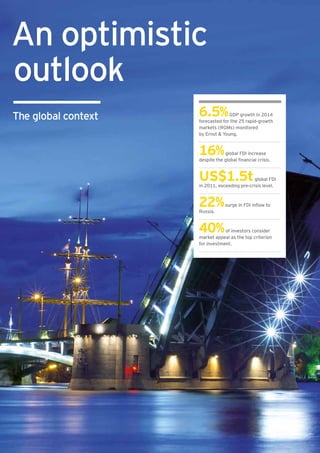

Ernst & Young's 2012 Attractiveness Survey highlights that Russia has improved its position as a destination for foreign direct investment (FDI), showcasing its abundant natural resources and skilled labor force. Despite growing confidence and optimism among investors, concerns exist regarding the political and administrative environment, which hinder further investment inflow. The report calls for enhancements to create a more investor-friendly climate as Russia gradually diversifies its economic sectors beyond oil and gas.