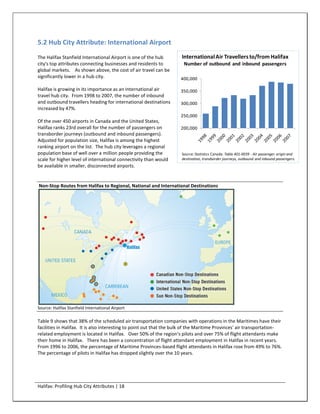

Halifax serves as a crucial hub city for Nova Scotia and Atlantic Canada, driving economic growth and competitiveness through the concentration of key industries, decision-makers, and resources. The report explores various attributes including transportation, education, and specialized services that benefit both Halifax and surrounding regions. It concludes that the city's role is vital for regional economic health, providing employment and significant tax revenue for local governments.

![2.2 Employment Trending outside the Halifax CMA

While it is true that certain occupations are concentrating in the Halifax CMA due to the clustering effect, there is

little evidence this concentration is having a negative impact on the rest of Nova Scotia. A review of top level

occupational groups and the change in employment from 1996 to 2006 shows that the employment declines in

Nova Scotia outside the Halifax CMA are exclusively in occupations in primary industry and in manufacturing. The

two sectors where the Halifax CMA has a very low employment level. Without these two declining sectors,

employment in Nova Scotia outside the Halifax CMA was up by a strong 9% from 1996 to 2006.

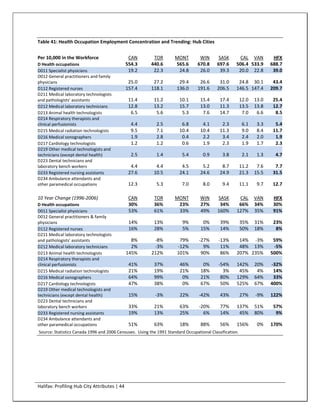

Table 1 below shows the 10 year employment growth among the two digit occupational groups for the Halifax

CMA and the rest of Nova Scotia. Collectively, the rest of Nova Scotia witnessed employment growth in most

occupational categories with the exception of those occupations associated with agriculture, forestry and other

manufacturing.

In other words, the jobs are not being lost to Halifax with the exception of specific occupations (such as senior

management, specialized health occupations, etc.) that are offset by gains in other areas. The challenges in Nova

Scotia (outside the Halifax CMA) seem to be restricted to the industries that are primarily rural and small

community centered.

Table 1: Employment by Occupation (Nova Scotia less the Halifax CMA)

Halifax

Total Total Employment Employment Employment

Employment Employment # Change % Change Intensity

1996 2006 (96-06) (96-06) (2006)

Total labour force 256,000 263,190 7,190 3% 45%

Occupation - Not applicable [1] 9,430 4,730 -4,700 -50% 37%

All occupations 246,570 258,455 11,885 5% 45%

A Management occupations 17,420 18,885 1,465 8% 55%

B Business, finance and administrative occupations 32,425 37,535 5,110 16% 53%

C Natural and applied sciences and related

occupations 7,295 10,295 3,000 41% 59%

D Health occupations 13,680 16,455 2,775 20% 47%

E Occupations in social science, education,

government service and religion 15,825 17,865 2,040 13% 50%

F Occupations in art, culture, recreation and sport 4,605 5,145 540 12% 60%

G Sales and service occupations 67,735 68,195 460 1% 46%

H Trades, transport and equipment operators and

related occupations 41,400 43,440 2,040 5% 36%

I Occupations unique to primary industry 24,860 21,510 -3,350 -13% 12%

J Occupations unique to processing, manufacturing

and utilities 21,320 19,135 -2,185 -10% 21%

Employment (less I & J Occupations) 200,390 217,810 17,420 9%

Source: Statistics Canada 1996 and 2006 Censuses. Using the 1991 Standard Occupational Classification.

1. Occupation - Not applicable. Defined as unemployed persons 15 years and over who have never worked for pay or in self-

employment or who had last worked prior to January 1, 2005 only.

Halifax: Profiling Hub City Attributes | 9](https://image.slidesharecdn.com/halifaxhubresearchfinaljune2010-101130183711-phpapp02/85/Halifax-Hub-City-for-the-Maritime-Provinces-10-320.jpg)