HIGH INFLATION, EMPLOYMENT, then RECESSION?

- 1. HIGH INFLATION & EMPLOYMENT, INTEREST INCREASES, then RECESSION? Paul H. Carr

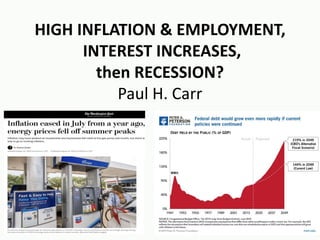

- 2. HIGH INFLATION & EMPLOYMENT, INTEREST INCREASES, then RECESSION? How well is the Federal Reserve meeting its goals of 2% inflation and low unemployment? Might there be a tradeoff? Will the Fed's increasing interest rates drive us into a recession? Will increasing interest rates lead the US to default on its escalating national debt? Would you pay higher taxes to save US from defaulting?

- 3. 3.5 % unemployment 10 years after 2009 depression. Only 2 years after 2020 depression. Depressions

- 4. Lowest unemployment in over 40 years, but larger increase in US debt

- 5. HIGHEST INFLATION IN 40 YEARS

- 7. Electric Cars: Fun Saving our Planet Paul H Carr, IEEE Life Fellow, Chevy Bolt

- 10. The Fed is increasing interest rates to reduce inflation

- 12. TRADEOFF Lowest 3.5% unemployment in over 40 years, but highest inflation, and Highest increase in US debt.

- 13. Higher increase in US public debt after 2009

- 14. Most wage earners are complaining about the fact that their increased wages have not kept up with inflation. Do they realize that without the inflationary government stimulus, that they would most likely have been unemployed?

- 15. Since 2000, the Fed has met its goal of 2% inflation In 1980 some professionals believed it was impossible for the Fed to decrease the 14% inflation

- 16. Fed increased interest rates to 18% to bring down inflation.

- 17. Since 1985 interest rages have been declining.

- 18. INFLATION, EMPLOYMENT, then RECESSION? How well is the Federal Reserve meeting its goals of 2% inflation and high employment? Might there be a tradeoff? Will the Fed’s recent increase in interest rates drive us into a recession? Will increasing interest rates lead the US to default on its escalating national debt?

- 19. GDP has been declining for the last two quarters? Recession?

- 20. During the 2020 recession, investors bought gold, but not recently.

- 22. INFLATION, EMPLOYMENT, then RECESSION? How well is the Federal Reserve meeting its goals of 2% inflation and high employment? Might there be a tradeoff? Will the Fed's increasing interest rates drive us into a recession? Will increasing interest rates lead the US to default on its escalating national debt? Would you pay higher taxes to save us?

- 25. Debt Decrease

- 26. The Dot-Com boom, plus tax increases, and lower government spending fueled the 2000 budget surplus. 1998- 2001 Surplu s 1998- 2001 Surplus

- 27. KEYSIAN ECONOMICS 1. During a recession, the government should temporarily increase spending financed by increased debt. 2.We are not reducing National debt now that recessions are over.

- 28. INFLATION, EMPLOYMENT, then RECESSION? How well is the Federal Reserve meeting its goals of 2% inflation and high employment? Might there be a tradeoff? Will the Fed's increasing interest rates drive us into a recession? Will increasing interest rates lead the US to default on its escalating national debt? Would you pay higher taxes to save us?

- 29. MODERN MONETARY THEORY ?? Former Chair of the Federal Reserve Alan Greenspan (1987-2006) once said, "The United States can pay any debt it has because we can always print money to do that. So there is zero probability of default.” But printing money lowers its value; its’ inflationary. In 2006, when there were indications that risky sub- prime mortgages would bring about the second worst recession, Greenspan said something like, “Don’t worry, our banking system is managed by professionals who know what they are doing.” These professionals had bundled risky investments with stable government bonds. It didn’t work!

- 30. INCREASING DEBT LEGACY An increase in interest rates of 1 percentage point above projected rates, according to Brian Riedl of the Manhattan Institute, would raise interest payments by $30 trillion through 2051, and at that time the payments would be equal to 70 percent of all tax revenue. An increase of 2 percentage points would mean that interest payments would equal 100 percent of all tax revenue in 2051.

- 31. INFLATION, EMPLOYMENT, then RECESSION? How well is the Federal Reserve meeting its goals of 2% inflation and high employment? Might there be a tradeoff? Will the Fed's increasing interest rates drive us into a recession? Will increasing interest rates lead the US to default on its escalating national debt? Would you pay higher taxes to save us?

- 32. Would you pay higher taxes to reduce the us public debt?

- 33. New revenue from the 2022 Inflation and Climate Act will reduce the US debt by $274 B in 10 years.

- 34. CONCLUSION: INFLATION, EMPLOYMENT, then RECESSION? TRADEOFF: Lowest 3.5% unemployment in over 40 years, but highest inflation, and highest increase in US debt. Will the Fed's increasing interest rates drive us into a recession? Will increasing interest rates lead the US to default on its escalating national debt? Would you pay higher taxes to save us?

Editor's Notes

- Source: U.S. Bureau of Labor Statistics Release: Employment Situation Units: Percent, Seasonally Adjusted Frequency: Monthly The unemployment rate represents the number of unemployed as a percentage of the labor force. Labor force data are restricted to people 16 years of age and older, who currently reside in 1 of the 50 states or the District of Columbia, who do not reside in institutions (e.g., penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces. This rate is also defined as the U-3 measure of labor underutilization. The series comes from the 'Current Population Survey (Household Survey)' The source code is: LNS14000000 U.S. Bureau of Labor Statistics, Unemployment Rate [UNRATE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UNRATE, August 10, 2022.

- Source: U.S. Bureau of Labor Statistics Release: Employment Situation Units: Percent, Seasonally Adjusted Frequency: Monthly The unemployment rate represents the number of unemployed as a percentage of the labor force. Labor force data are restricted to people 16 years of age and older, who currently reside in 1 of the 50 states or the District of Columbia, who do not reside in institutions (e.g., penal and mental facilities, homes for the aged), and who are not on active duty in the Armed Forces. This rate is also defined as the U-3 measure of labor underutilization. The series comes from the 'Current Population Survey (Household Survey)' The source code is: LNS14000000 U.S. Bureau of Labor Statistics, Unemployment Rate [UNRATE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UNRATE, August 10, 2022.

- Source: Board of Governors of the Federal Reserve System (US) Release: H.15 Selected Interest Rates Units: Percent, Not Seasonally Adjusted Frequency: Daily, 7-Day For additional historical federal funds rate data, please see Daily Federal Funds Rate from 1928-1954.The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with excess cash, which is often referred to as liquidity, will lend to another bank that needs to quickly raise liquidity. (1) The rate that the borrowing institution pays to the lending institution is determined between the two banks; the weighted average rate for all of these types of negotiations is called the effective federal funds rate.(2) The effective federal funds rate is essentially determined by the market but is influenced by the Federal Reserve through open market operations to reach the federal funds rate target.(2)The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. As previously stated, this rate influences the effective federal funds rate through open market operations or by buying and selling of government bonds (government debt).(2) More specifically, the Federal Reserve decreases liquidity by selling government bonds, thereby raising the federal funds rate because banks have less liquidity to trade with other banks. Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for trade. Whether the Federal Reserve wants to buy or sell bonds depends on the state of the economy. If the FOMC believes the economy is growing too fast and inflation pressures are inconsistent with the dual mandate of the Federal Reserve, the Committee may set a higher federal funds rate target to temper economic activity. In the opposing scenario, the FOMC may set a lower federal funds rate target to spur greater economic activity. Therefore, the FOMC must observe the current state of the economy to determine the best course of monetary policy that will maximize economic growth while adhering to the dual mandate set forth by Congress. In making its monetary policy decisions, the FOMC considers a wealth of economic data, such as: trends in prices and wages, employment, consumer spending and income, business investments, and foreign exchange markets.The federal funds rate is the central interest rate in the U.S. financial market. It influences other interest rates such as the prime rate, which is the rate banks charge their customers with higher credit ratings. Additionally, the federal funds rate indirectly influences longer- term interest rates such as mortgages, loans, and savings, all of which are very important to consumer wealth and confidence.(2)References(1) Federal Reserve Bank of New York. "Federal funds." Fedpoints, August 2007.(2) Monetary Policy, Board of Governors of the Federal Reserve System. Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [DFF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFF, August 9, 2022.

- Source: Board of Governors of the Federal Reserve System (US) Release: H.15 Selected Interest Rates Units: Percent, Not Seasonally Adjusted Frequency: Daily For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and Treasury Yield Curve Methodology. Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, August 9, 2022.

- Source: U.S. Department of the Treasury. Fiscal Service Release: Treasury Bulletin Units: Millions of Dollars, Not Seasonally Adjusted Frequency: Quarterly, End of Period U.S. Department of the Treasury. Fiscal Service, Federal Debt: Total Public Debt [GFDEBTN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GFDEBTN, August 10, 2022.

- Source: Board of Governors of the Federal Reserve System (US) Release: H.15 Selected Interest Rates Units: Percent, Not Seasonally Adjusted Frequency: Daily, 7-Day For additional historical federal funds rate data, please see Daily Federal Funds Rate from 1928-1954.The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with excess cash, which is often referred to as liquidity, will lend to another bank that needs to quickly raise liquidity. (1) The rate that the borrowing institution pays to the lending institution is determined between the two banks; the weighted average rate for all of these types of negotiations is called the effective federal funds rate.(2) The effective federal funds rate is essentially determined by the market but is influenced by the Federal Reserve through open market operations to reach the federal funds rate target.(2)The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. As previously stated, this rate influences the effective federal funds rate through open market operations or by buying and selling of government bonds (government debt).(2) More specifically, the Federal Reserve decreases liquidity by selling government bonds, thereby raising the federal funds rate because banks have less liquidity to trade with other banks. Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for trade. Whether the Federal Reserve wants to buy or sell bonds depends on the state of the economy. If the FOMC believes the economy is growing too fast and inflation pressures are inconsistent with the dual mandate of the Federal Reserve, the Committee may set a higher federal funds rate target to temper economic activity. In the opposing scenario, the FOMC may set a lower federal funds rate target to spur greater economic activity. Therefore, the FOMC must observe the current state of the economy to determine the best course of monetary policy that will maximize economic growth while adhering to the dual mandate set forth by Congress. In making its monetary policy decisions, the FOMC considers a wealth of economic data, such as: trends in prices and wages, employment, consumer spending and income, business investments, and foreign exchange markets.The federal funds rate is the central interest rate in the U.S. financial market. It influences other interest rates such as the prime rate, which is the rate banks charge their customers with higher credit ratings. Additionally, the federal funds rate indirectly influences longer- term interest rates such as mortgages, loans, and savings, all of which are very important to consumer wealth and confidence.(2)References(1) Federal Reserve Bank of New York. "Federal funds." Fedpoints, August 2007.(2) Monetary Policy, Board of Governors of the Federal Reserve System. Board of Governors of the Federal Reserve System (US), Federal Funds Effective Rate [DFF], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DFF, August 9, 2022.

- Source: Board of Governors of the Federal Reserve System (US) Release: H.15 Selected Interest Rates Units: Percent, Not Seasonally Adjusted Frequency: Daily For further information regarding treasury constant maturity data, please refer to the H.15 Statistical Release notes and Treasury Yield Curve Methodology. Board of Governors of the Federal Reserve System (US), Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity, Quoted on an Investment Basis [DGS10], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DGS10, August 9, 2022.

- Source: Chicago Board Options Exchange Release: CBOE Market Statistics Units: Index, Not Seasonally Adjusted Frequency: Daily, Close Exchange Traded Funds (ETFs) are shares of trusts that hold portfolios of stocks designed to closely track the price performance and yield of specific indices. Copyright, 2016, Chicago Board Options Exchange, Inc. Reprinted with permission. Chicago Board Options Exchange, CBOE Gold ETF Volatility Index [GVZCLS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GVZCLS, August 10, 2022.

- Source: U.S. Department of the Treasury. Fiscal Service Release: Treasury Bulletin Units: Millions of Dollars, Not Seasonally Adjusted Frequency: Quarterly, End of Period U.S. Department of the Treasury. Fiscal Service, Federal Debt: Total Public Debt [GFDEBTN], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GFDEBTN, August 10, 2022.