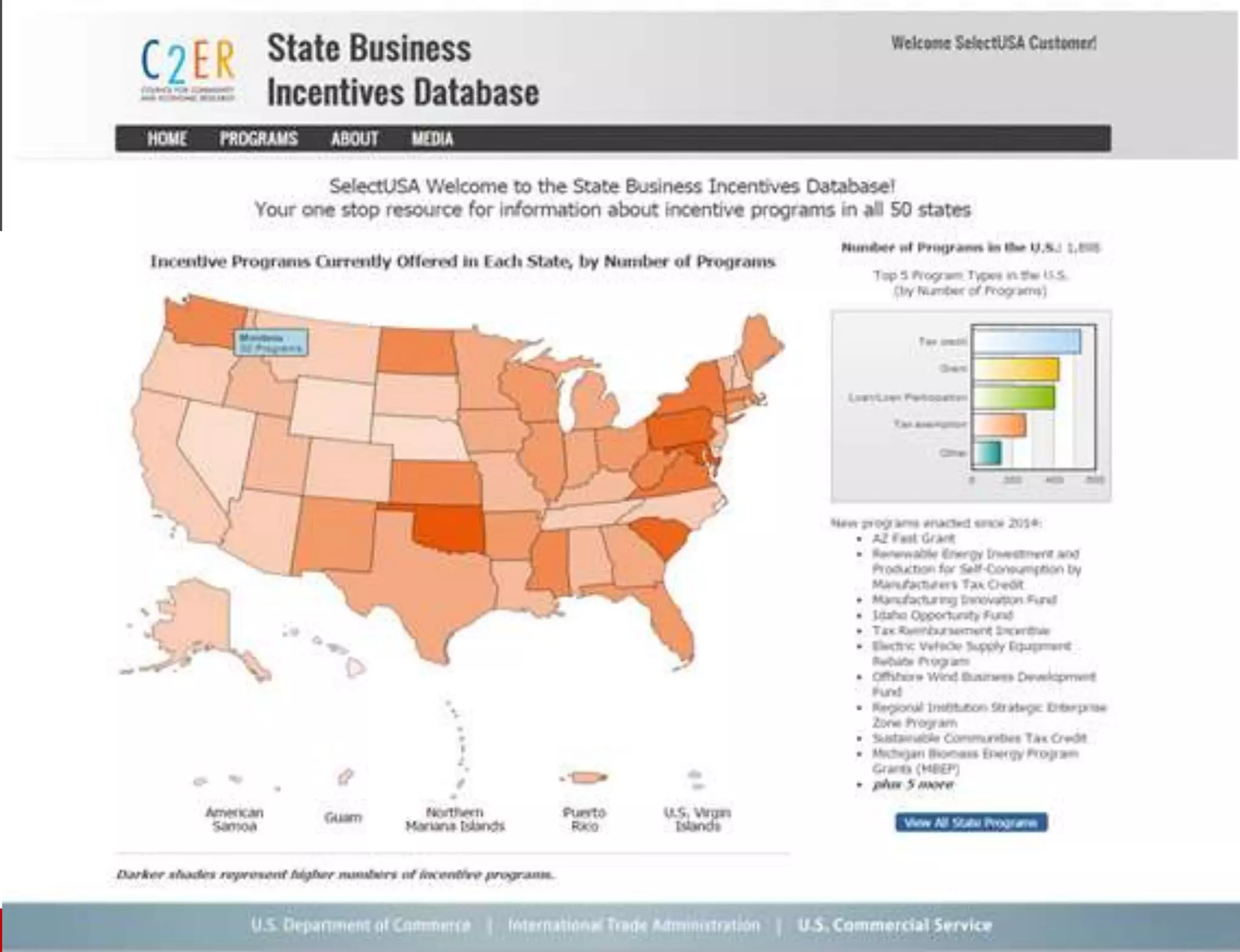

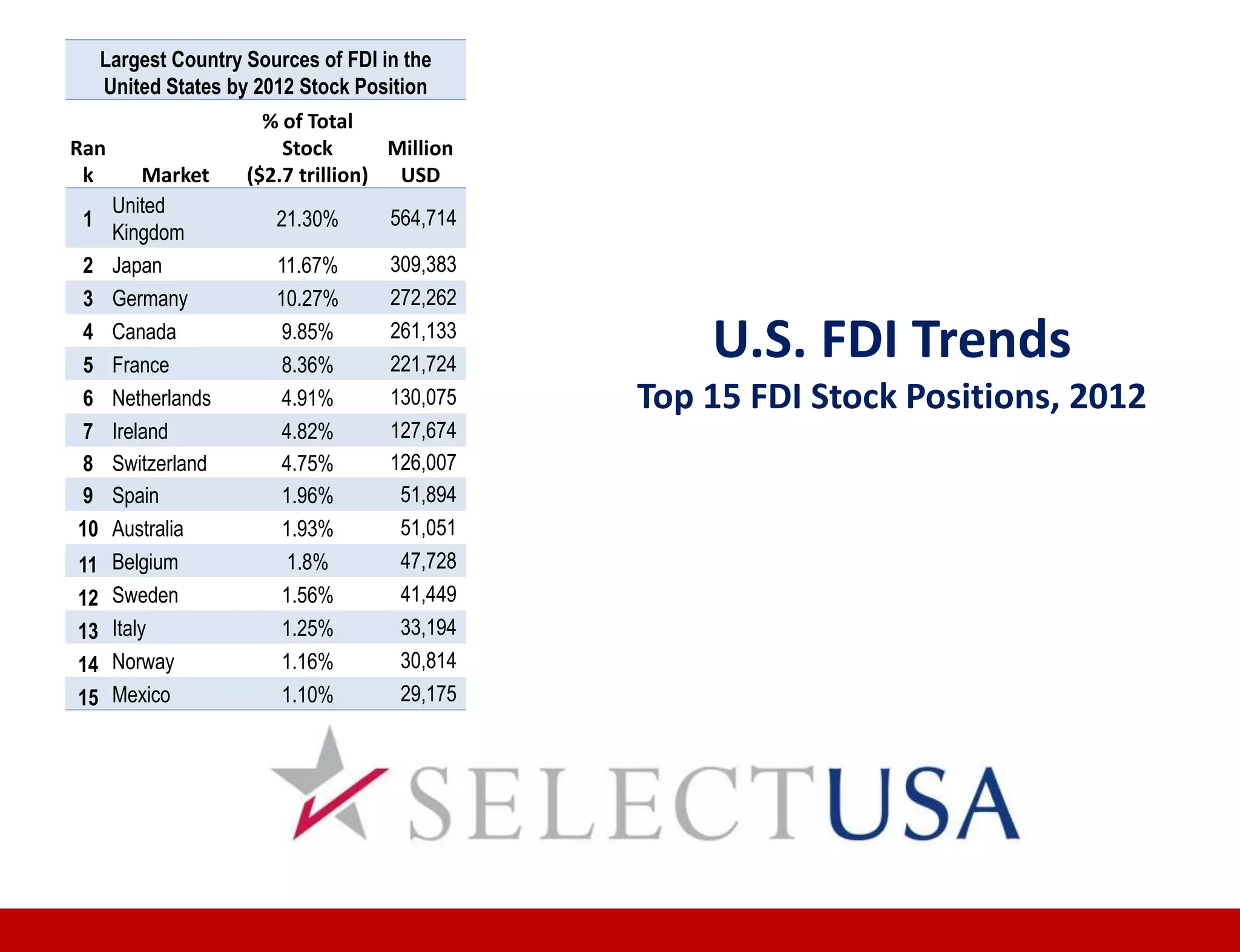

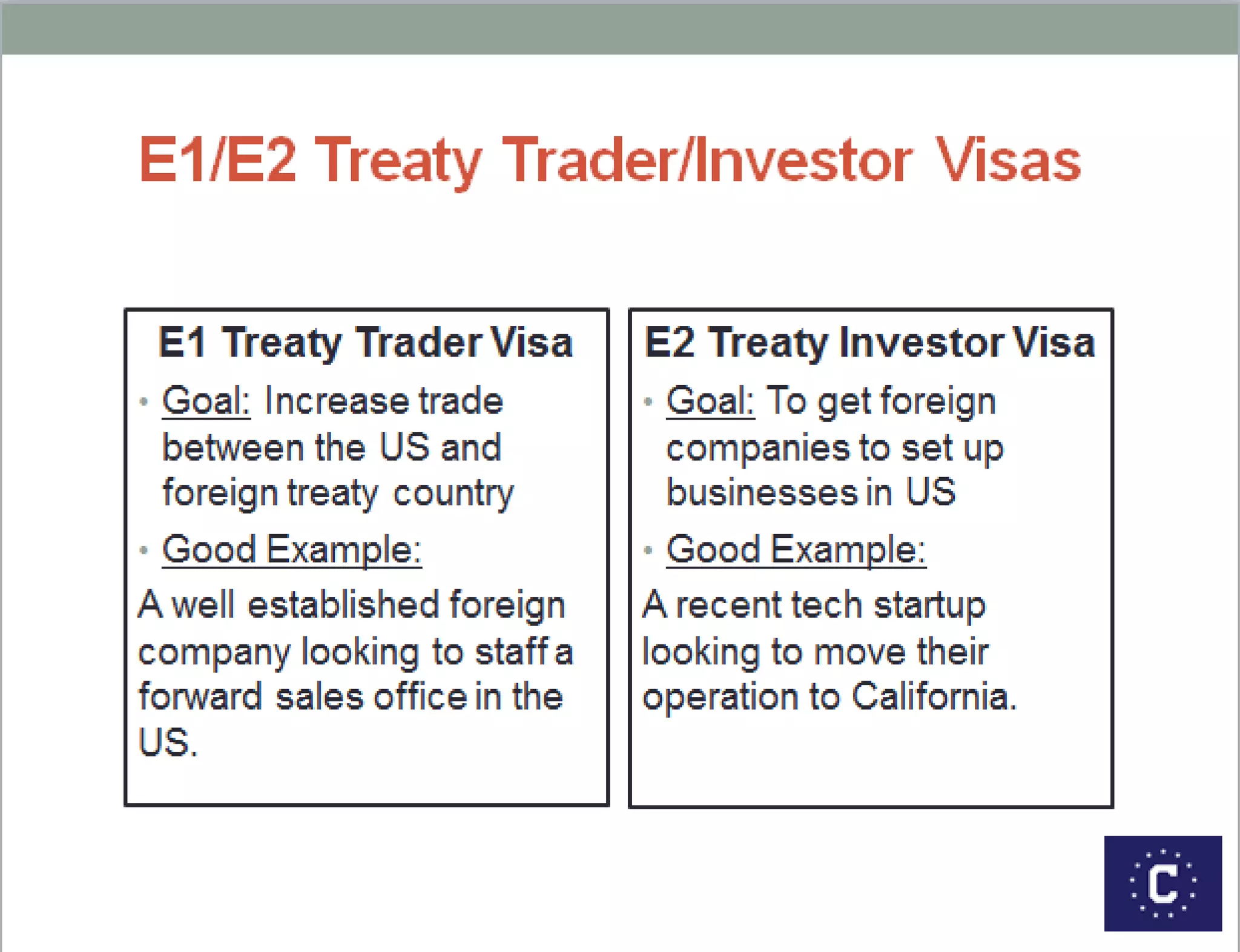

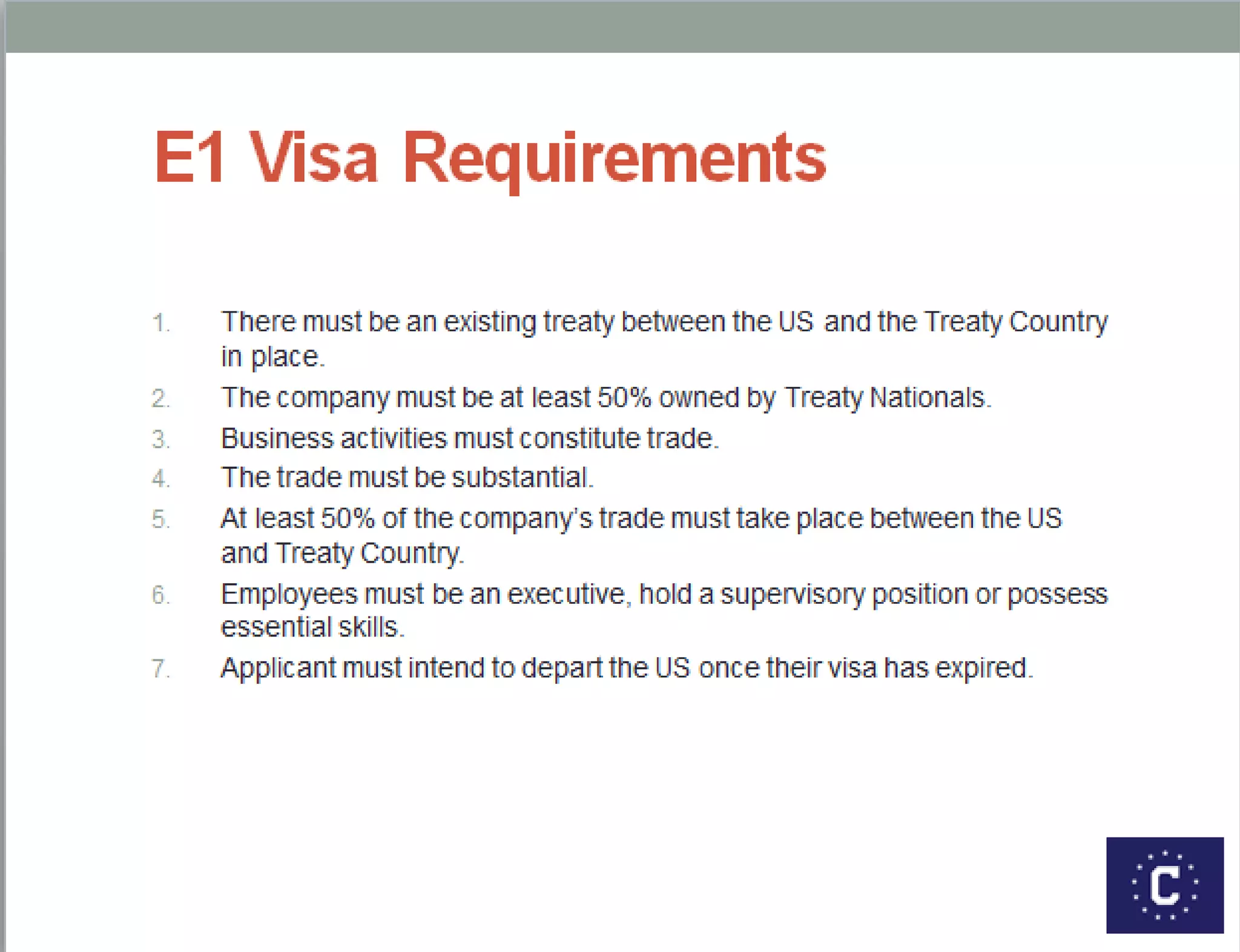

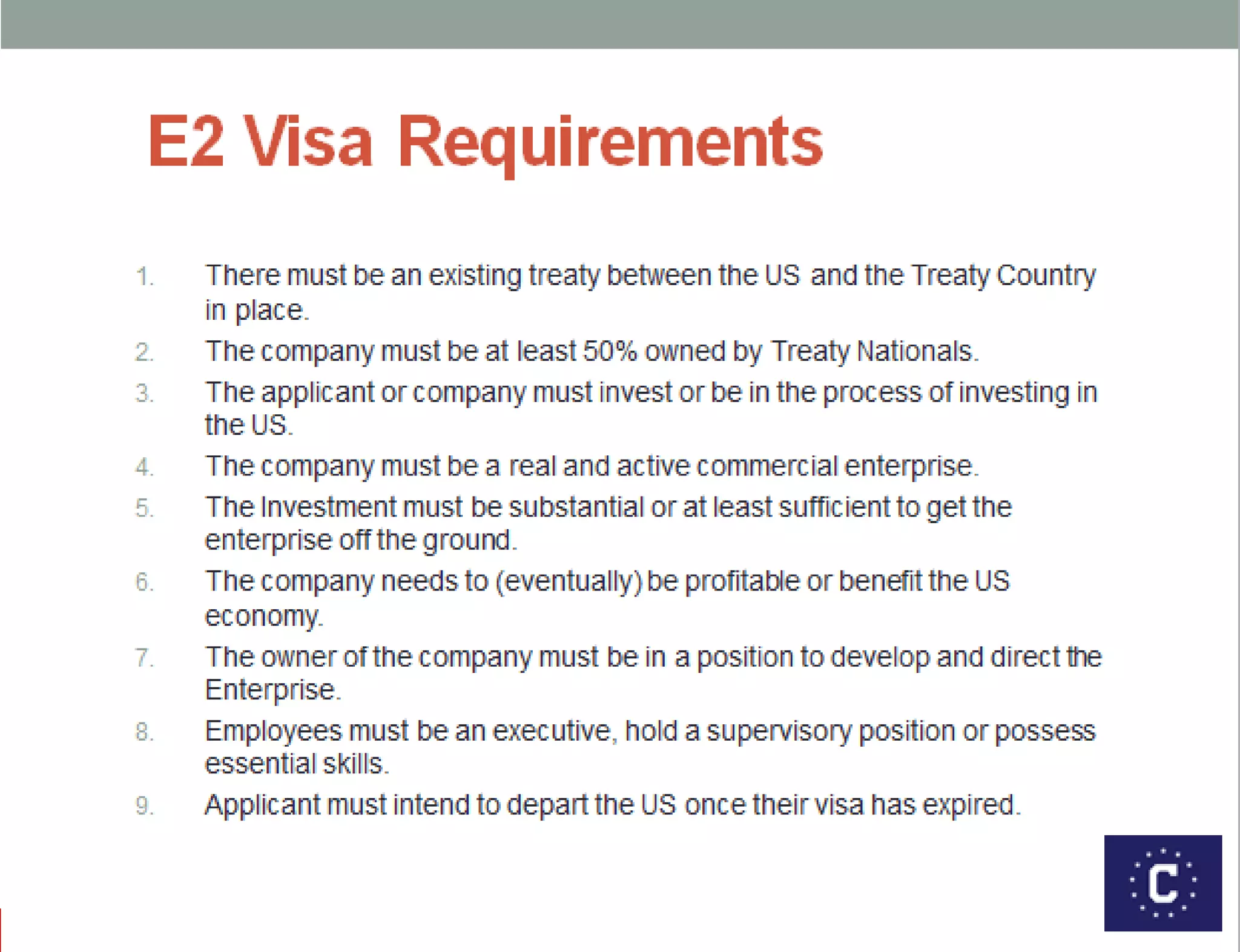

The document discusses considerations for bringing a startup business to the United States. It covers choosing the right legal, banking, accounting, and HR partners in the US ecosystem. Key legal considerations include corporate structure, intellectual property, terms and conditions, litigation landscape, and managing legal costs. Immigration visas like the E-1 and E-2 for treaty traders and investors are described. Tax compliance in the US involves corporate, payroll, and individual income tax filings. Locating business space and setting up payroll also have financial and tax implications to manage. Contact information is provided for experts on business expansion to the US.