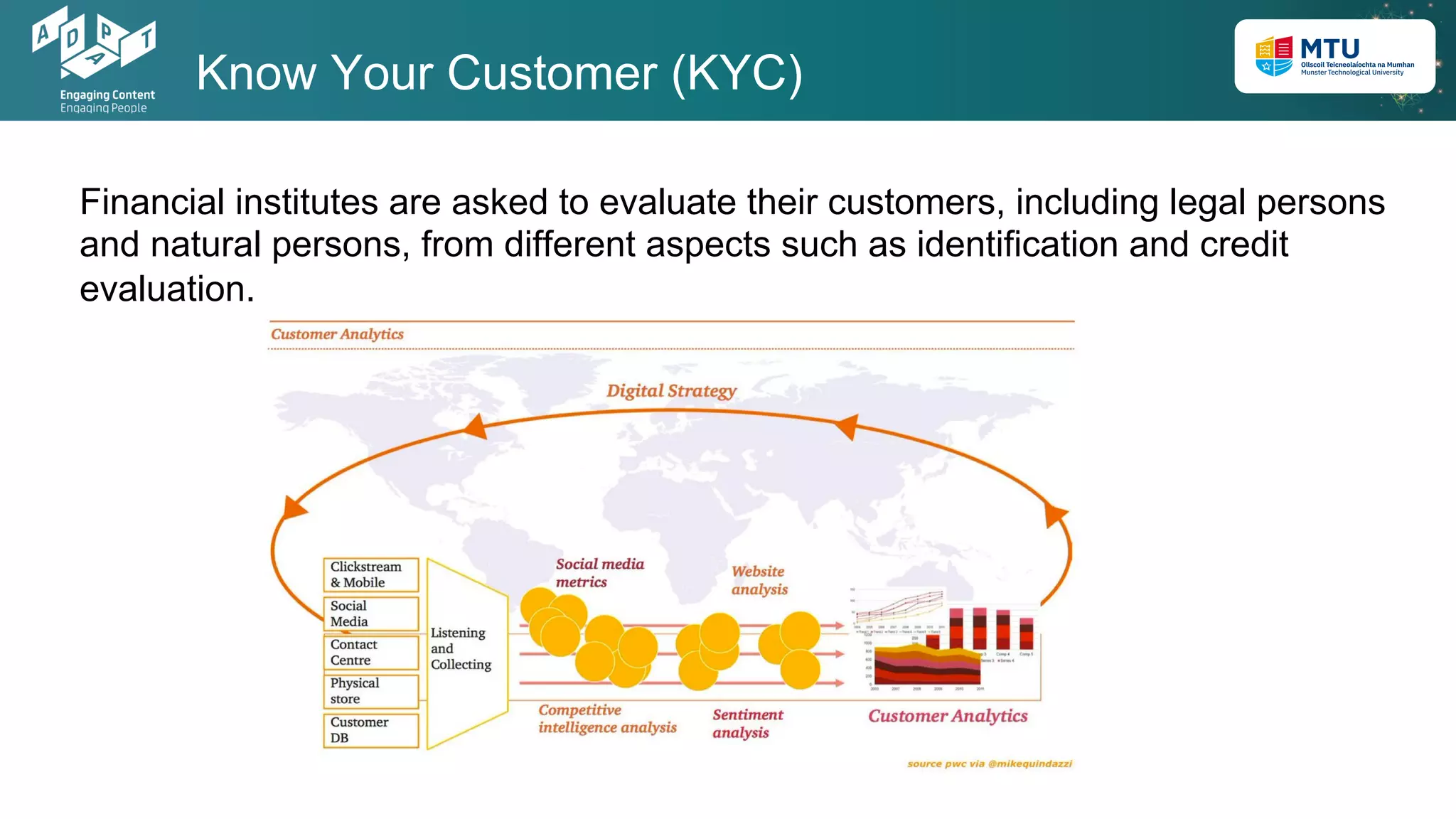

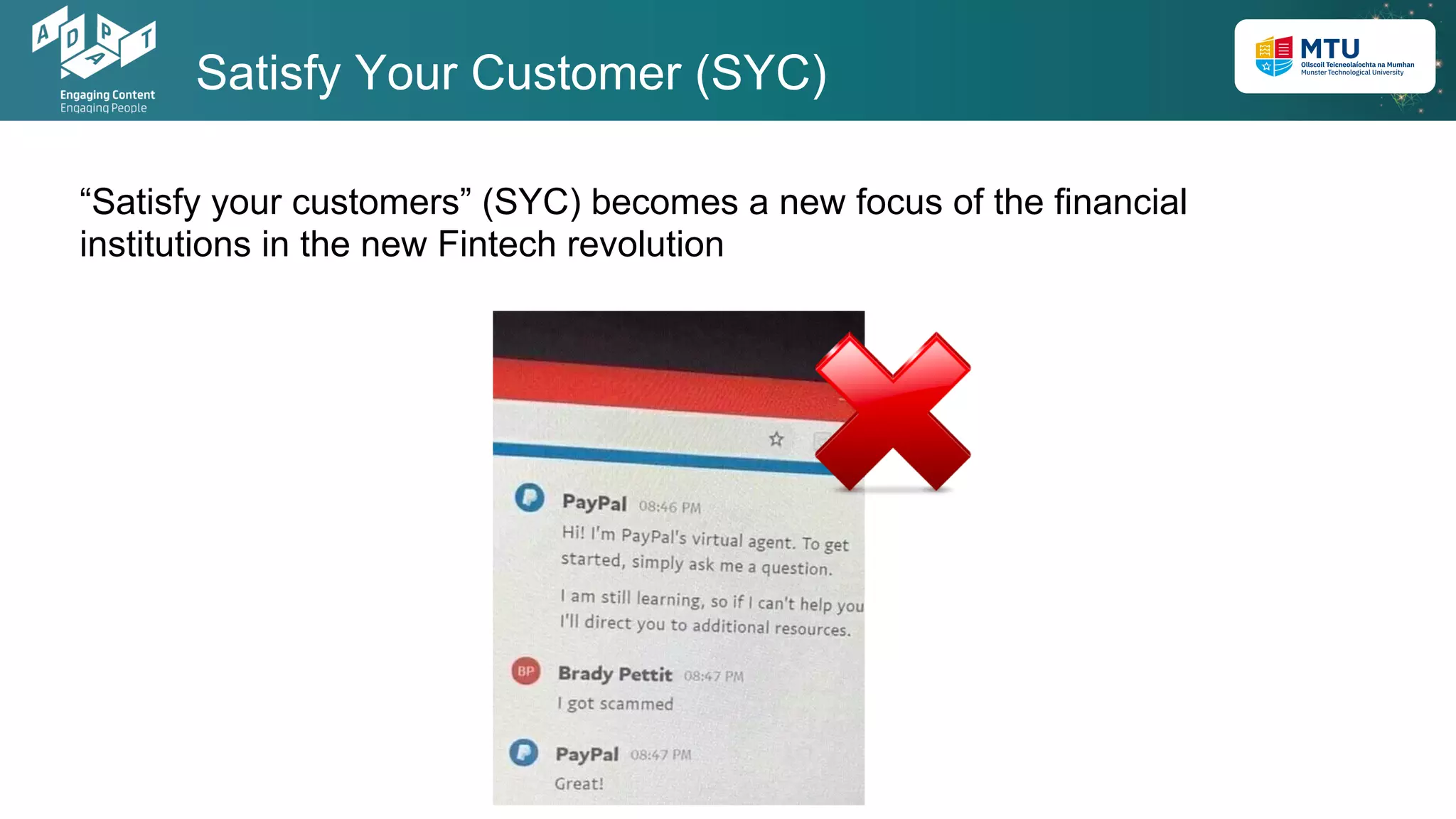

This document discusses how natural language processing is reshaping the financial services industry. It explains that NLP allows fintech companies to parse textual data like contracts and analyze industry terminology, numbers, currencies, and company names. The document outlines three key applications of NLP in fintech: know your customer (KYC) to evaluate customers, know your product (KYP) to analyze financial instruments, and satisfy your customer (SYC) which is a new focus on customer satisfaction. It concludes by thanking the audience.