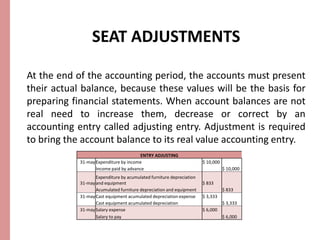

This document discusses accounting policies for changes in accounting principles, estimates, and errors according to IAS 8. It states that the objective is to prescribe criteria for selecting and changing accounting policies to enhance the relevance and reliability of financial statements. Changes in accounting principles are only allowed in exceptional circumstances to maintain comparability. Changes in estimates occur due to new information and conditions and must be revised. Errors discovered in approved financial statements make them unreliable and must be remedied. Adjusting entries are also discussed to accurately reflect account balances at the end of a period.