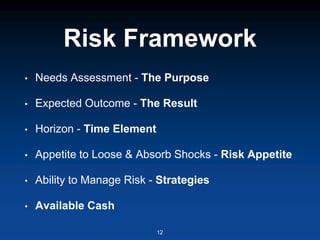

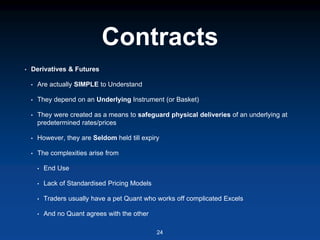

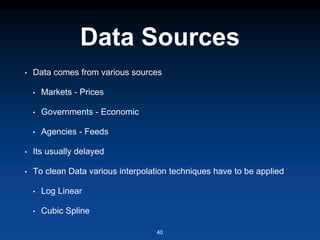

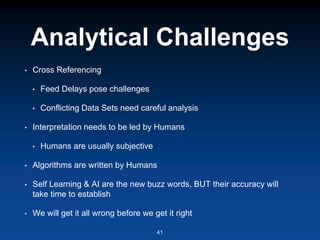

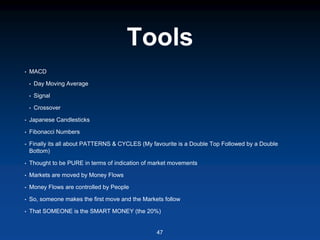

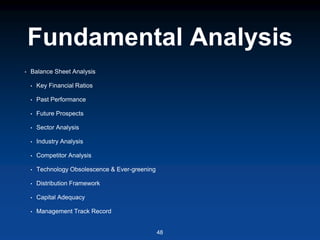

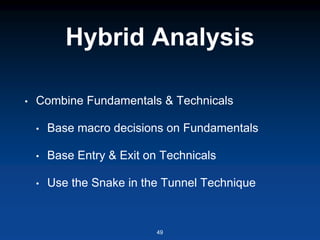

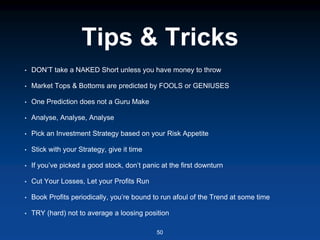

- The document discusses risk mitigation in financial investments through the use of data analytics. It covers assessing different investor types and their varying objectives, analyzing different asset classes and their risks, and using analytical tools like technical analysis and fundamental analysis to develop investment strategies and manage portfolio risk. The focus is on collecting and analyzing relevant data from multiple sources to predict market movements and make informed investment decisions.