The document discusses the impact investor marketplace in Australia, including what has attracted impact investors, challenges in building the market, and how to grow it further. Key points include:

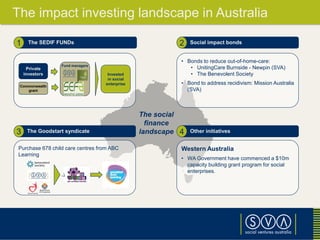

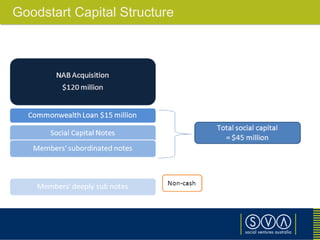

- Goodstart's $670 million acquisition of childcare centers attracted impact investors due to its strong governance, large size, and proven government cashflows.

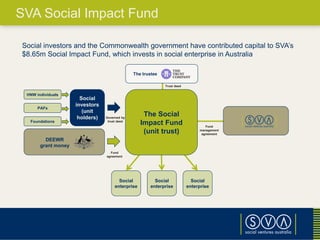

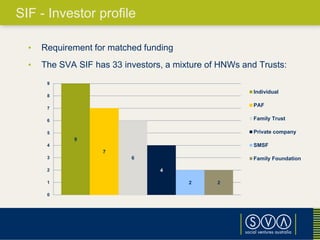

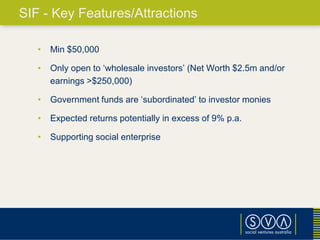

- The SVA Social Impact Fund pools money from both social investors and the government to invest in social enterprises, with features like minimum investment amounts and expected returns over 9%.

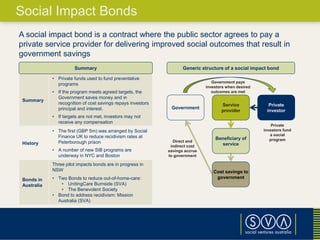

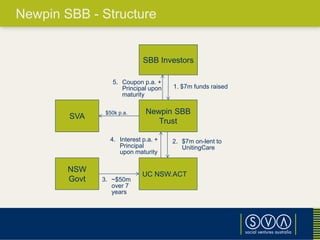

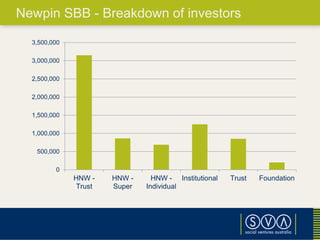

- Social impact bonds in Australia use private investor funds for social programs, with the government repaying investors from cost savings if programs meet targets. Three pilot bonds aim to reduce out-of-home care and recidivism