This document provides an overview of ICICI Bank, one of the largest private sector banks in India. Some key points:

- ICICI Bank was established in 1955 and has grown to become the second largest bank in India by assets and third largest by market capitalization.

- It has a network of over 2,800 branches within India and a presence in 19 countries worldwide.

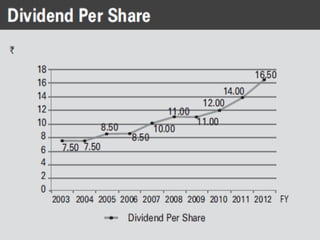

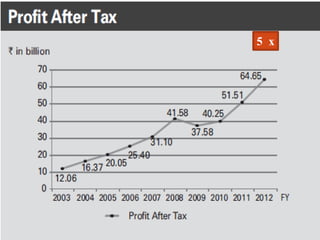

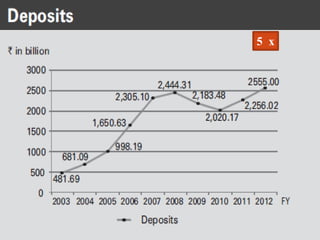

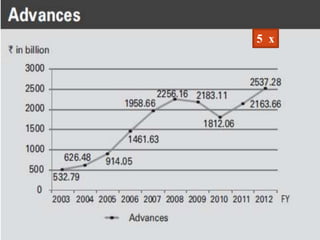

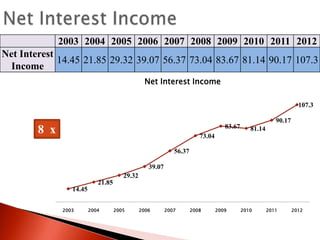

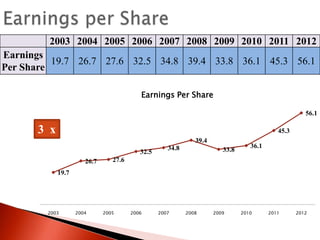

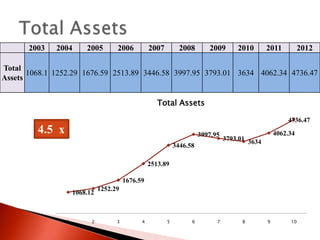

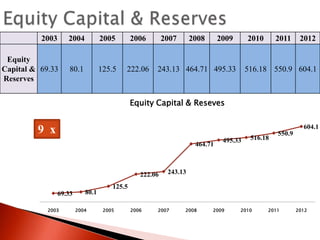

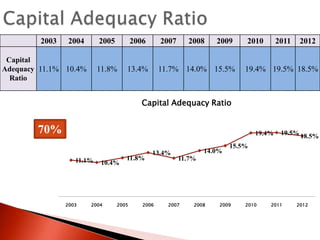

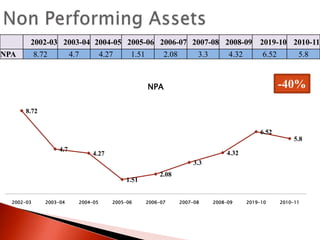

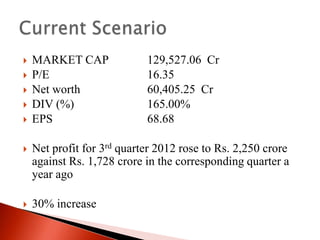

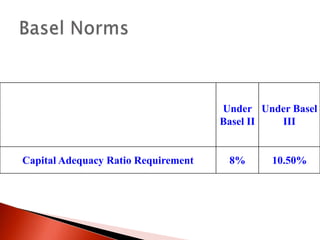

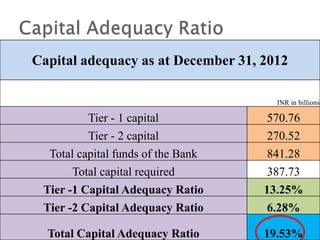

- Over the years, ICICI Bank has increased its net interest income, earnings per share, total assets, equity capital and reserves, and capital adequacy ratio according to data shown from 2003-2012.

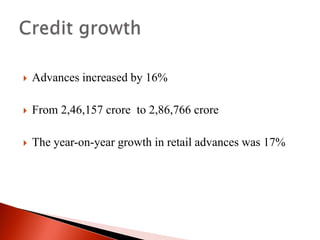

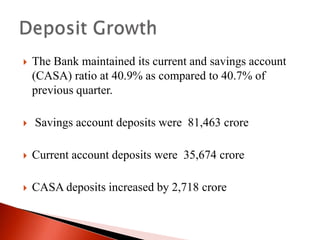

- Projections estimate the bank will continue growing its total assets, deposits, credit growth, deposit growth, net profit