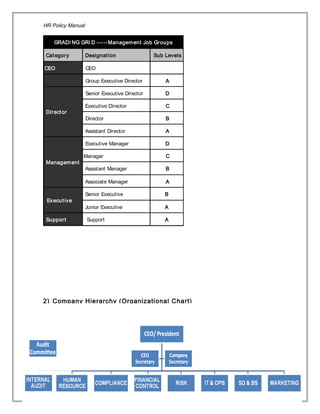

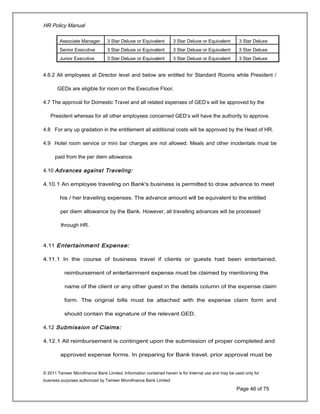

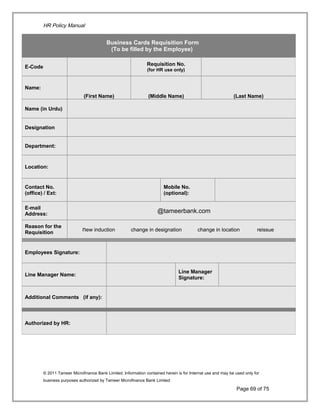

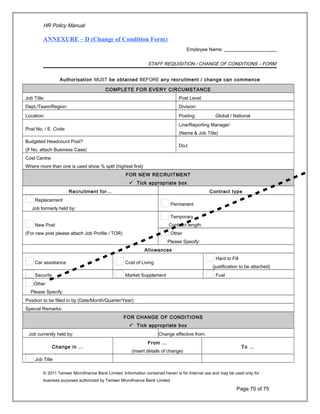

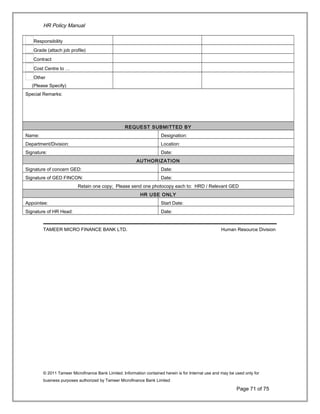

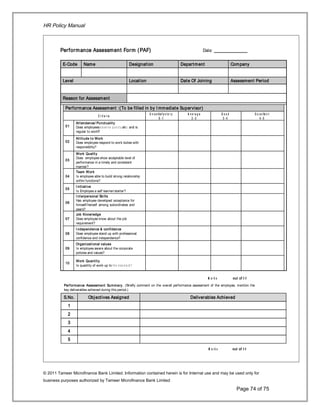

The document is an HR policy manual for Tameer Microfinance Bank. It contains policies and procedures related to various HR functions such as employee classification, compensation and benefits, code of conduct, organizational development, and HR operations. The manual provides guidance for implementing consistent HR practices across the organization.