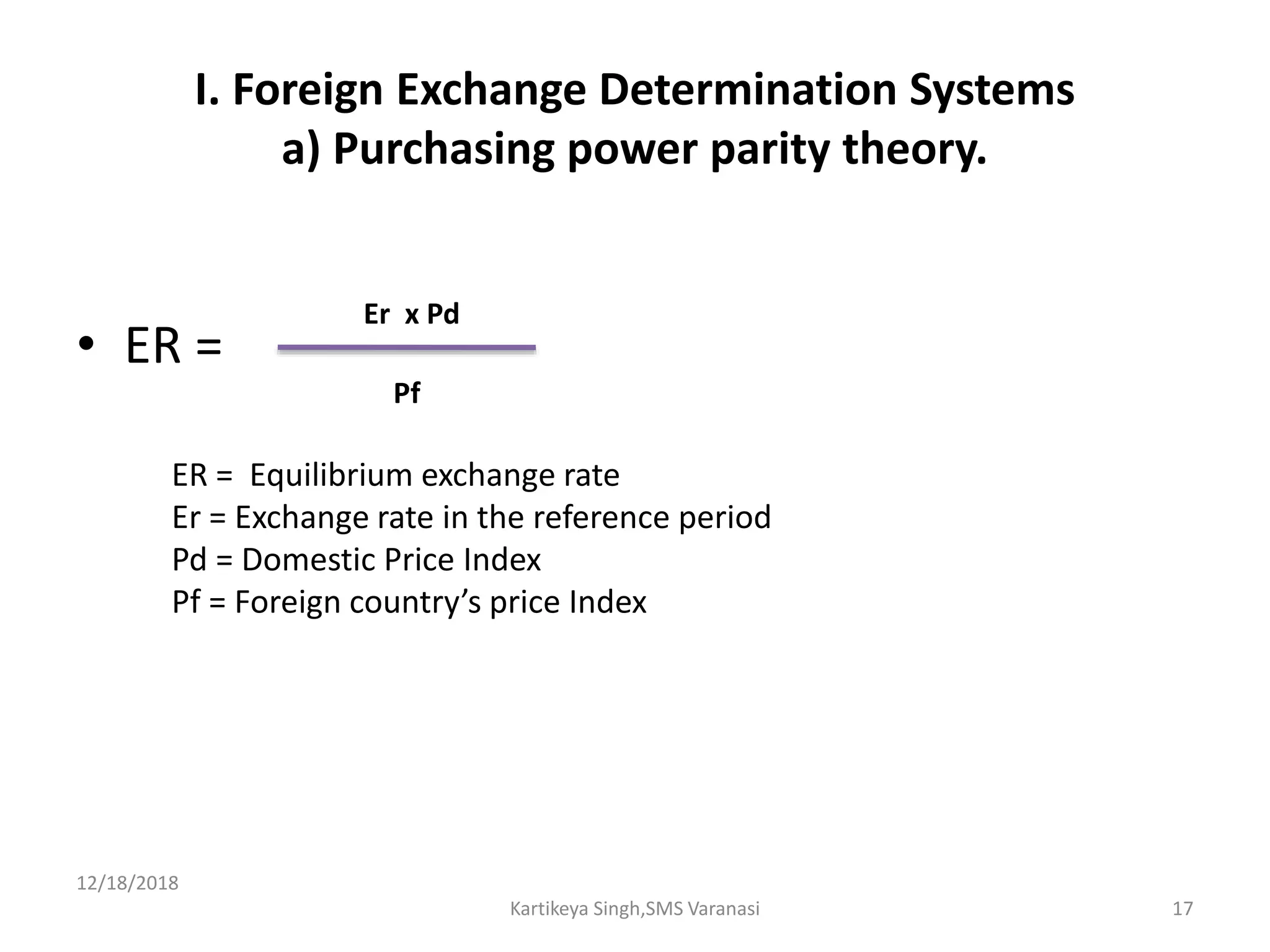

1. The document discusses different foreign exchange determination systems and exchange rate regimes. It describes purchasing power parity theory and the balance of payments theory, which says exchange rates are determined by demand and supply in the foreign exchange market.

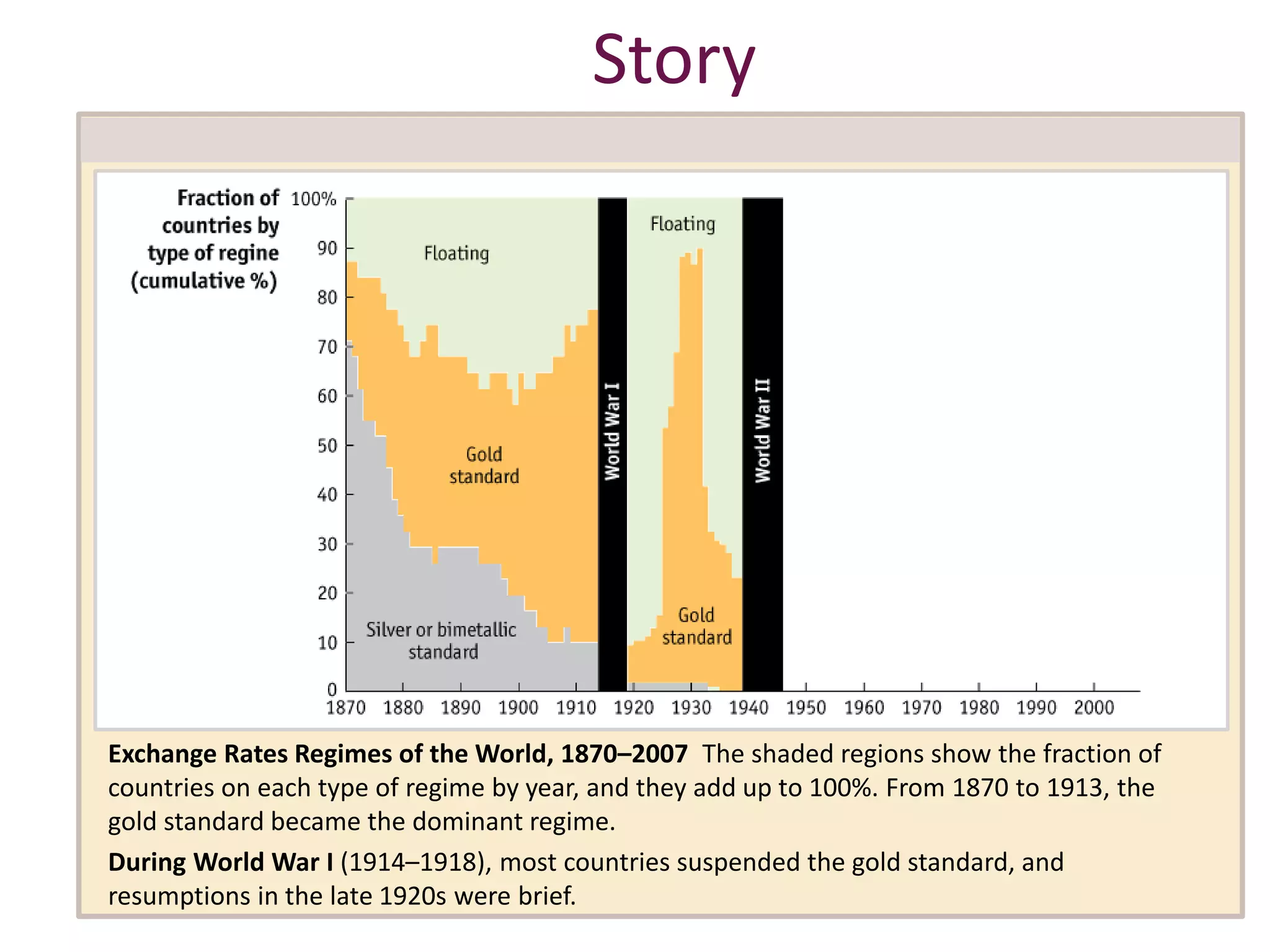

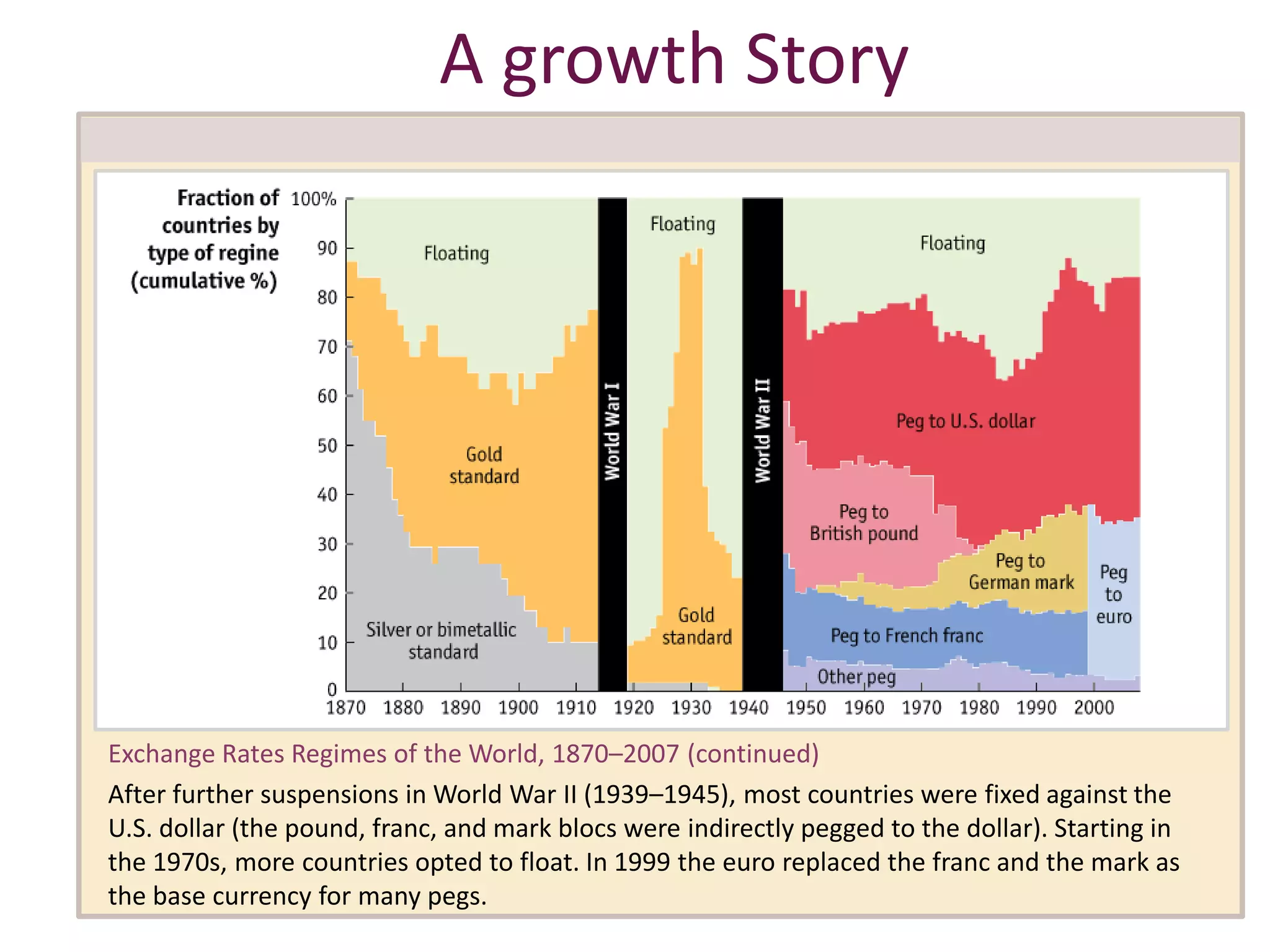

2. It analyzes fixed and floating exchange rate regimes, noting advantages and disadvantages of each. Fixed rates aim to promote trade and investment but lack flexibility, while floating rates automatically adjust for economic imbalances but add uncertainty.

3. Interest rates, inflation, and exchange rates are interrelated, and central banks can influence inflation and exchange rates by adjusting interest rates.