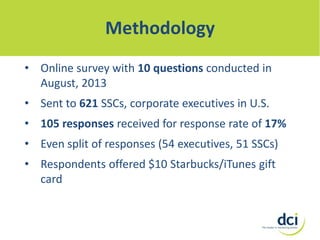

The document summarizes the results of a survey of 105 US corporate executives and site selection consultants about their perceptions of Canada's business climate.

The key findings were:

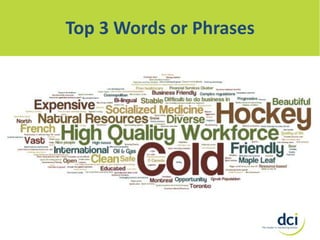

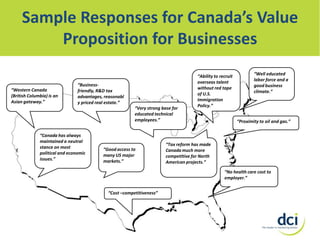

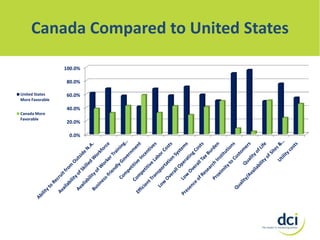

1) Executives associate Canada with a high quality workforce.

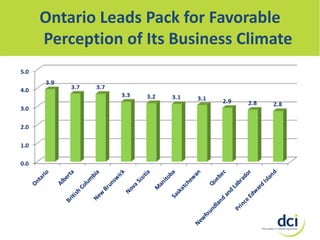

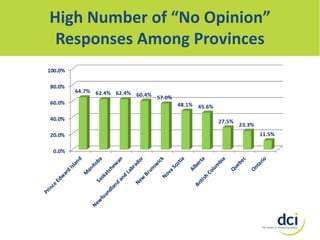

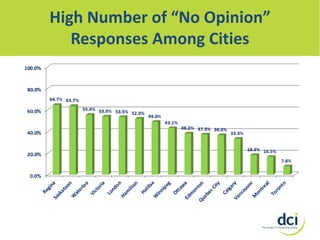

2) Ontario is overwhelmingly the most considered location for projects in Canada, while many other regions are unknown.

3) Perceptions of Canada's business climate have improved over the past 5 years.

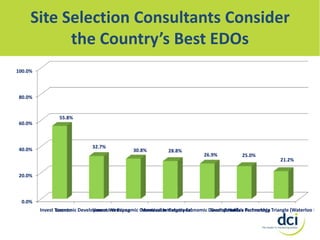

4) Different marketing tactics are most effective for reaching corporate executives versus site selection consultants.