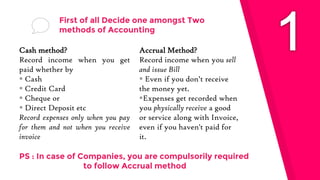

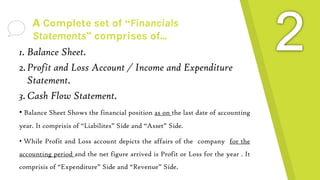

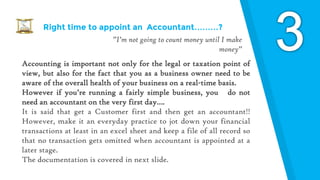

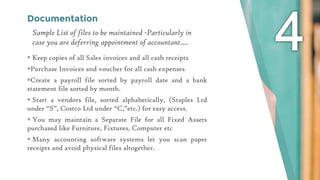

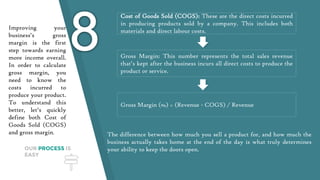

The document provides an overview of important financial accounting concepts that startup founders should understand, such as choosing between cash-based or accrual-based accounting, the components of financial statements, when to hire an accountant, basic documentation and record-keeping, distinguishing capital vs revenue expenditures, analyzing inventory and receivables, and an introduction to presumptive taxation. It aims to help founders better manage the financial health and tax obligations of their new business.