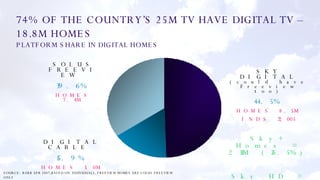

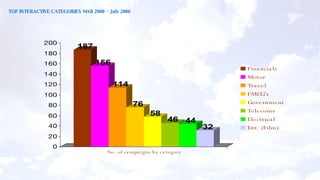

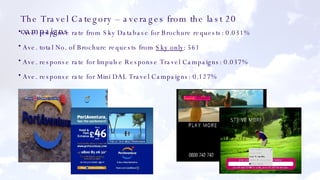

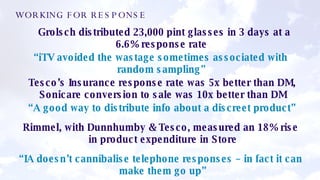

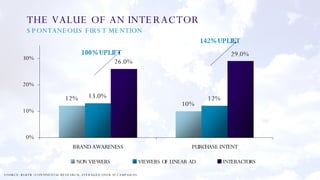

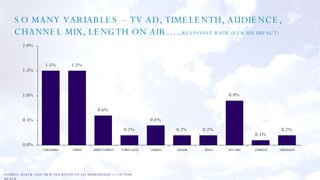

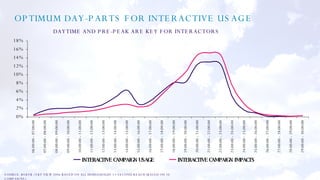

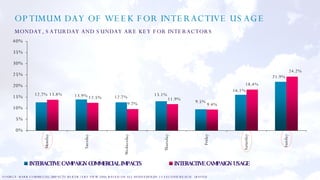

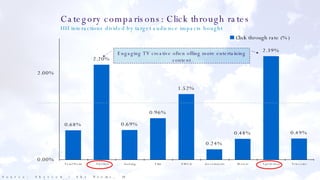

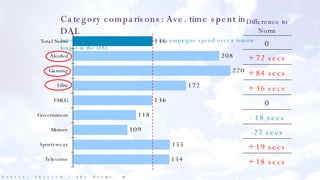

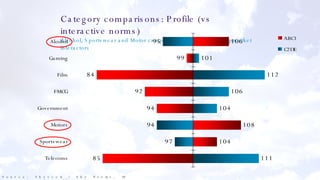

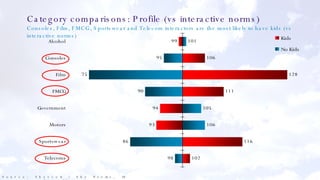

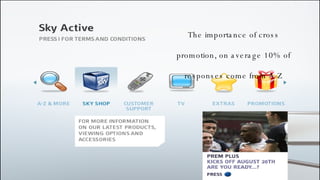

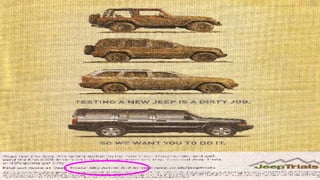

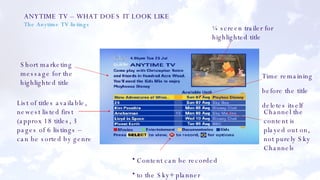

This document discusses Sky's embrace of interactive television in the UK and provides examples of interactive advertising campaigns on Sky platforms. It analyzes the results of various interactive ad campaigns across categories and finds that alcohol, FMCG, sportswear, and other categories had high levels of interactions. The document also discusses future directions for interactive TV, including Anytime TV and viewer-created ad messages.