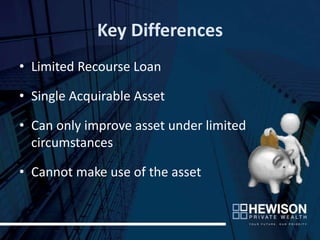

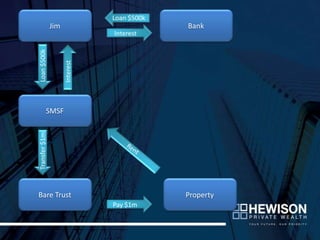

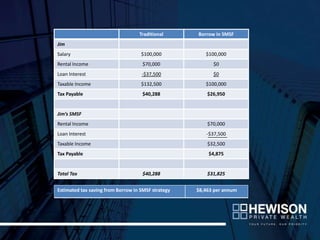

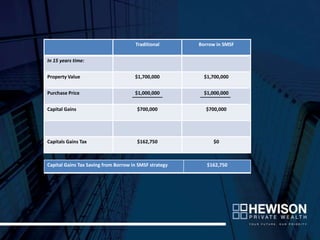

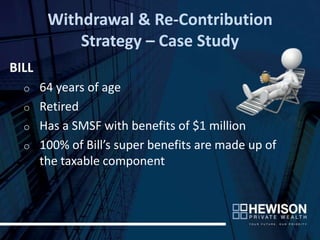

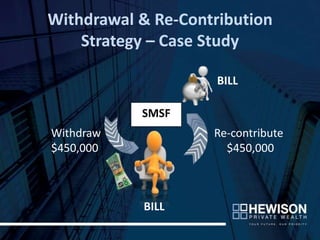

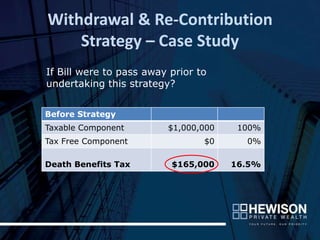

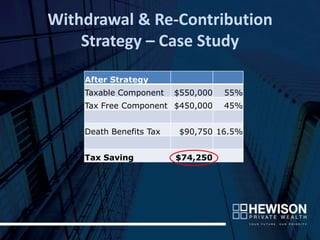

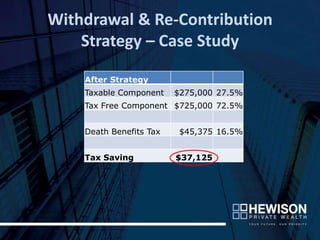

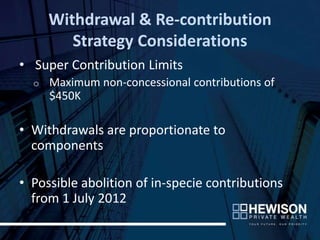

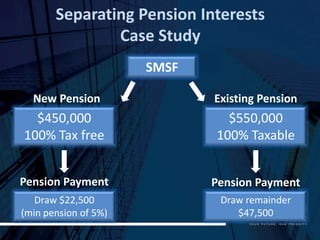

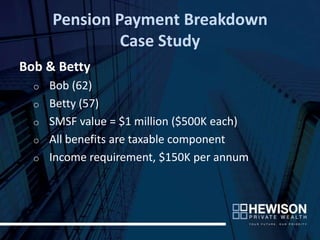

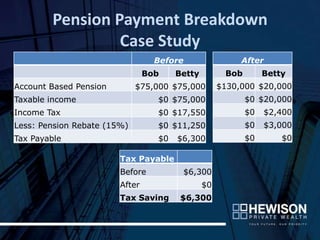

This document discusses several strategies for borrowing in superannuation and managing pension payments to reduce tax liabilities. It provides a case study on borrowing $500k from an SMSF to purchase an investment property. It estimates an annual tax saving of $8,463 and a capital gains tax saving of $162,750 over 15 years compared to purchasing the property traditionally. It also discusses withdrawing and recontributing super benefits to increase the tax-free component, and separating pension interests to preserve that tax-free amount.