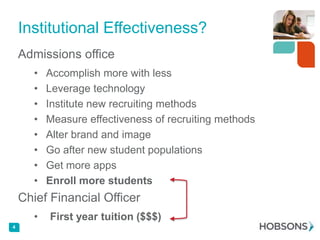

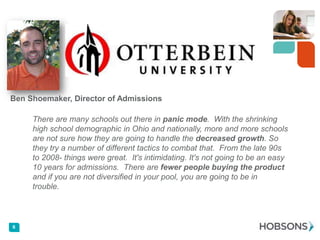

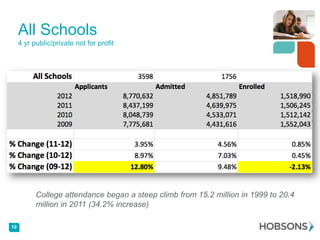

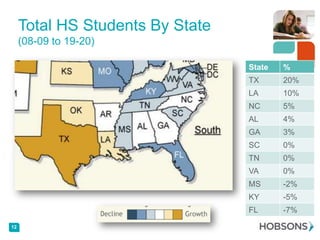

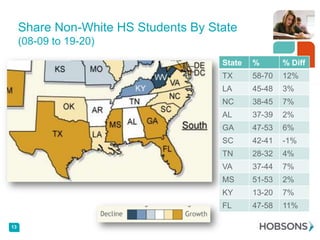

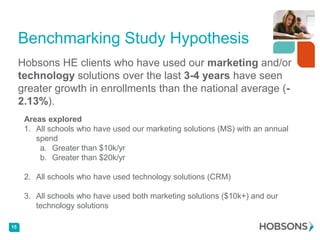

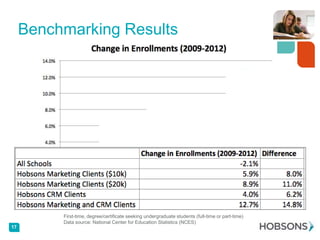

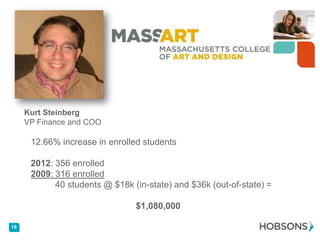

The document discusses enrollment trends and challenges faced by colleges in the U.S., highlighting a shrinking high school demographic that impacts student recruitment efforts. It emphasizes the need for institutions to diversify their recruitment strategies and adapt to changing market conditions, as many are experiencing declines in enrollment. The findings suggest that schools utilizing targeted marketing and technology solutions have seen better enrollment growth than the national average.