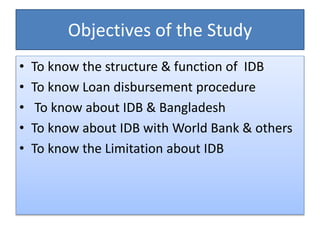

This document presents an overview of the Islamic Development Bank (IDB), including its structure, functions, objectives, and relationship with member countries such as Bangladesh. It details the IDB's history, loan disbursement procedures, collaboration with other financial institutions, and limitations faced by the organization. The IDB aims to promote socio-economic development and cooperation among member nations while adhering to Islamic financial principles.