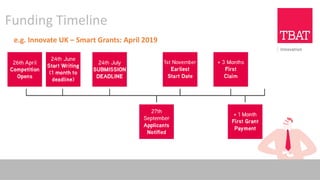

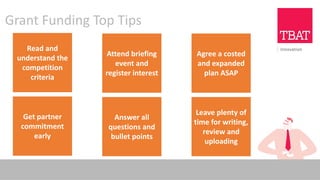

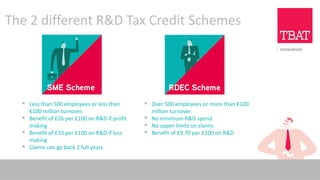

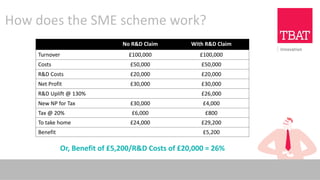

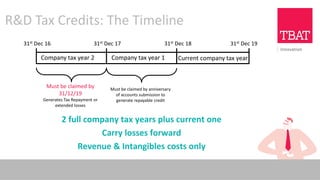

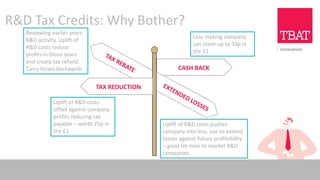

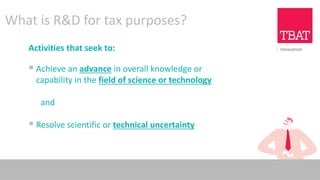

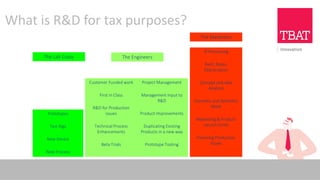

This document provides information about funding and tax incentive programs in the UK to support innovation and research and development. It discusses the Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS) which provide tax relief for equity investments in small companies. It also summarizes R&D tax credits that reward innovation, the Patent Box that lowers taxes on profits from patented inventions, and various grant programs from Innovate UK including Smart Grants. The document provides guidance on eligibility and claiming these different innovation support programs in the UK.