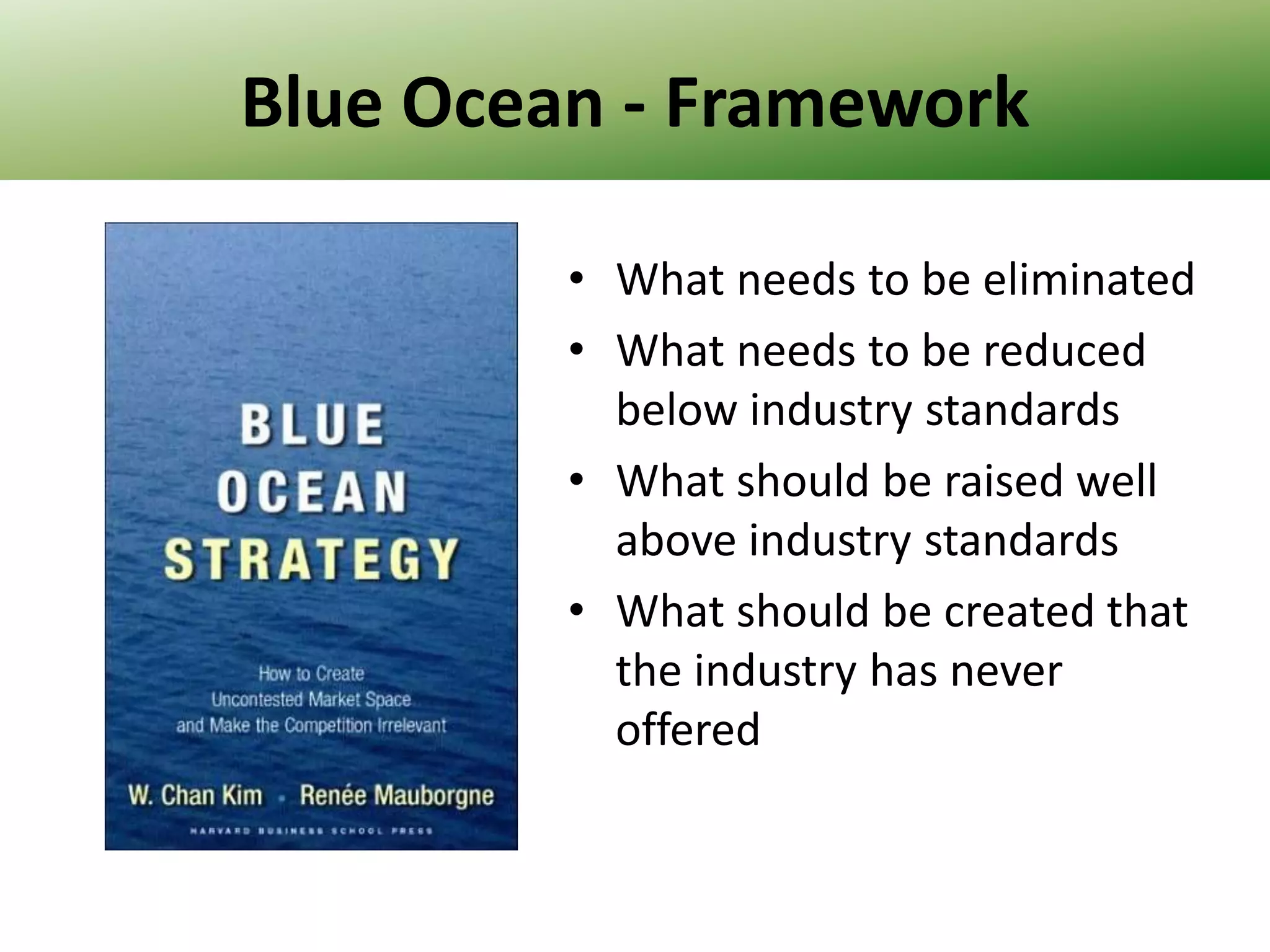

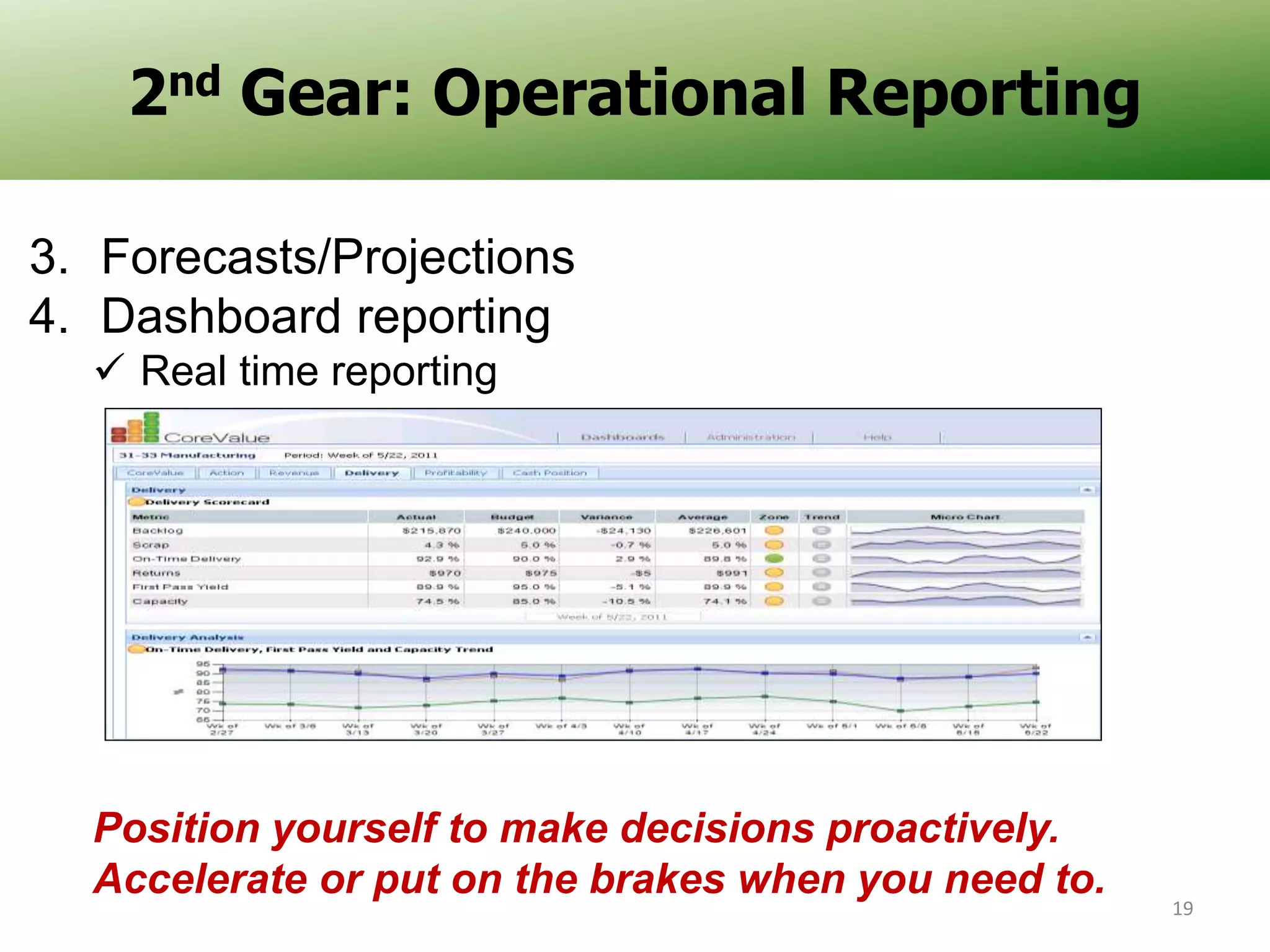

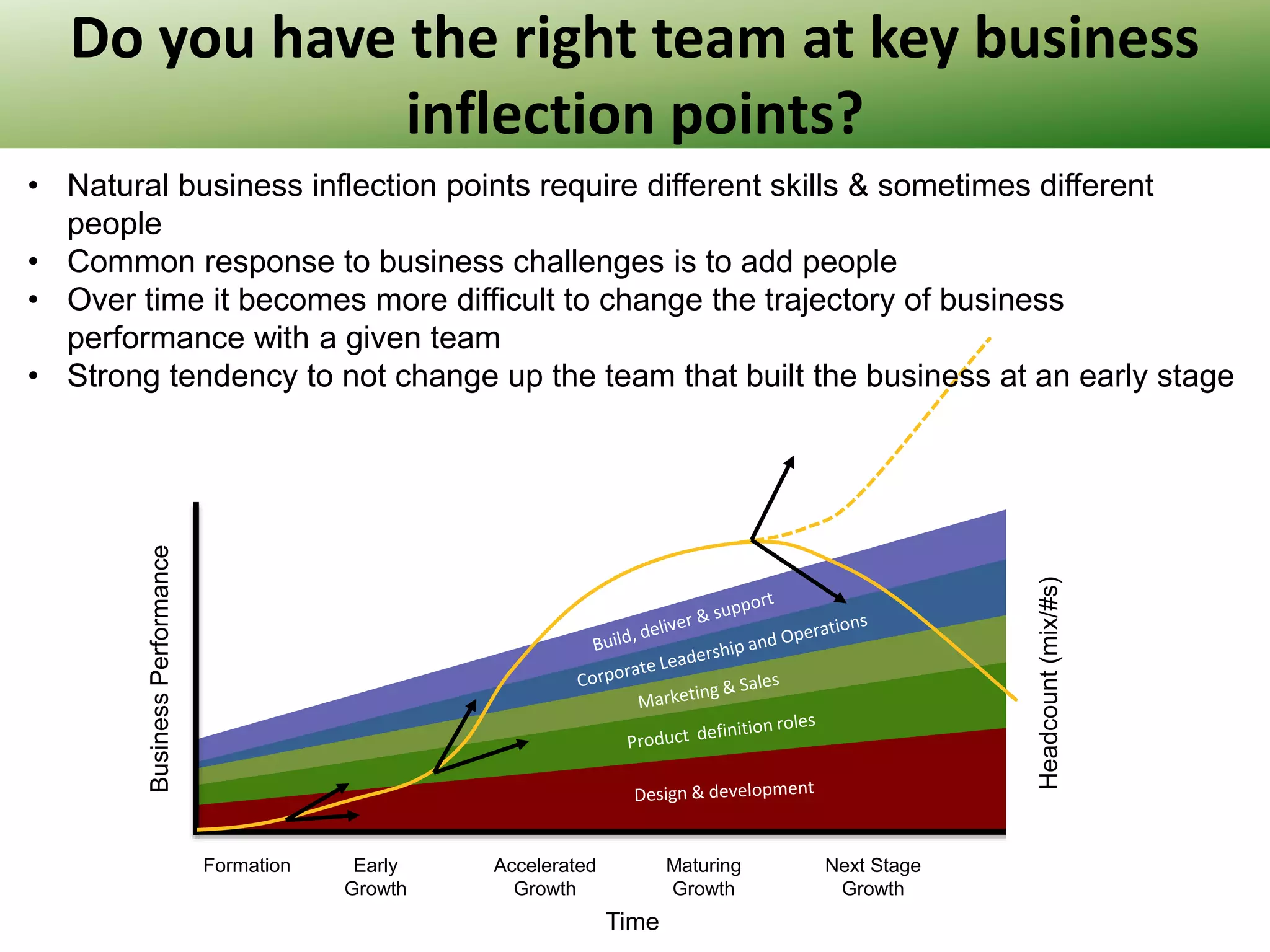

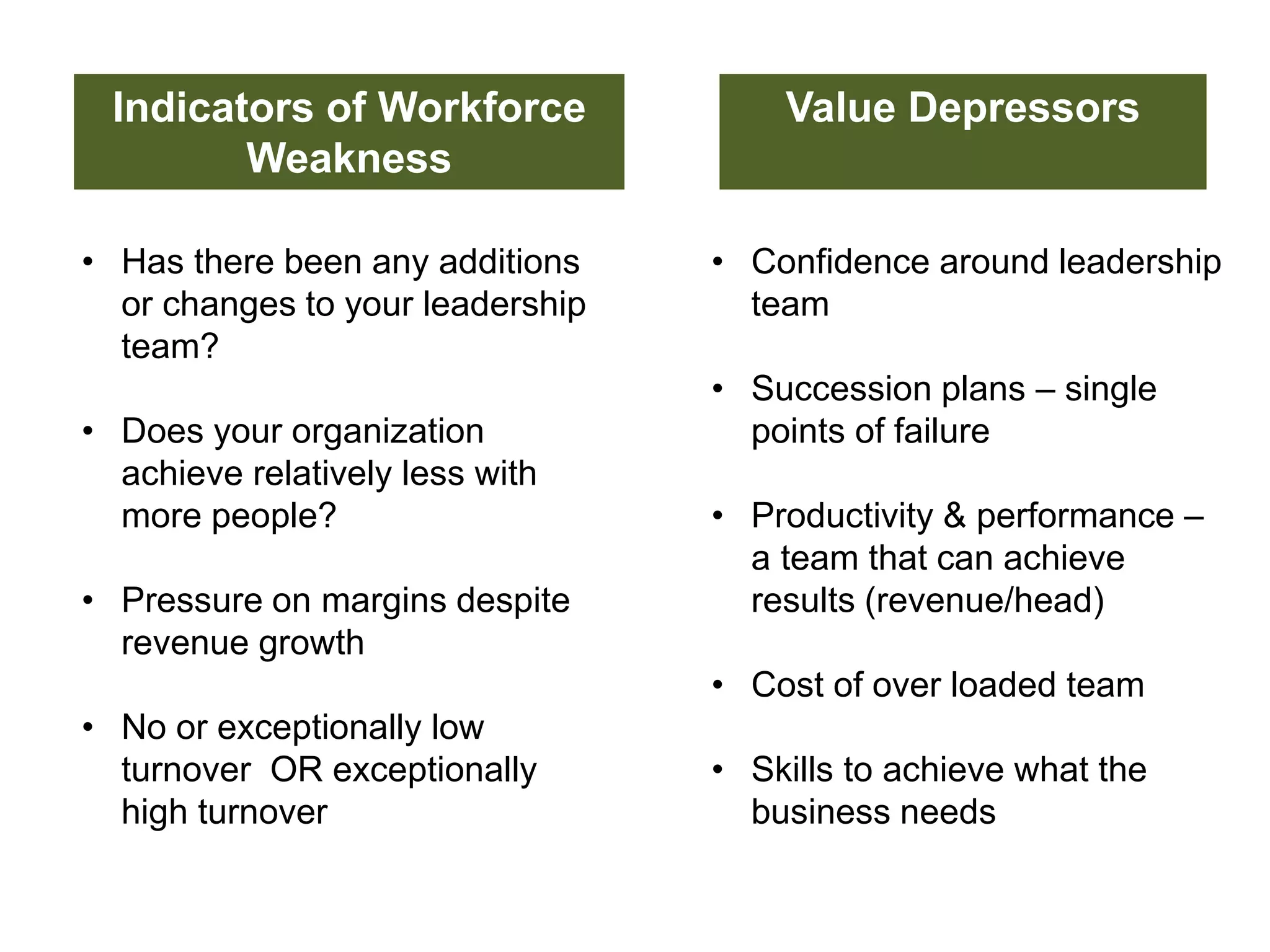

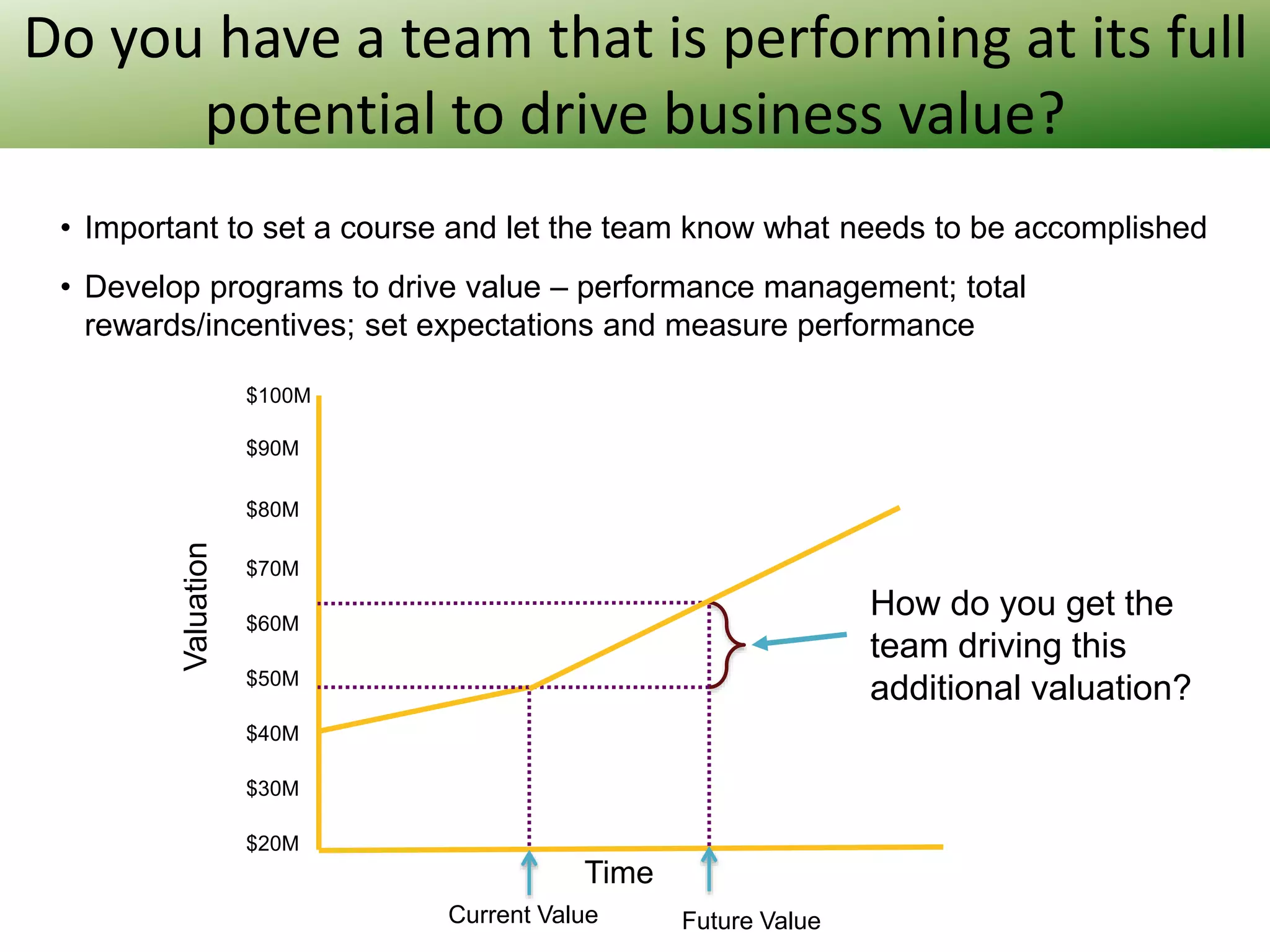

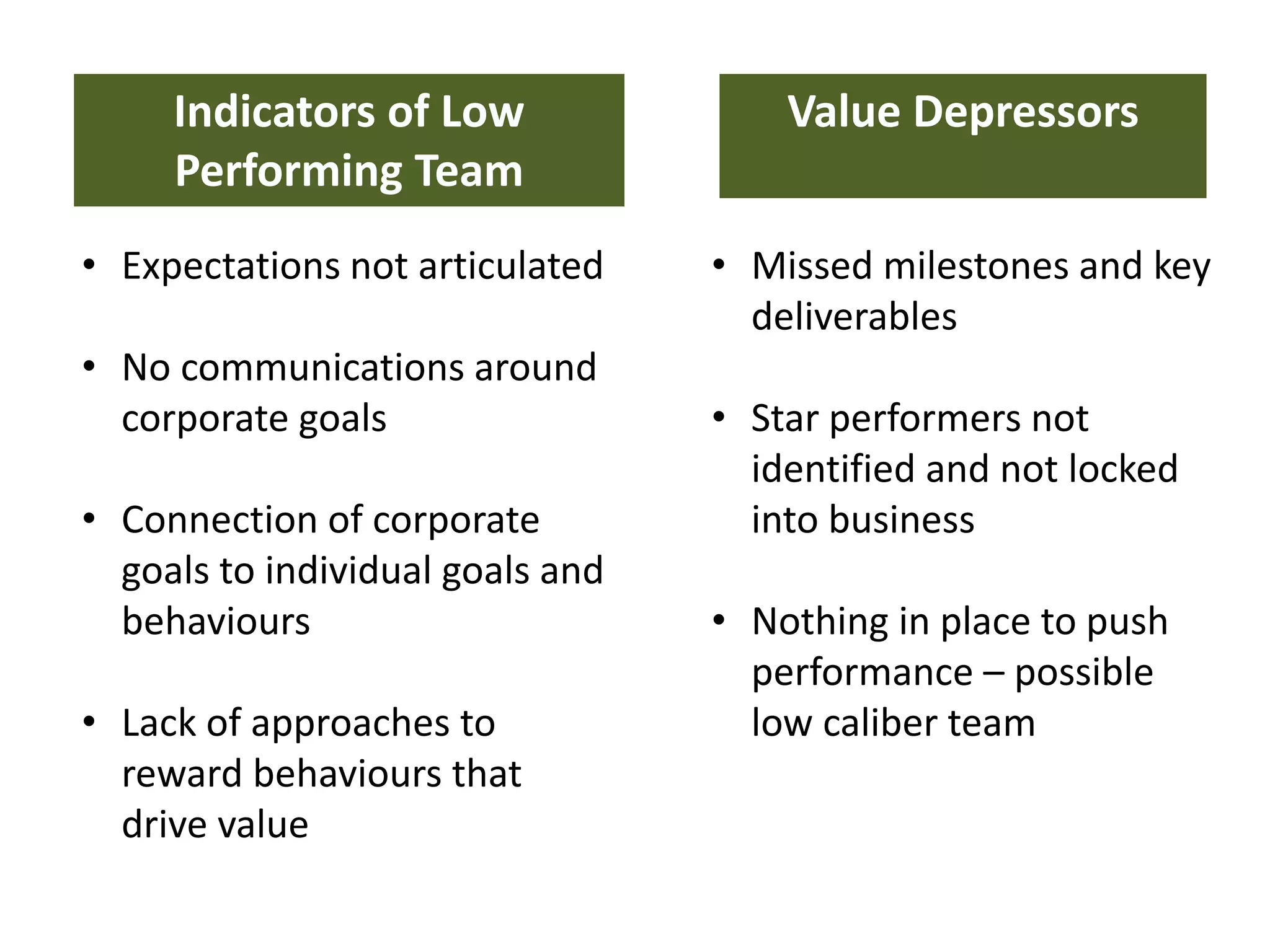

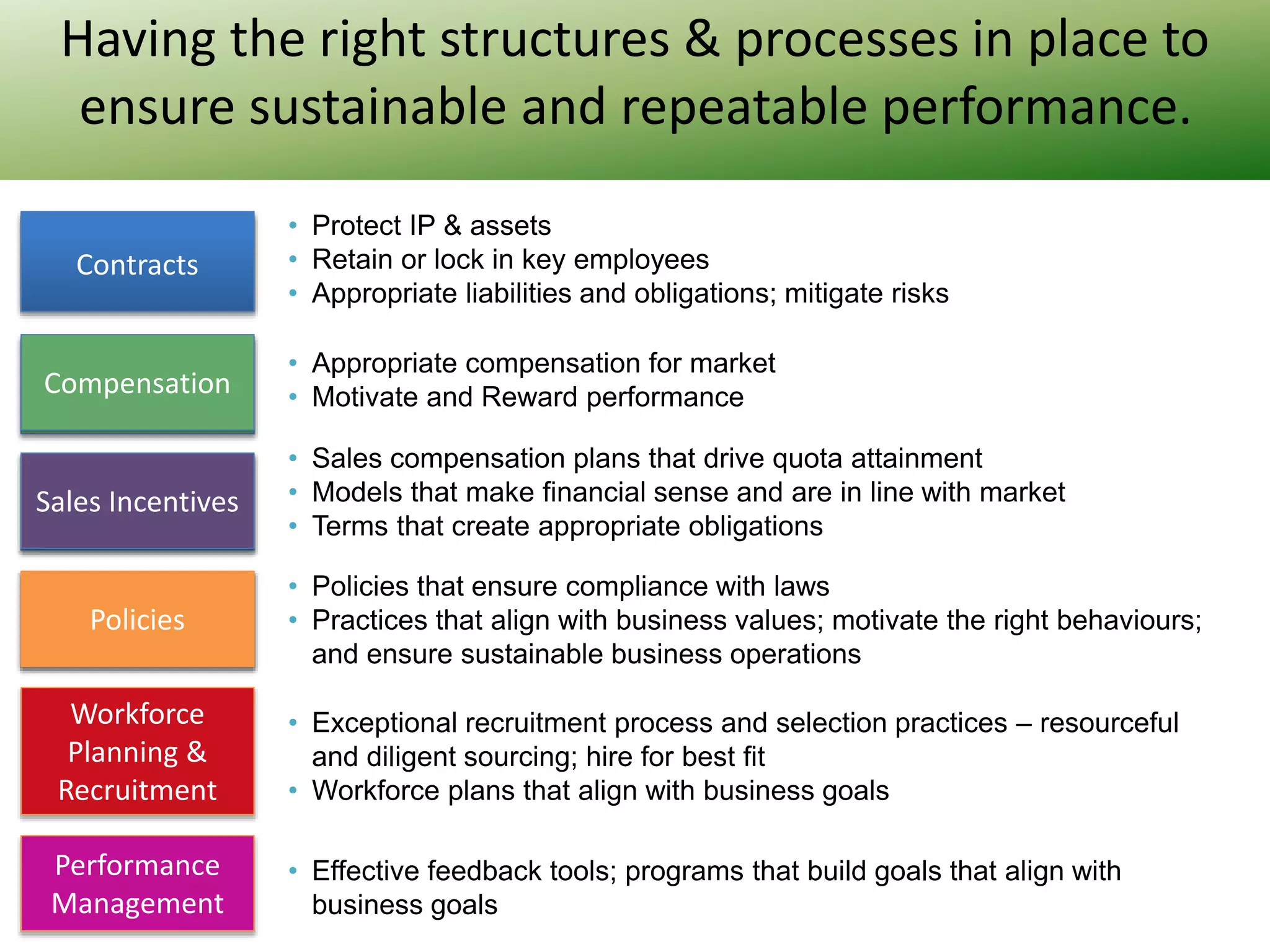

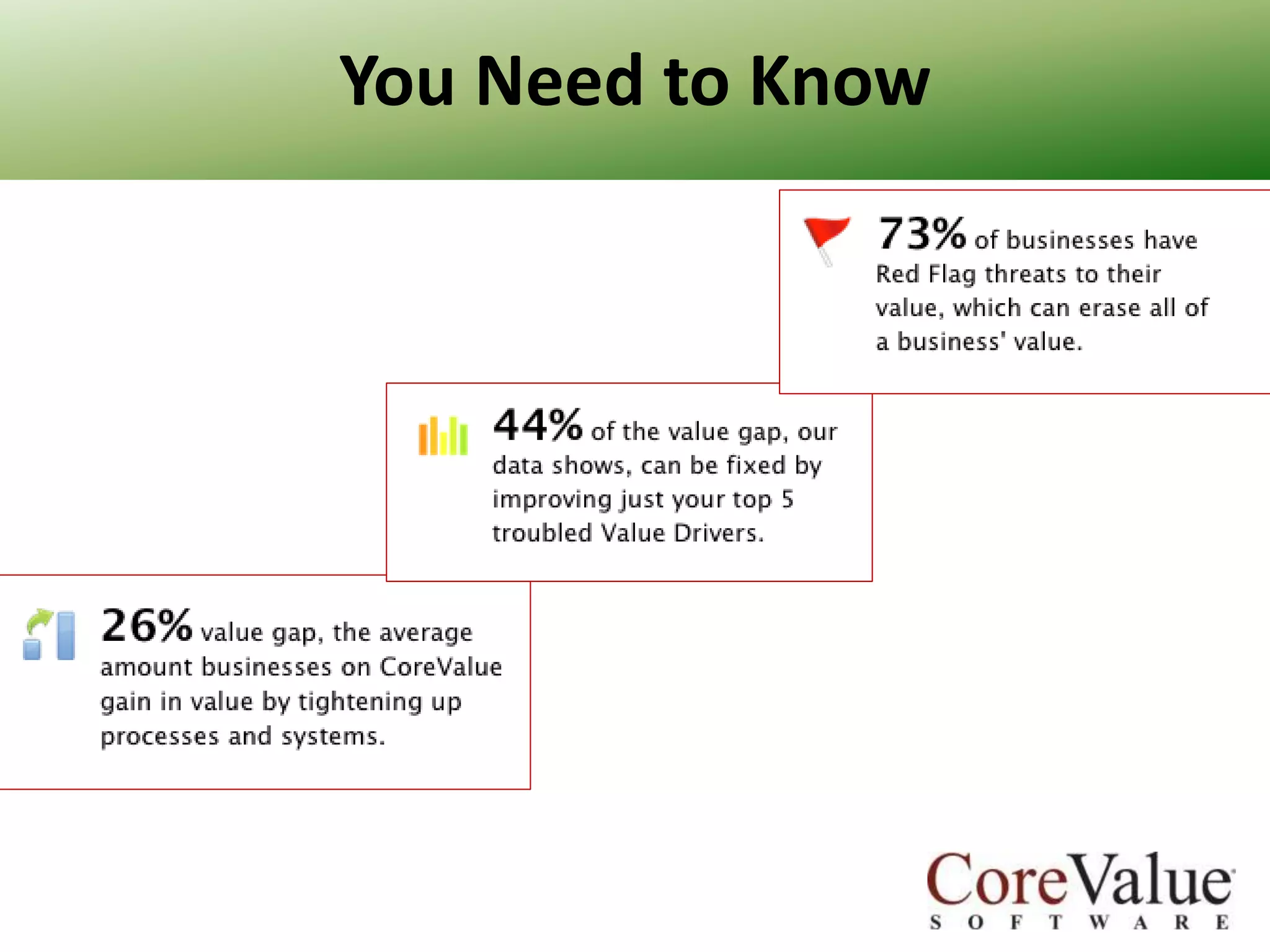

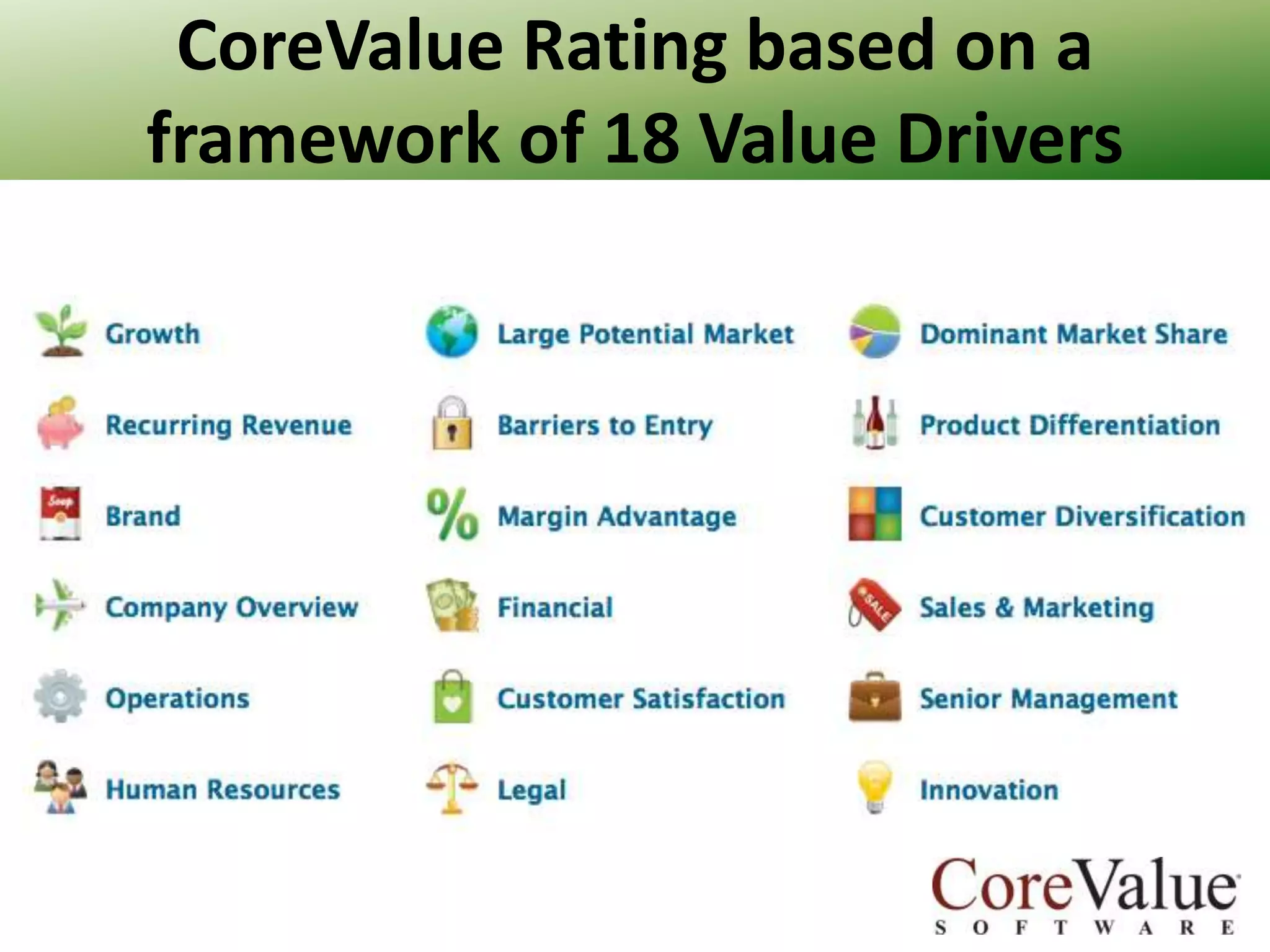

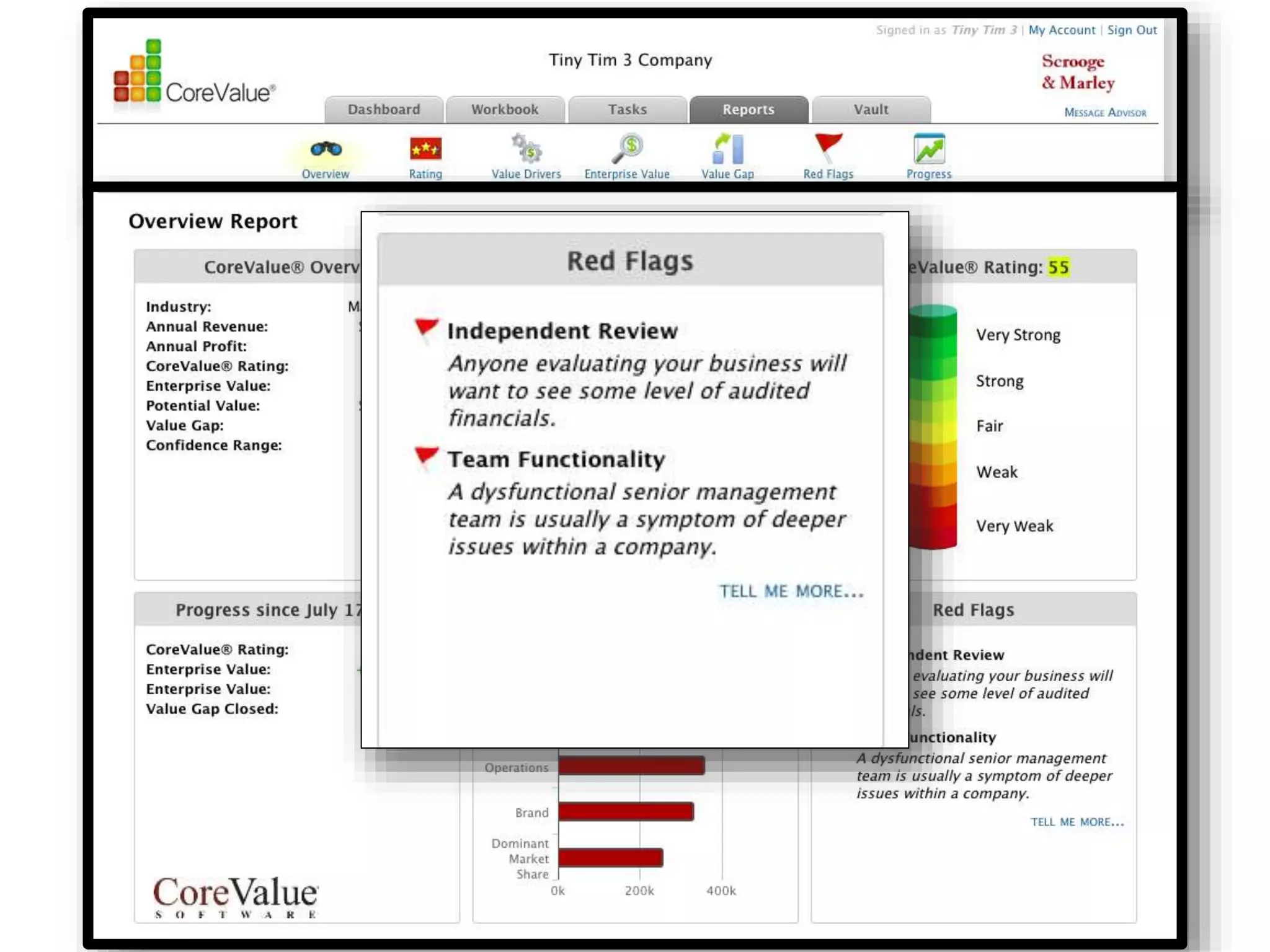

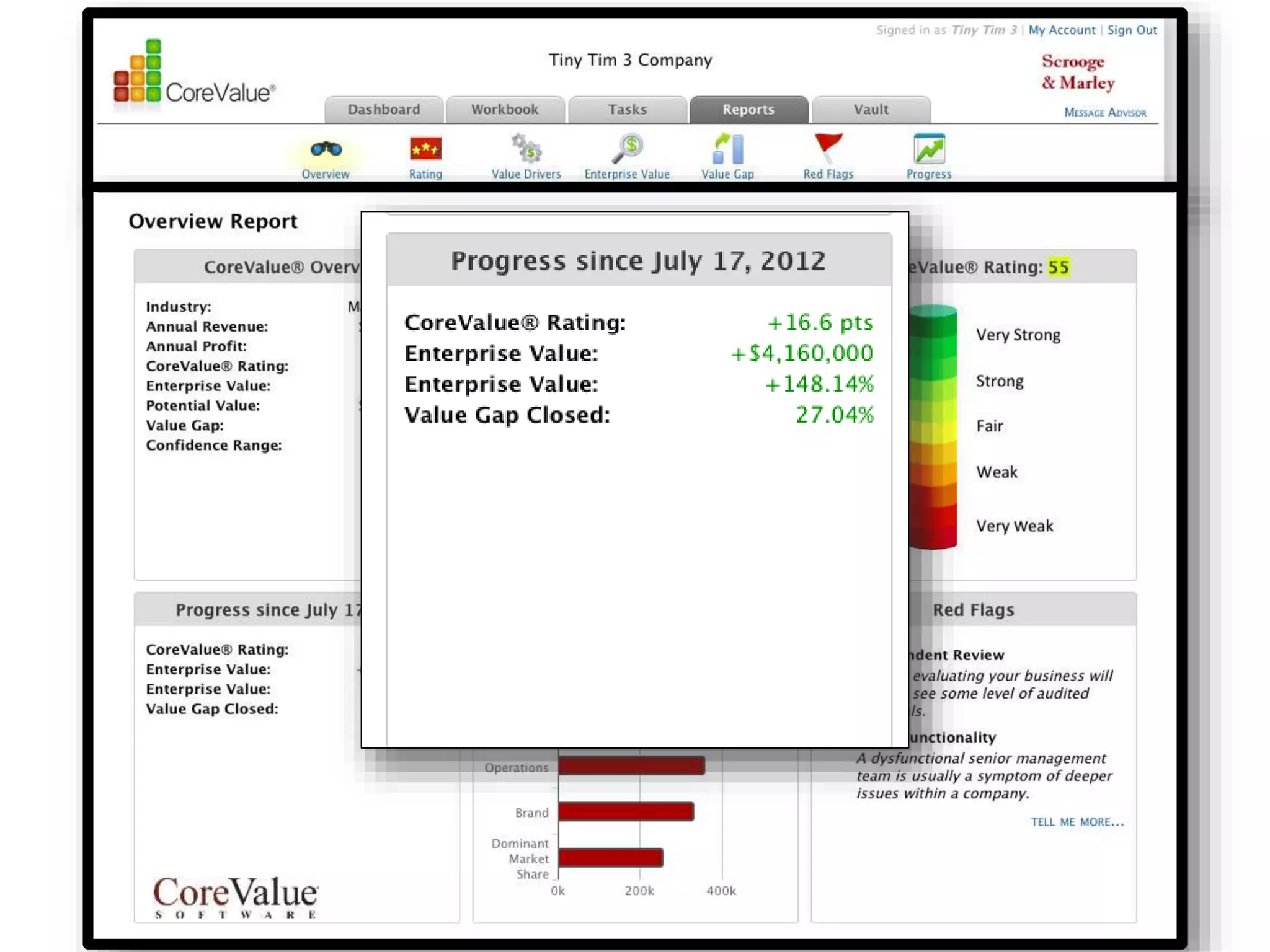

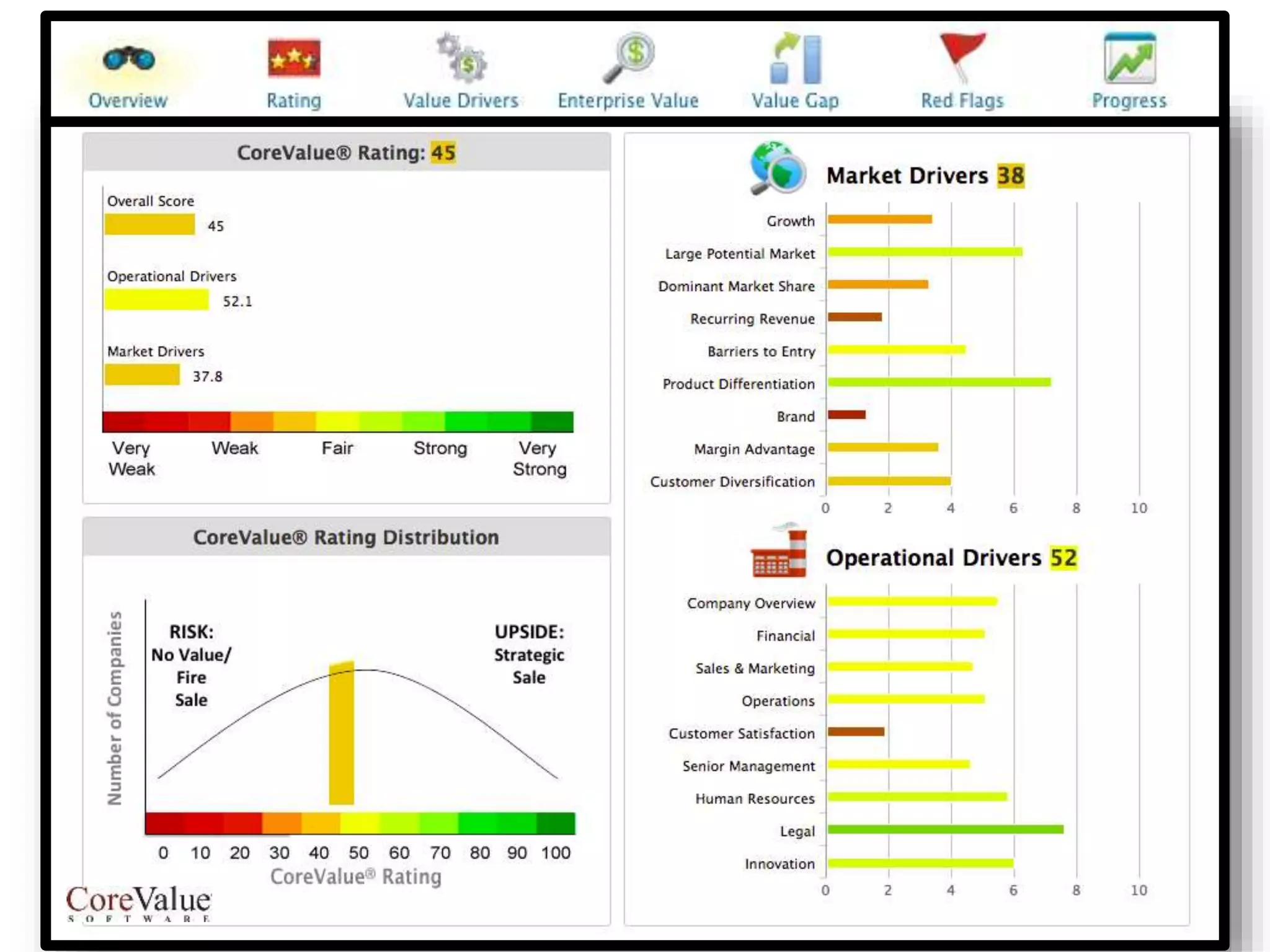

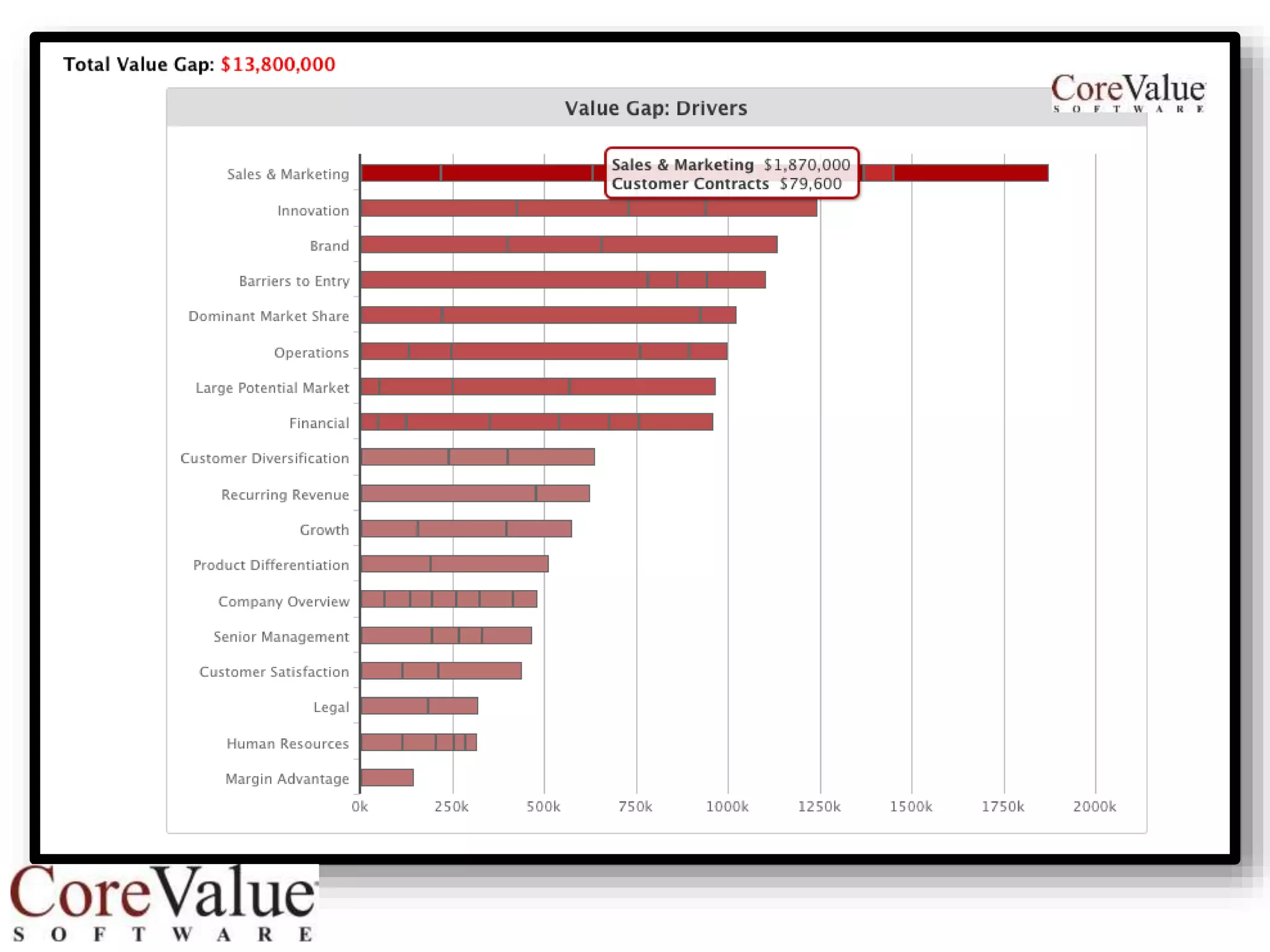

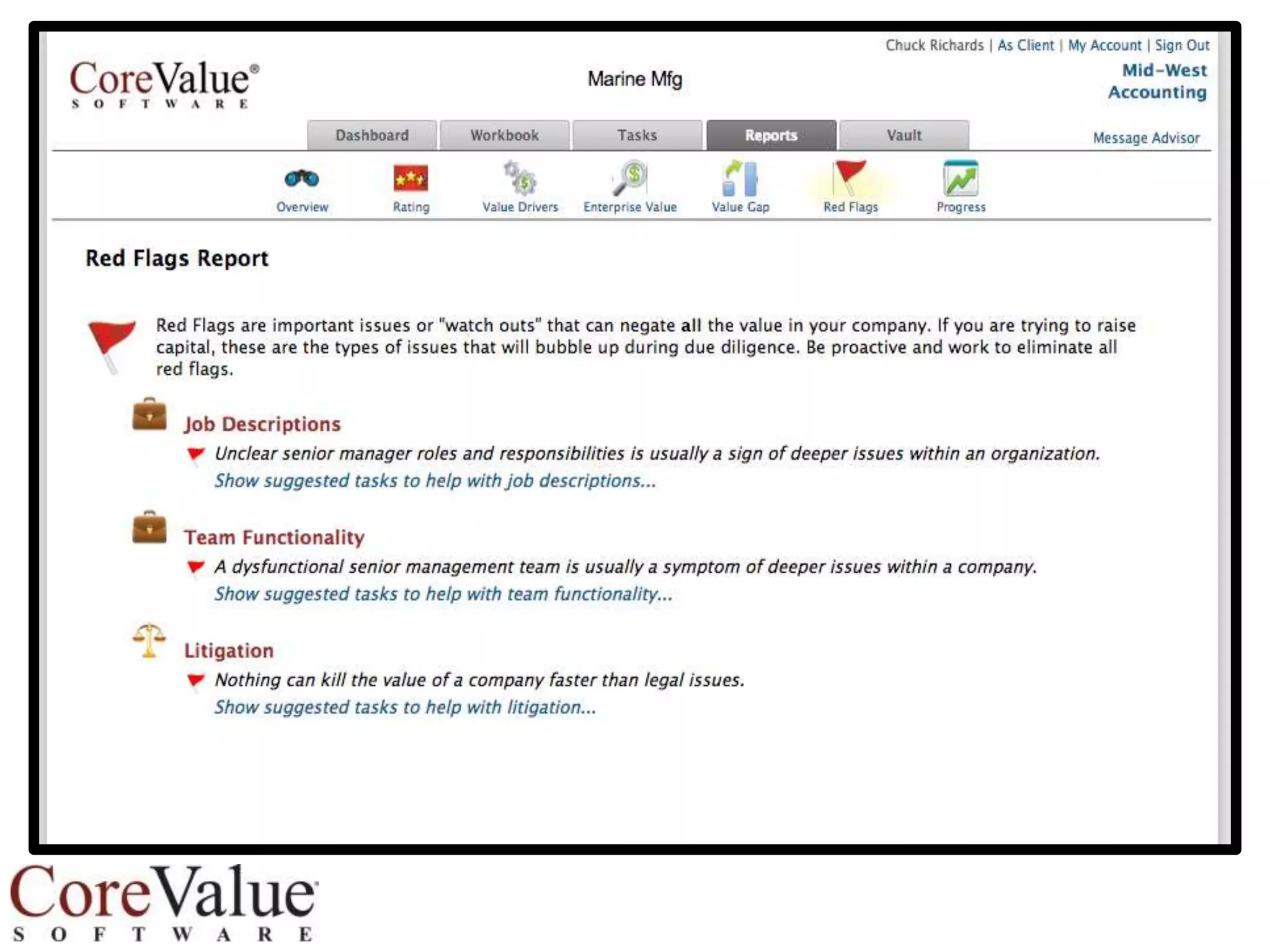

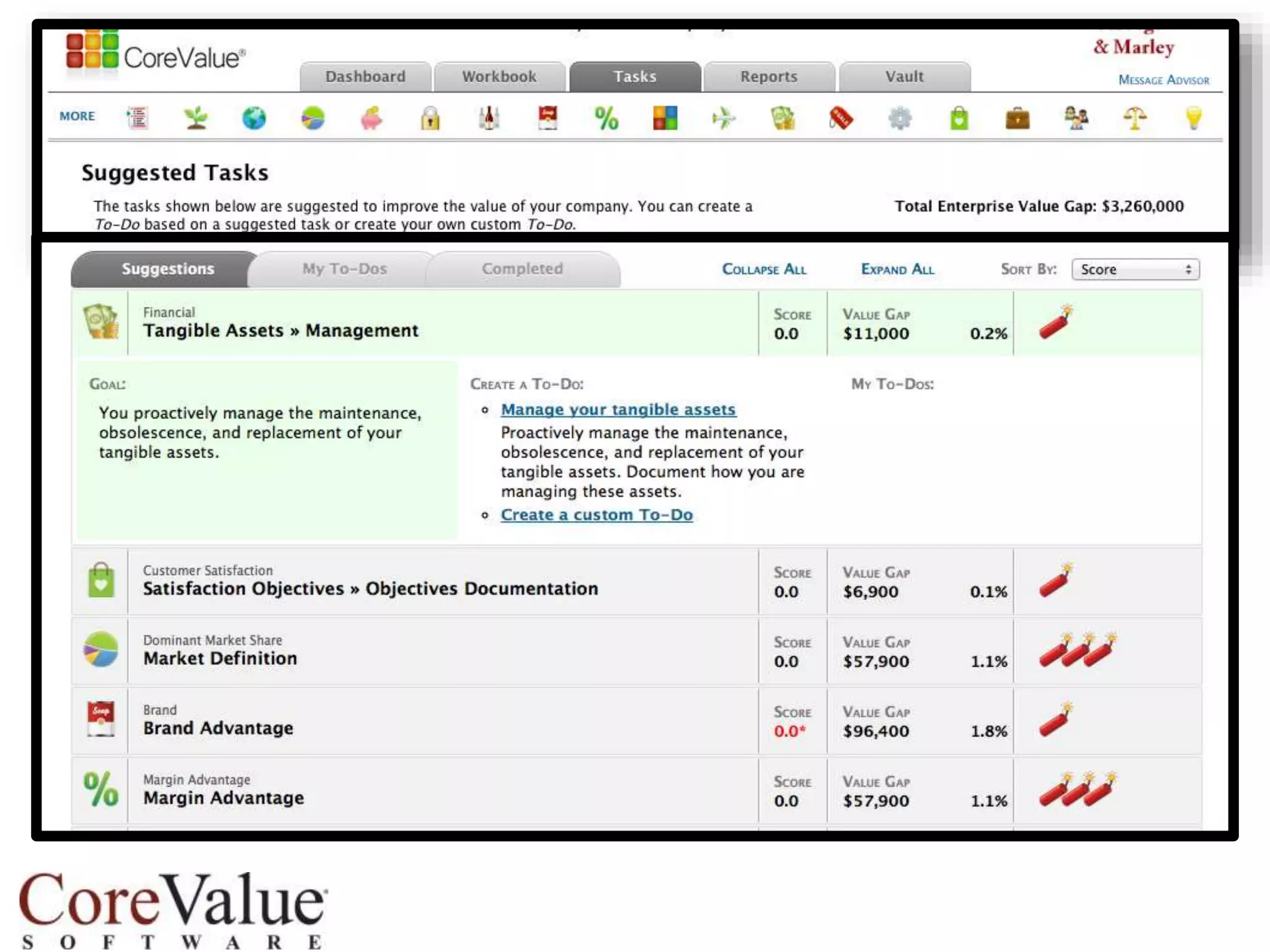

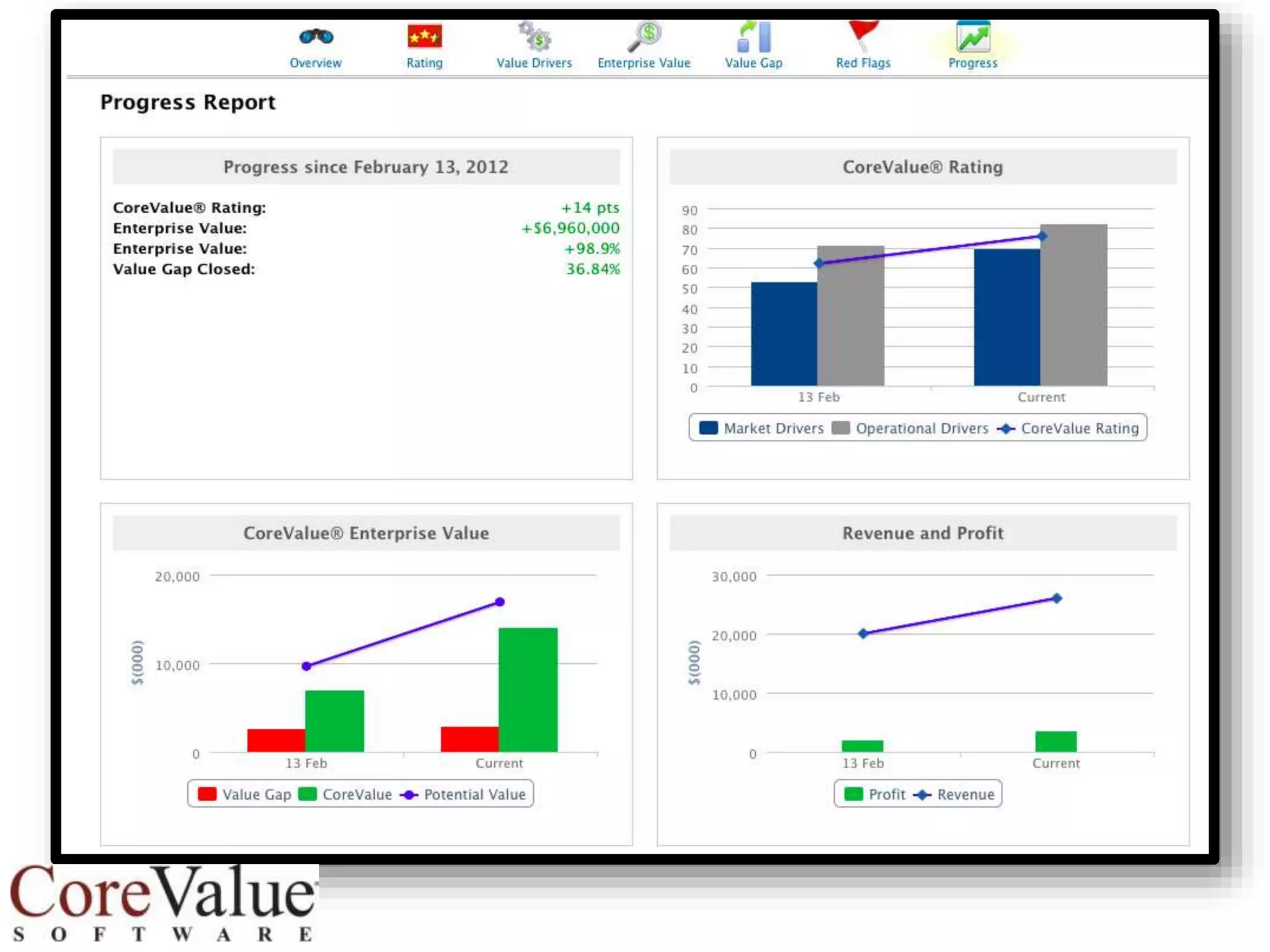

The document outlines strategies for business owners to enhance company value and operational effectiveness, emphasizing the importance of quantifiable advantages, financial management, talent management, and strategic direction. It highlights critical red flags that could signify value loss and provides guidance on aligning business goals with operational capabilities. The overall aim is to equip owners with insights to optimize performance, prepare for future transitions, and ensure their businesses are resilient and strategically aligned.