The document provides an overview of international business concepts including:

1. It defines international business and discusses its key features such as the flow of capital across countries and the need for accurate information.

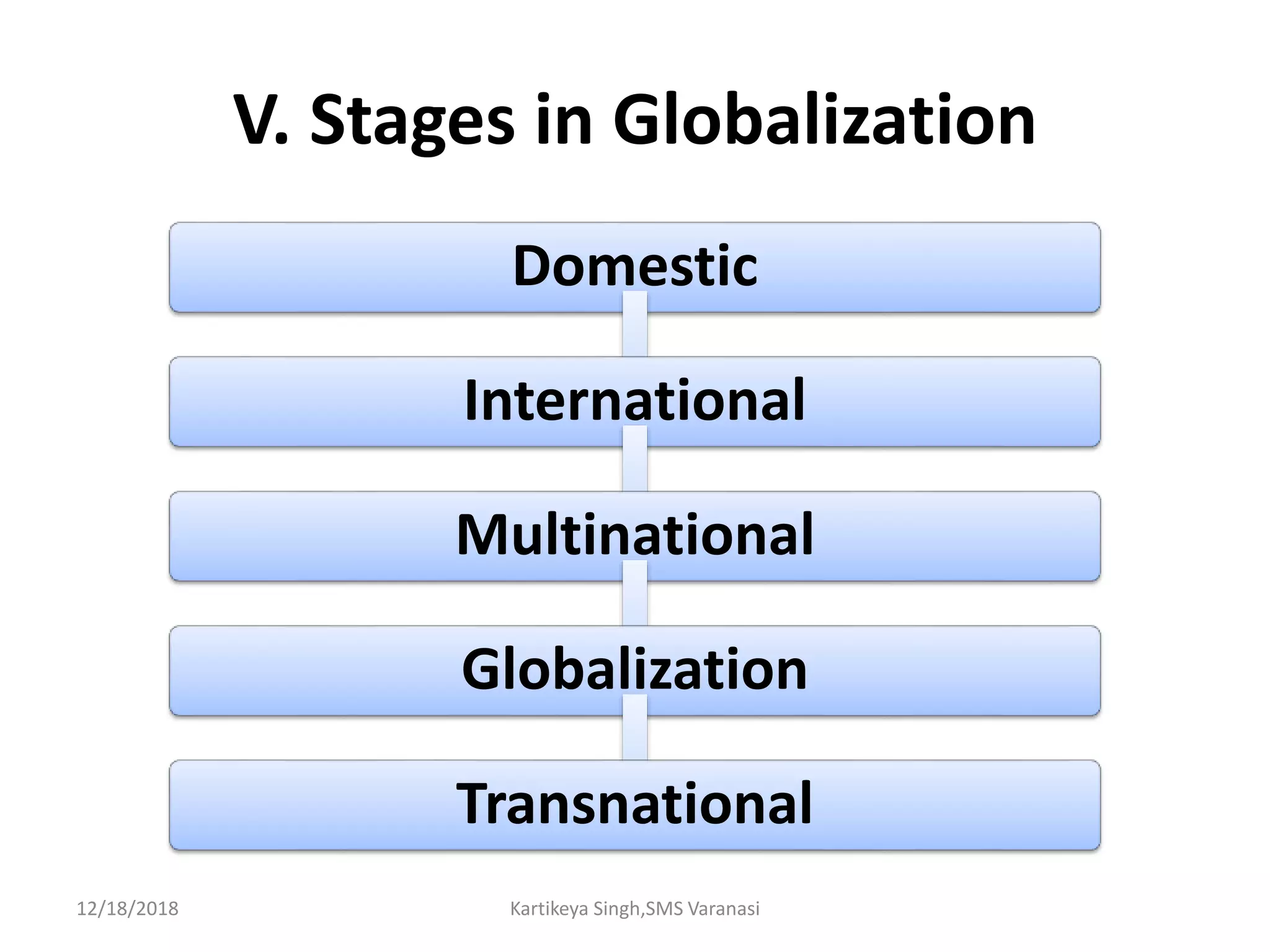

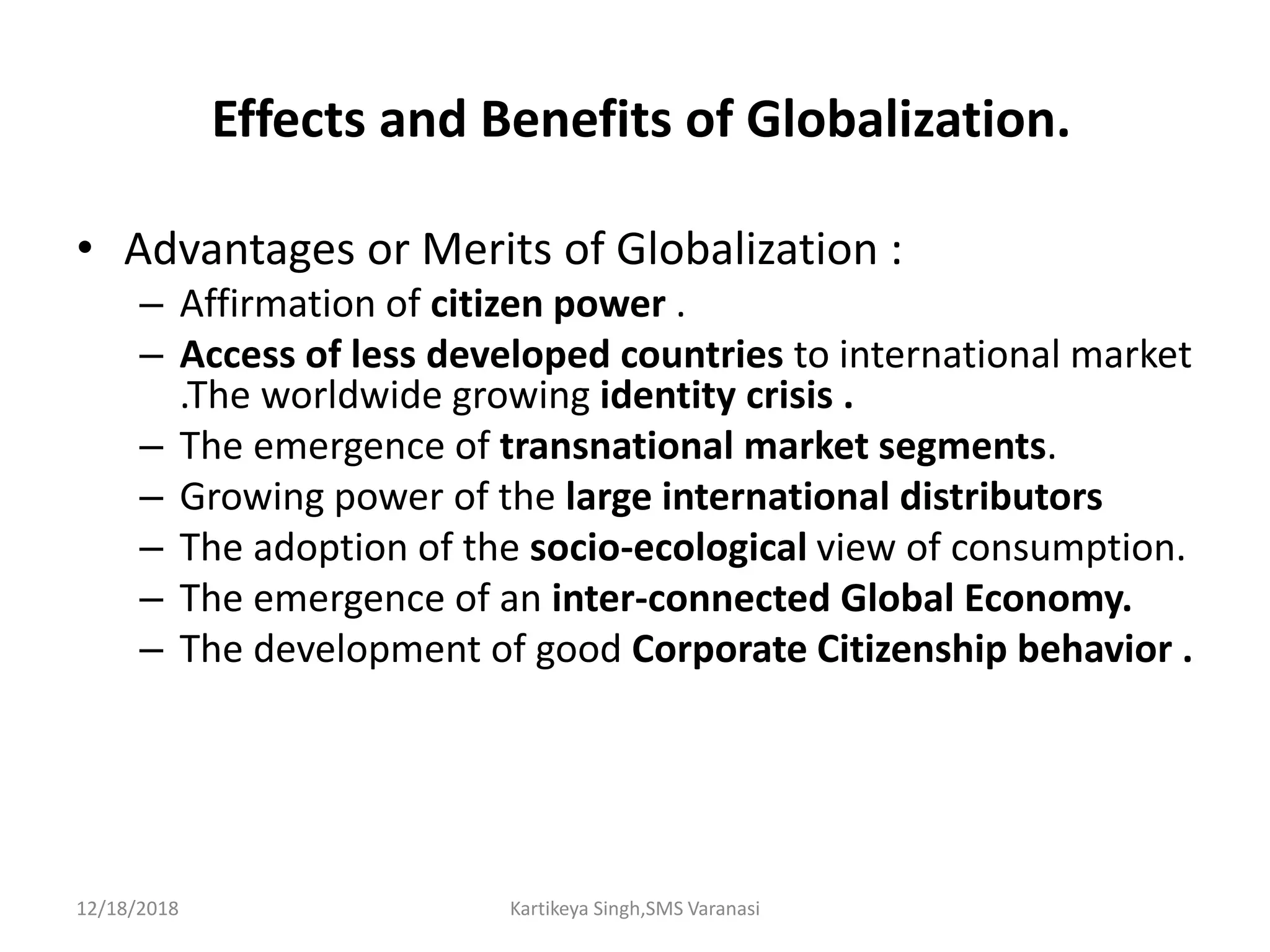

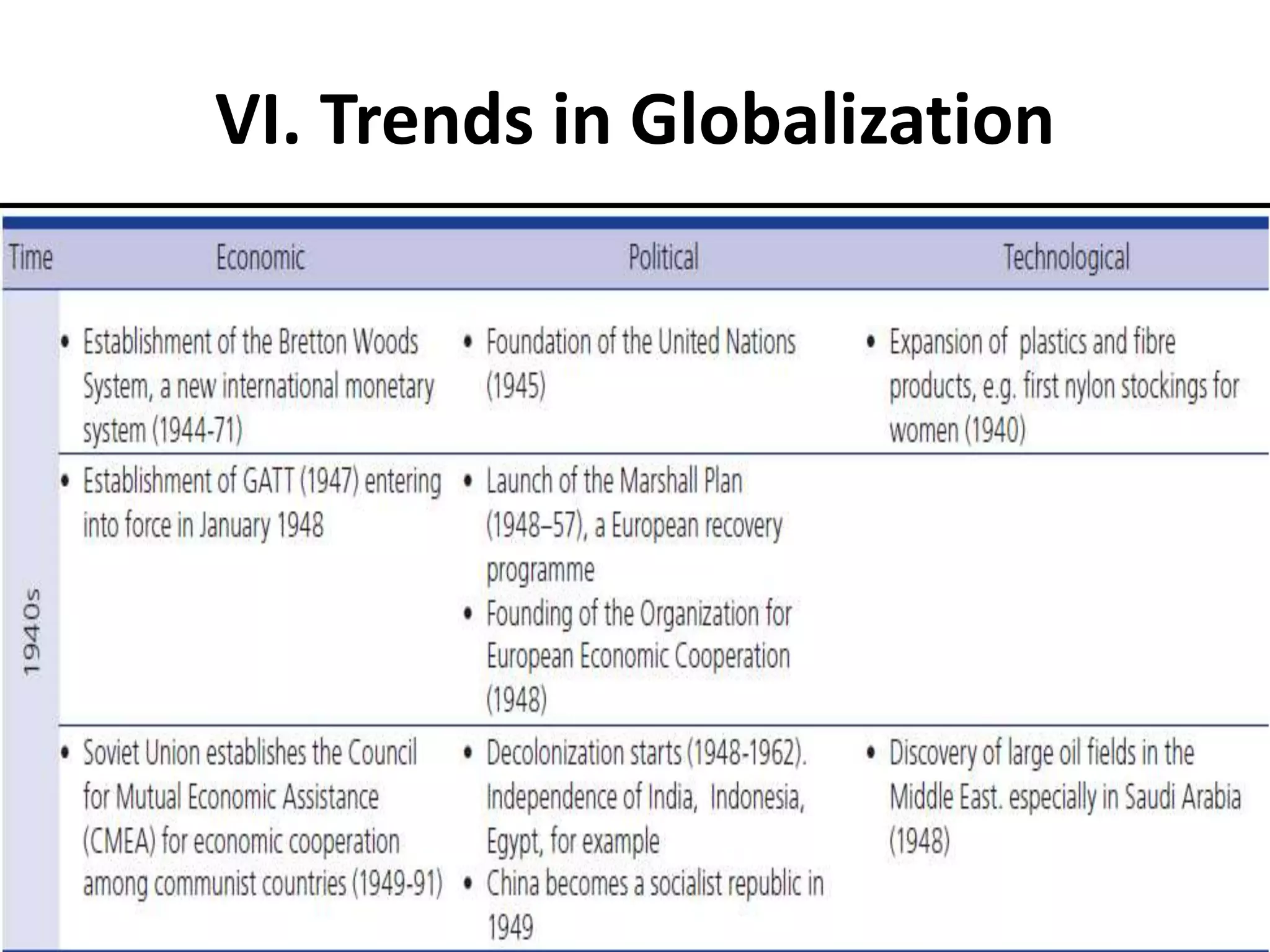

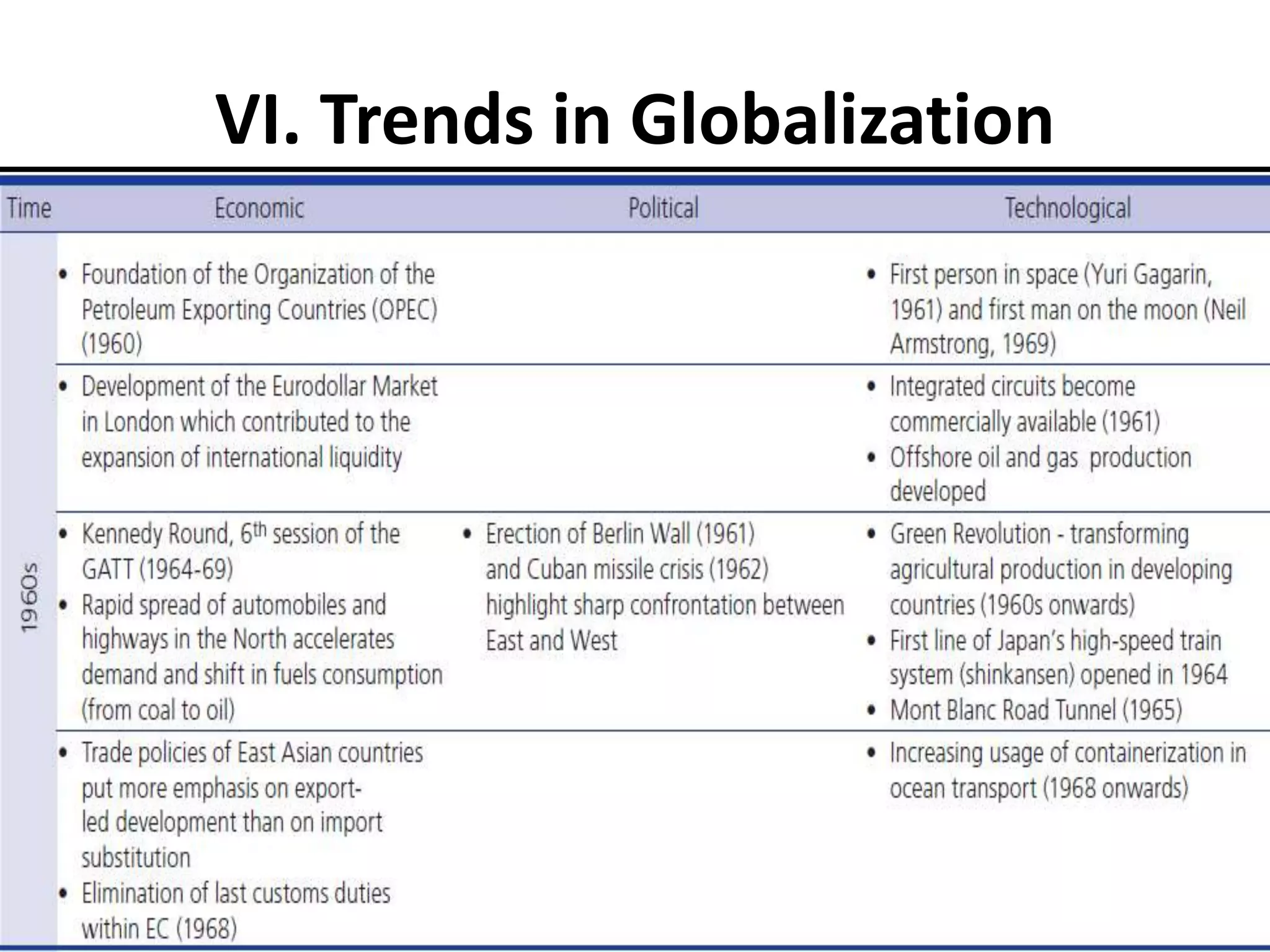

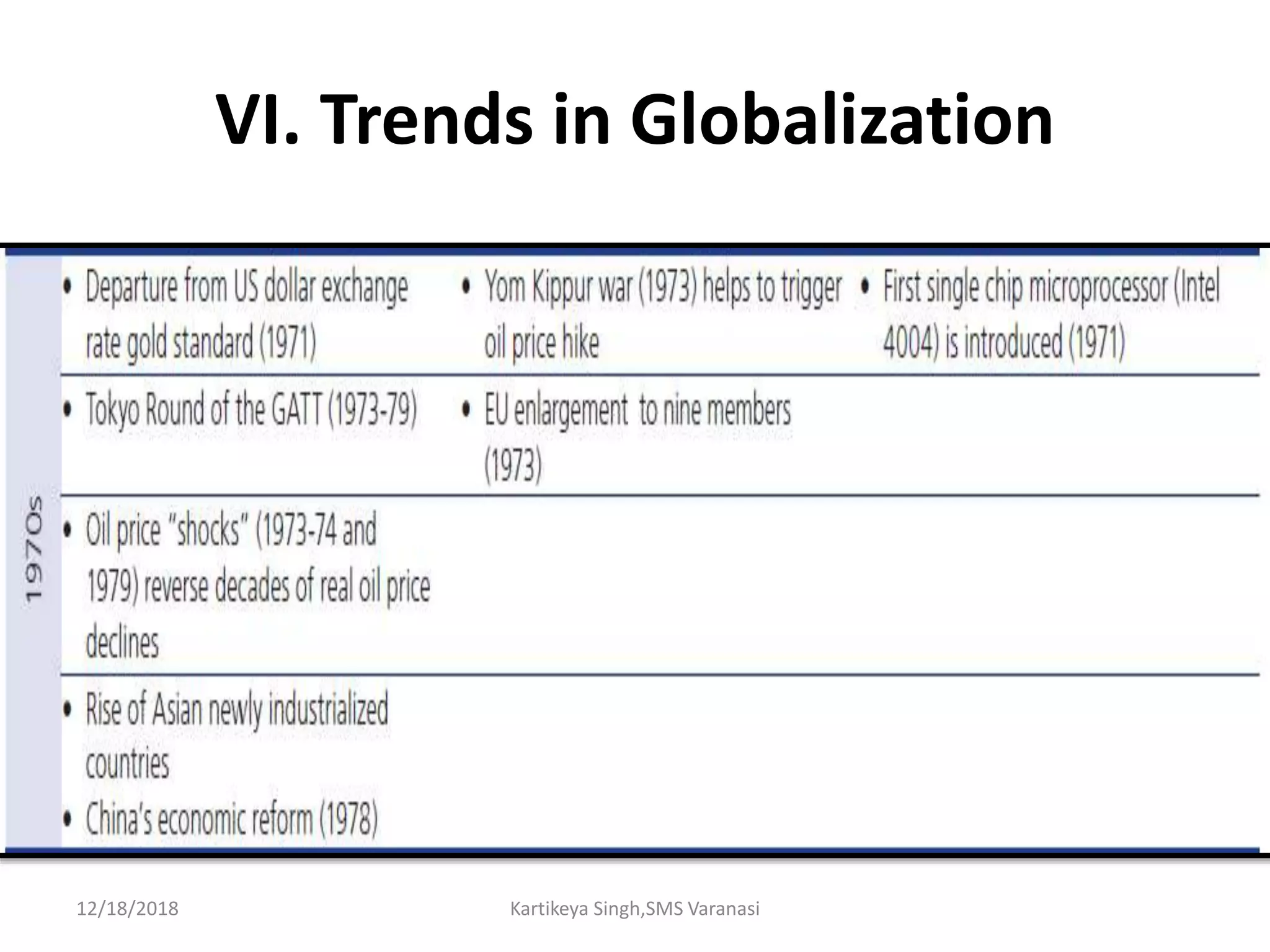

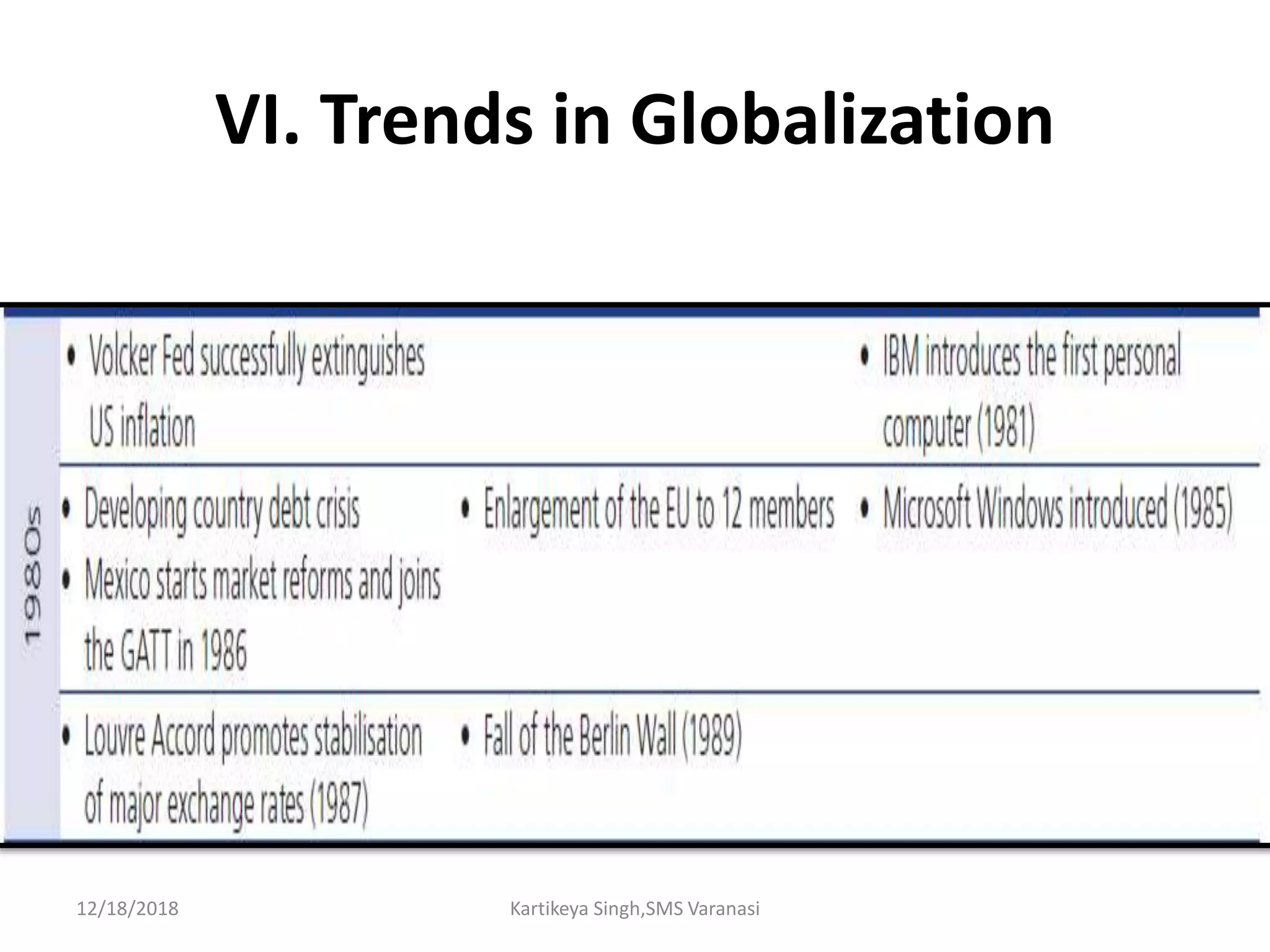

2. It outlines various stages in the process of globalization from domestic operations to multinational operations. Domestic firms focus only on their home country market while international firms export but have no foreign investments. Multinational firms have operations and trading in multiple countries.

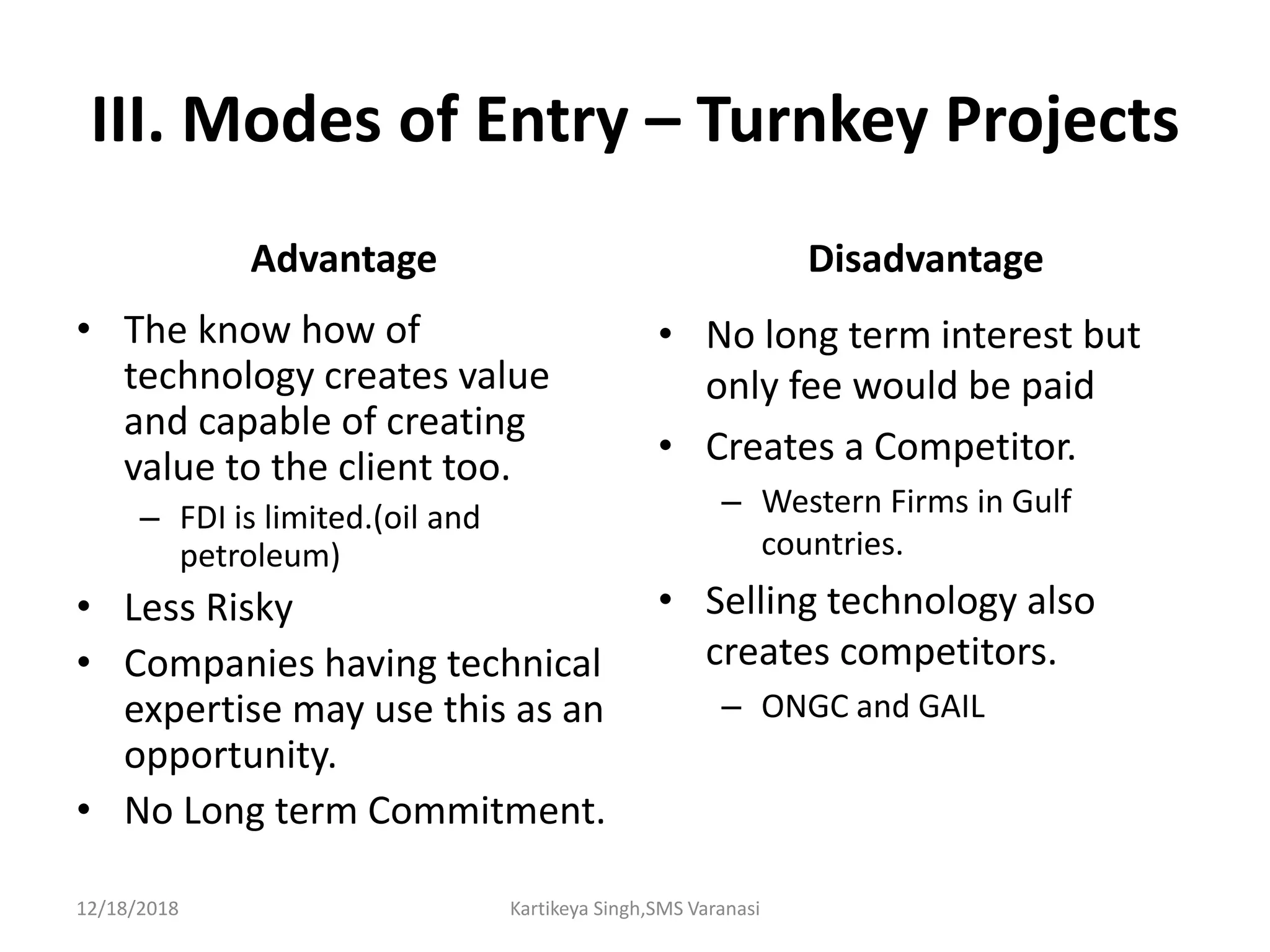

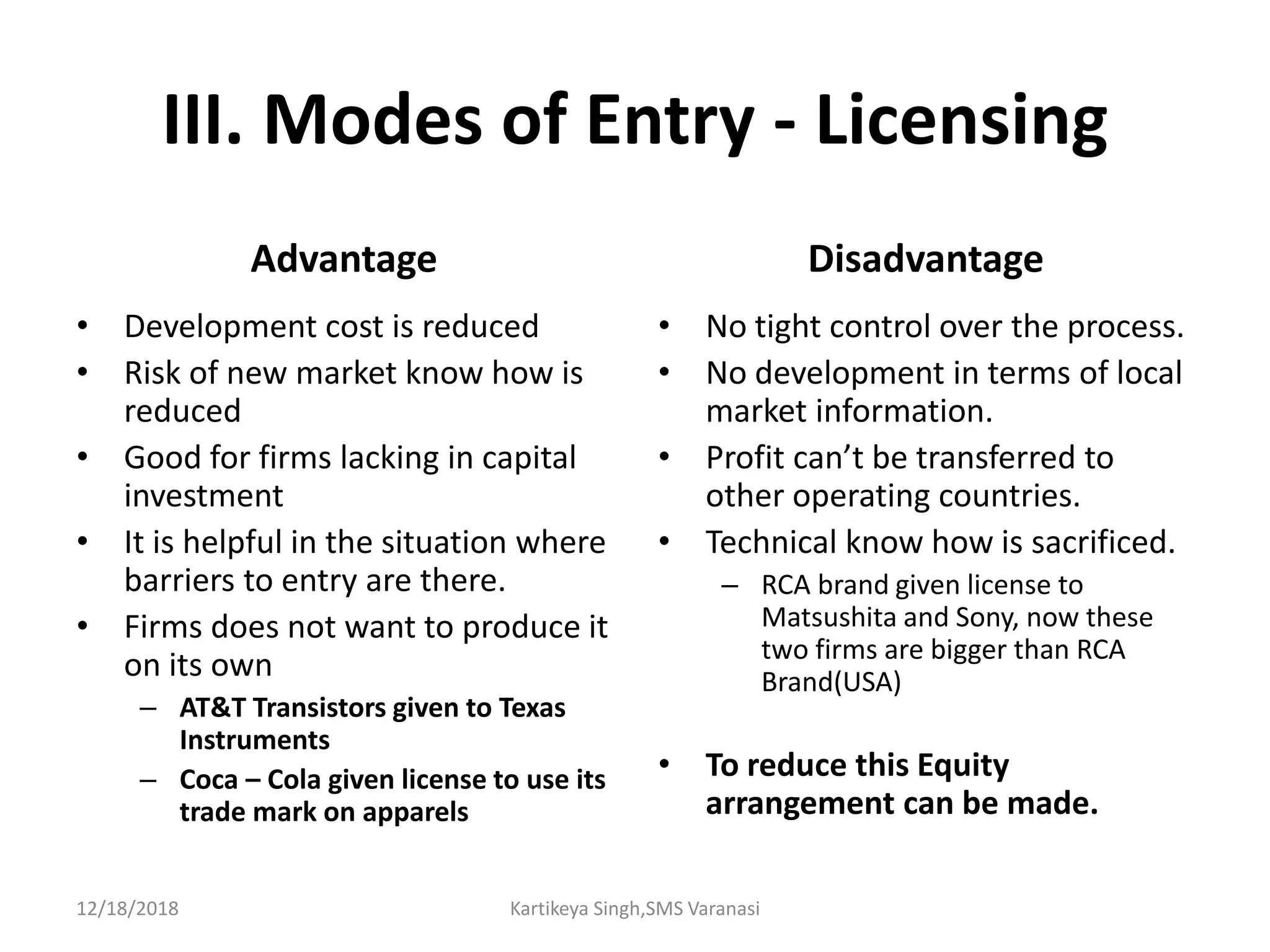

3. It examines different modes of entering foreign markets including exporting, turnkey projects, licensing, franchising, joint ventures, wholly owned subsidiaries, and strategic alliances. Each option has advantages and disadvantages depending on a firm's resources and goals