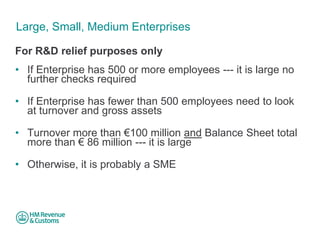

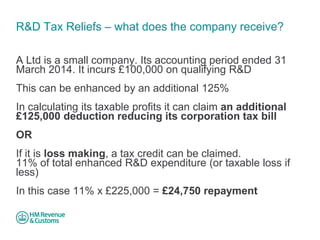

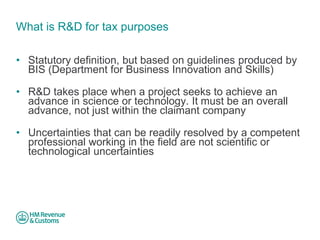

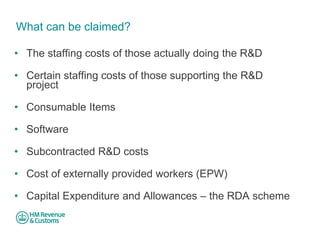

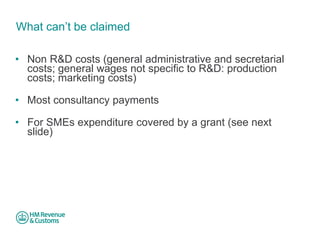

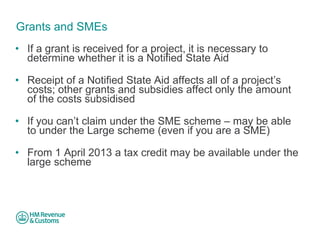

This document discusses R&D tax incentives and reliefs for companies in the UK, including schemes for small and medium enterprises. It provides details on qualifying criteria for SME status, how enhanced deductions or tax credits for R&D expenditures are calculated, eligible R&D costs, exclusions, rules around state aid grants, the claims process, and introduces the new Patent Box incentive effective from 2013.