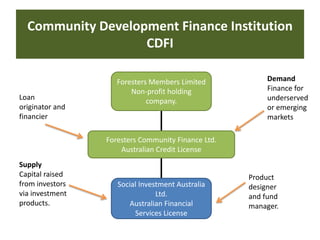

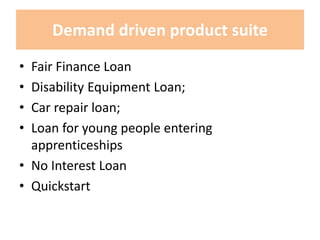

Foresters is a community development finance institution (CDFI) that provides financial products and services to underserved individuals and communities in Australia. It has a non-profit holding company structure with subsidiaries that have an Australian Financial Services License and Australian Credit License. Foresters offers loans to individuals experiencing financial exclusion as well as organisational finance to non-profits and social enterprises. It also has investment products through a wholly owned subsidiary that are matched to the finance needs of its markets. Foresters' vision is to empower communities through self-determination and its mission is to provide innovative financial solutions that support social change.