1 59

Paraguay 66 14,9 65

Venezuela 65 8,9 66

84 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-83-320.jpg)

![Regional and country profiles

China

Capital: Beijing ++ O cial Language: Standard Mandarin ++ Currency: Yuan Renminbi

Basic Facts VCPE-Ranking

2005/06 2009/10 Quar le

Rank Value Rank 4th 1st

VCPE Ranking 42 48,5 28

Econom c Ac t 28 79,7 35

Depth of Cap. Market 16 37,7 6

Taxa on 62 72,1 62

In . Prot. & Corp. Go . 55 48,6 52

Hum. & Soc. En . 42 61,4 42

4th

Quar le

1st

Entrepr. Culture & Opp. 50 29,6 50

GDP 4192 [bn USD] IPO Volume

Popula on 1336 [mn] M&A Volume

GDP Growth '02 '08 VC Ac t

Pop. Growth '02 '08 PE Ac t Key Factors Performance

Econom c

Ac t

125

100

SWOT Analysis

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Period from first VC/PE round to IPO is shorter than in other

0

countries

• Various IPOs with high international recognition in the past few

years Hum. & Soc.

Taxa on

En ronment

• Numerous alternative stock markets available for VC/PE exits

• Large companies acquiring VC/PE investees seen as attractive Ch na

alternative exit In . Prot. & As a

Corp. Go .

United States = 100 Points

Weaknesses

• Downturn of economy due to poor export atmosphere

Separate VC and PE Indices

• Poor market sentiment due to financial crisis

• Government policy may affect the availability of exits in overseas 15

stock markets due to strict going public criteria

20

Opportunities

25

• Strong growing economy

Index Rank

• Focus on new industries, such as solar and wind power 30

• Higher chances of success for green field investments

35

Threats

• High valuation levels may reduce the number of transactions 40

• LPs are requesting the GPs to be more cautious with investment

45

decisions

2005/06 2006/07 2007/08 2008/09 2009/10

• Uncertainty on the success of stimulus policies

VC PE VCPE

Outlook

• Too early to assess the impact of the stimulus policies to the Comparison within Peer Group

economy, but World Bank’s economic growth forecast for China

2005/06 2009/10 Quar le

rose significantly

Rank Value Rank 4th 1st

• Large increase in use of wind and solar power over the next

Hong Kong 4 79,5 5

decade planned: aimed to match Europe by 2020, producing a

fifth of its energy from renewable sources Japan 7 76,5 7

Republ c of Korea 15 67,5 13

Ringo Choi, Managing Partner, Ernst & Young China Mala s a 23 54,4 25

Ch na 42 48,5 28

In a 46 40,9 38

Russ an Federa on 49 38,0 48

Indones a 60 30,7 54

Ph l pp nes 57 26,1 61

86 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-85-320.jpg)

![Regional and country profiles

Colombia

Capital: Bogotá ++ Official Language: Spanish ++ Currency: Colombian Peso

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 55 29,4 58

Economic Activity 46 65,6 49

Depth of Cap. Market 47 8,1 51

Taxation 64 105,1 45

Inv. Prot. & Corp. Gov. 59 39,1 58

Hum. & Soc. Env. 60 31,3 64

Quartile

4th 1st

Entrepr. Culture & Opp. 51 30,2 49

GDP 234 [bn USD] IPO Volume

Population 47 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Low barriers to participation for institutional investors

0

• Liberal policies towards foreign portfolio investment

• Under recent corporate governance reforms, standards for listed

firms have improved Hum. & Soc.

Taxation

Environment

Weaknesses Colombia

• Decline in the country’s capital market development Inv. Prot. & Latin America

• Low levels of market capitalization and high costs of meeting Corp. Gov.

United States = 100 Points

listing requirements mean that IPO exits are still not accessible to

the vast majority of SMEs

Separate VC and PE Indices

• Efforts to transition to international accounting standards have

met with continued delays 53

Opportunities 54

• A loosening of restrictions will now allow further participation of 55

pension funds in PE/VC activities

Index Rank

56

Threats

57

• Corruption and the weakness of the local judicial system are still

roadblocks 58

• Restricted size and liquidity of capital markets, and resulting 59

difficulty of exits constitute an important impediment

60

2005/06 2006/07 2007/08 2008/09 2009/10

VC PE VCPE

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Chile 27 45,8 32

Mexico 51 35,8 49

Brazil 56 34,6 51

Uruguay 50 33,4 52

Peru 54 32,4 53

Colombia 55 29,4 58

Argentina 59 29,1 59

Paraguay 66 14,9 65

Venezuela 65 8,9 66

88 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-87-320.jpg)

![Regional and country profiles

Croatia

Capital: Zagreb ++ Official Language: Croatian ++ Currency: Croatian Kuna

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 47 38,6 45

Economic Activity 44 70,6 46

Depth of Cap. Market 59 8,4 49

Taxation 16 128,9 15

Inv. Prot. & Corp. Gov. 45 50,8 48

Hum. & Soc. Env. 40 61,1 43

Quartile

4th 1st

Entrepr. Culture & Opp. 32 43,4 31

GDP 61 [bn USD] IPO Volume

Population 5 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

150

125

SWOT Analysis 100

Entrepr. Culture Depth of Cap.

& Opp. 75 Market

Strengths 50

• Significant demand for all kind of financing 25

0

• Government recently introduced strategy for innovations (“BICRO”

and “CRANE”)

Hum. & Soc.

Taxation

Weaknesses Environment

• VC/PE market is in an initial phase of development Croatia

• Limited number of large potential investments Inv. Prot. & Eastern Europe

• Legal and business conditions are not supporting a dynamic SME Corp. Gov.

United States = 100 Points

sector due to lack of simple licensing and registration processes,

and barriers for investments

Separate VC and PE Indices

Opportunities

30

• Traditional bank loans become expensive and unavailable

• Growth potential in companies that are active in Croatia and 35

neighboring countries

40

• Untapped midsize market

Index Rank

Threats 45

• Cultural structure does not contribute to the development of 50

entrepreneurship

• Reduced availability of debt financing and general illiquidity 55

Outlook 60

• The Croatian market is traditionally bank oriented. Reduced access 2005/06 2006/07 2007/08 2008/09 2009/10

to bank loans for SMEs is expected to provide a platform for VC PE VCPE

increasing VC/PE activities. Hidden values are expected to be more

tapped by VC/PE in the near future. Comparison within Peer Group

2005/06 2009/10 Quartile

Balazs Tuske, Partner, Ernst & Young Hungary

Rank Value Rank 4th 1st

Poland 41 45,8 31

Czech Republic 33 45,5 34

Estonia 30 44,5 35

Hungary 34 41,1 37

Lithuania 37 40,4 40

Croatia 47 38,6 45

Romania 52 38,1 47

Latvia 39 35,6 50

Bulgaria 48 30,6 55

90 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-89-320.jpg)

![Regional and country profiles

Czech Republic

Capital: Prague ++ Official Language: Czech ++ Currency: Czech Koruna

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 33 45,5 34

Economic Activity 25 84,7 26

Depth of Cap. Market 43 9,9 44

Taxation 35 120,4 28

Inv. Prot. & Corp. Gov. 32 67,0 35

Hum. & Soc. Env. 23 87,2 20

Quartile

4th 1st

Entrepr. Culture & Opp. 35 41,9 33

GDP 232 [bn USD] IPO Volume

Population 10 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Relatively strong mid-term economic growth prospects

0

• Highly educated and skilled labor force, well developed

infrastructure

Hum. & Soc.

Taxation

Weaknesses Environment

• Illiquid capital market Czech Republic

• Negative perception/low profile of VC/PEs as a source of finance Inv. Prot. & Eastern Europe

• Few opportunities for large investments (>500m) Corp. Gov.

United States = 100 Points

• Poor quality of legal enforcement and uncertain tax environment

Opportunities Separate VC and PE Indices

• Many good companies with poor financial management 29

• Large pool of owner managed businesses where owners are now 30

reaching retirement 31

• Companies struggling to obtain credit from banks and looking for 32

other sources of finance

Index Rank

33

• Opportunities in non-cyclical industries such as healthcare 34

Threats 35

• 2010 elections may result in less favorable tax regime 36

37

• FX volatility (postponement of EURO adoption to at least 2015)

38

and adverse impact on export competitiveness

39

Outlook 2005/06 2006/07 2007/08 2008/09 2009/10

• Czech market continues to offer VC/PEs opportunities to execute VC PE VCPE

leveraged transactions with companies showing reasonable

growth prospects. Comparison within Peer Group

2005/06 2009/10 Quartile

Vladislav Severa, Partner, Ernst & Young Czech Republic

Rank Value Rank 4th 1st

Poland 41 45,8 31

Czech Republic 33 45,5 34

Estonia 30 44,5 35

Hungary 34 41,1 37

Lithuania 37 40,4 40

Croatia 47 38,6 45

Romania 52 38,1 47

Latvia 39 35,6 50

Bulgaria 48 30,6 55

92 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-91-320.jpg)

![Regional and country profiles

Denmark

Capital: Copenhagen ++ Official Language: Danish ++ Currency: Danish Krone

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 10 67,7 12

Economic Activity 14 92,3 14

Depth of Cap. Market 26 14,3 29

Taxation 33 120,5 27

Inv. Prot. & Corp. Gov. 4 106,0 4

Hum. & Soc. Env. 2 120,8 2

Quartile

4th 1st

Entrepr. Culture & Opp. 7 100,1 2

GDP 345 [bn USD] IPO Volume

Population 6 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Strong VC/PE environment with local as well as international

0

players

Weaknesses Hum. & Soc.

Taxation

• Low end of the VC market not powerful enough Environment

Denmark

Opportunities

• Many PE houses have raised funds recently Inv. Prot. & Western Europe

Corp. Gov.

• Backlog of exits from PE houses United States = 100 Points

Threats

Separate VC and PE Indices

• Financing can still be a problem

• Imbalance between financing opportunities and market pricing 8

on companies 9

10

Outlook 11

• Continuous PE activity expected

Index Rank

12

13

Christian Aarosin, Partner, Ernst & Young Denmark 14

15

16

17

18

2005/06 2006/07 2007/08 2008/09 2009/10

VC PE VCPE

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Germany 9 69,1 10

Denmark 10 67,7 12

Finland 12 65,9 15

France 17 65,2 16

Belgium 19 61,1 17

Austria 20 58,6 19

Ireland 16 58,3 21

Italy 32 47,5 29

Greece 44 40,7 39

94 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-93-320.jpg)

![Regional and country profiles

Egypt

Capital: Cairo ++ Official Language: Arabic ++ Currency: Egyptian Pound

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 53 30,1 57

Economic Activity 61 52,8 59

Depth of Cap. Market 51 9,3 45

Taxation 37 122,1 23

Inv. Prot. & Corp. Gov. 53 49,3 49

Hum. & Soc. Env. 49 37,9 61

Quartile

4th 1st

Entrepr. Culture & Opp. 57 20,7 58

GDP 168 [bn USD] IPO Volume

Population 77 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

150

125

SWOT Analysis 100

Entrepr. Culture Depth of Cap.

& Opp. 75 Market

Strengths 50

• Economy is sufficiently diversified and investors can find broad 25

0

industries for investment

• Growth relies on reform initiatives that spurred FDI flow and

strengthened the purchasing power of a large and growing Hum. & Soc.

Taxation

Environment

population base

Egypt

Weaknesses Middle East

Inv. Prot. &

• Market is too fragmented, hence local knowledge and presence in Corp. Gov.

United States = 100 Points

the market is necessary

• Regulatory enforcement is still a key issue to be addressed in the

Separate VC and PE Indices

country

50

Opportunities 51

• Ideal time to look at defensive sectors such as FMCG, education, 52

pharmaceutical and services related industries such as media and 53

advertising

Index Rank

54

• Ideal time to have a closer look at distressed companies having 55

good business models 56

Threats 57

58

• Over the short-term, economic growth is projected to slow down

59

as the global tourism industry slows down

60

Outlook 2005/06 2006/07 2007/08 2008/09 2009/10

• Over the short-term period, global economic slow-down will VC PE VCPE

impact growth prospects and overall business performance in

Egypt. However, the long-term positive impact of the economic Comparison within Peer Group

reforms will filter into the economy.

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Nawal Nely, Senior Manager, Ernst & Young Egypt

Israel 21 55,8 22

United Arab Emirates 26 51,7 26

Saudi Arabia 36 46,4 30

Kuwait 29 40,1 42

Oman 38 38,1 46

Morocco 58 30,3 56

Egypt 53 30,1 57

Nigeria 64 24,4 62

Kenya 63 19,3 64

96 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-95-320.jpg)

![Regional and country profiles

Estonia

Capital: Tallinn ++ Official Language: Estonian ++ Currency: Estonian Kroon

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 30 44,5 35

Economic Activity 39 51,6 60

Depth of Cap. Market 44 8,3 50

Taxation 25 129,7 14

Inv. Prot. & Corp. Gov. 21 82,6 20

Hum. & Soc. Env. 37 77,6 26

Quartile

4th 1st

Entrepr. Culture & Opp. 24 58,8 25

GDP 24 [bn USD] IPO Volume

Population 1 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

150

125

SWOT Analysis 100

Entrepr. Culture Depth of Cap.

& Opp. 75 Market

Strengths 50

• Simple and attractive tax system 25

0

• Increasing “European” business culture

• Open economy with strong foreign direct investment inflows

• Strong track record of VC/PE companies’ portfolios Hum. & Soc.

Taxation

Environment

Weaknesses Estonia

• Overall small M&A market and low liquidity stock exchange Inv. Prot. & Eastern Europe

• Mostly investments in traditional industries Corp. Gov.

United States = 100 Points

• Historical high account deficit

Opportunities Separate VC and PE Indices

• Government has no debt and has accumulated extensive 25

stabilization reserves

• Government strives to meet the Euro adaption criteria and join 30

the Euro-zone in 2011

• Increasing interest towards innovative industries

Index Rank

35

Threats

• Difficulties in obtaining bank financing in the near future 40

• VC/PE companies may struggle to find attractive exit

45

opportunities

• Baltic region, which is seen as one area, eclipses the amenities of

50

Estonia

2005/06 2006/07 2007/08 2008/09 2009/10

Outlook VC PE VCPE

• Development of VC/PE investments is much dependent on the

sentiment about growth prospects and devaluation risks in the Comparison within Peer Group

Baltics

2005/06 2009/10 Quartile

• Foreign VC/PE houses will start to show interest for Baltic Rank Value Rank 4th 1st

companies if the bottom has been reached and solid growth

Poland 41 45,8 31

opportunities arise

Czech Republic 33 45,5 34

Lili Kirikal, Manager, Ernst & Young Estonia Estonia 30 44,5 35

Hungary 34 41,1 37

Lithuania 37 40,4 40

Croatia 47 38,6 45

Romania 52 38,1 47

Latvia 39 35,6 50

Bulgaria 48 30,6 55

98 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-97-320.jpg)

![Regional and country profiles

Finland

Capital: Helsinki ++ Official Language: Finnish, Swedish ++ Currency: Euro

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 12 65,9 15

Economic Activity 19 90,7 17

Depth of Cap. Market 25 14,5 28

Taxation 32 116,3 32

Inv. Prot. & Corp. Gov. 5 102,9 5

Hum. & Soc. Env. 7 107,4 7

Quartile

4th 1st

Entrepr. Culture & Opp. 2 102,3 1

GDP 274 [bn USD] IPO Volume

Population 5 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• High education and R&D contribution

0

• Strong selected sectors

Weaknesses Hum. & Soc.

Taxation

• Relative small local markets to support the business case Environment

• Early stage VC financing needs to be further developed Finland

Opportunities Inv. Prot. & Western Europe

Corp. Gov.

• New sectors arising, for example cleantech United States = 100 Points

• Build globally leading clusters in certain strong industries

Separate VC and PE Indices

Threats

• Internalization is typically a must to success 10

• Challenges in financing in current environment 11

12

Outlook 13

• Finland will be seen as an interesting area to invest

Index Rank

14

15

Petri Ojala, Partner, Ernst & Young Finland 16

17

18

19

20

2005/06 2006/07 2007/08 2008/09 2009/10

VC PE VCPE

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Germany 9 69,1 10

Denmark 10 67,7 12

Finland 12 65,9 15

France 17 65,2 16

Belgium 19 61,1 17

Austria 20 58,6 19

Ireland 16 58,3 21

Italy 32 47,5 29

Greece 44 40,7 39

100 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-99-320.jpg)

![Regional and country profiles

France

Capital: Paris ++ Official Language: French ++ Currency: Euro

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 17 65,2 16

Economic Activity 24 95,0 11

Depth of Cap. Market 7 28,8 10

Taxation 58 106,1 44

Inv. Prot. & Corp. Gov. 23 83,9 19

Hum. & Soc. Env. 19 78,3 25

Quartile

4th 1st

Entrepr. Culture & Opp. 22 69,2 22

GDP 2834 [bn USD] IPO Volume

Population 62 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

125

SWOT Analysis 100

Entrepr. Culture 75 Depth of Cap.

& Opp. 50

Market

Strengths

25

• Smaller decrease of number of deals in France than in Europe

0

• Early stage investments resist better in France than in Europe, due

to convergent public incentives in favor of innovation

• Consistent deal-flow of high quality high tech projects Hum. & Soc.

Taxation

Environment

Weaknesses France

• French GPs realize less international deals than their European Inv. Prot. & Western Europe

peers, e.g., UK, Germany, Sweden Corp. Gov.

United States = 100 Points

• Cleantech investments are late in France, although accelerating

Opportunities Separate VC and PE Indices

• Tax policy in favor of asset class: “FCPI”, “Loi Tepa” 8

• Tax policy in favor of innovation: “Credit Impot Recherche”, 9

“OSEO” incentives 10

Threats 11

Index Rank

• Only a few large funds of funds 12

• French emerging companies have difficulties to grow (after four 13

years of existence) and to become market leaders 14

• Outlook 15

16

• French tax policies may foster new promising opportunities for

17

VC/PE

18

2005/06 2006/07 2007/08 2008/09 2009/10

Philippe Grand, Partner, Ernst & Young France

VC PE VCPE

Comparison within Peer Group

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Germany 9 69,1 10

Denmark 10 67,7 12

Finland 12 65,9 15

France 17 65,2 16

Belgium 19 61,1 17

Austria 20 58,6 19

Ireland 16 58,3 21

Italy 32 47,5 29

Greece 44 40,7 39

102 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-101-320.jpg)

![Regional and country profiles

Germany

Capital: Berlin ++ Official Language: German ++ Currency: Euro

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 9 69,1 10

Economic Activity 43 97,1 5

Depth of Cap. Market 8 23,6 14

Taxation 24 126,6 16

Inv. Prot. & Corp. Gov. 12 94,2 14

Hum. & Soc. Env. 17 90,0 19

Quartile

4th 1st

Entrepr. Culture & Opp. 12 85,1 14

GDP 3624 [bn USD] IPO Volume

Population 83 [mn] M&A Volume

GDP Growth '02 '08 VC Activity

Pop. Growth '02 '08 PE Activity Key Factors Performance

Economic

Activity

150

125

SWOT Analysis 100

Entrepr. Culture Depth of Cap.

& Opp. 75 Market

Strengths 50

• Large number of interesting targets of all sizes and strong 25

0

potential from privately owned businesses facing succession

problems

• Many corporations in technological and market leadership Hum. & Soc.

Taxation

Environment

• Diverse portfolio of industries in Europe’s leading economy

Germany

• Very strong infrastructure and reliable administration

• Cultural attitude towards performance and diligence Inv. Prot. & Western Europe

Corp. Gov.

United States = 100 Points

Weaknesses

• Crisis driven failures have damaged the reputation of the

Separate VC and PE Indices

industry and it will take some time to win back sellers’ and public

confidence 6

7

Opportunities

• Unfavorable loan situation makes many companies look for other 8

sources of capital and VC/PE represents a promising option 9

Index Rank

• Comprehensive restructuring in current crisis will bring German 10

industries into favorite competitive positions for the next cycle

11

Threats 12

• Current portfolios are hit hard by the crisis

13

• German economy is export oriented, and hence, strongly

14

dependent on the recovery of the world’s markets

2005/06 2006/07 2007/08 2008/09 2009/10

Outlook VC PE VCPE

• Mid-term, the market will reach former performance as German

targets are mostly leading players in important markets, and will Comparison within Peer Group

fully participate from the post crisis upturn of the world economy.

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

Florian Huber, Senior Manager, Ernst & Young Germany

Germany 9 69,1 10

Denmark 10 67,7 12

Finland 12 65,9 15

France 17 65,2 16

Belgium 19 61,1 17

Austria 20 58,6 19

Ireland 16 58,3 21

Italy 32 47,5 29

Greece 44 40,7 39

104 The Global Venture Capital and Private Equity Country Attractiveness Index - 2009/2010 annual](https://image.slidesharecdn.com/iesevcpeindexannual2009-110326195513-phpapp02/85/Iese-vcpe-index_annual_2009-103-320.jpg)

![Regional and country profiles

Greece

Capital: Athens ++ Official Language: Greek ++ Currency: Euro

Basic Facts VCPE-Ranking

2005/06 2009/10 Quartile

Rank Value Rank 4th 1st

VCPE Ranking 44 40,7 39

Economic Activity 29 88,5 21

Depth of Cap. Market 36 12,6 35

Taxation 41 120,9 26

Inv. Prot. & Corp. Gov. 48 54,2 45

Hum. & Soc. Env. 46 47,7 50

Quartile

4th 1st