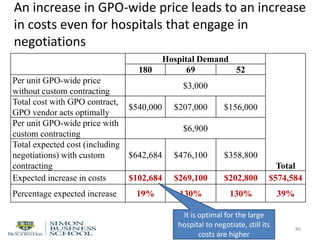

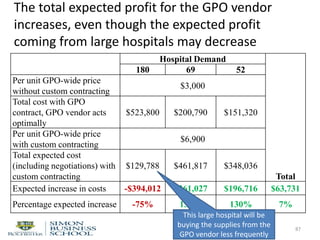

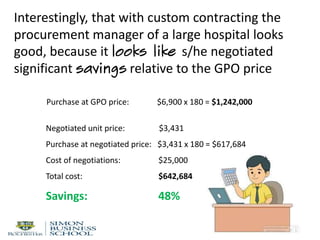

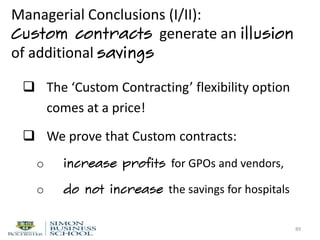

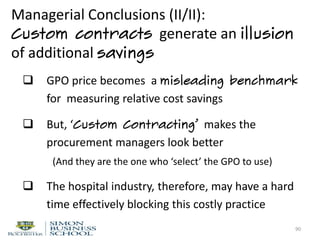

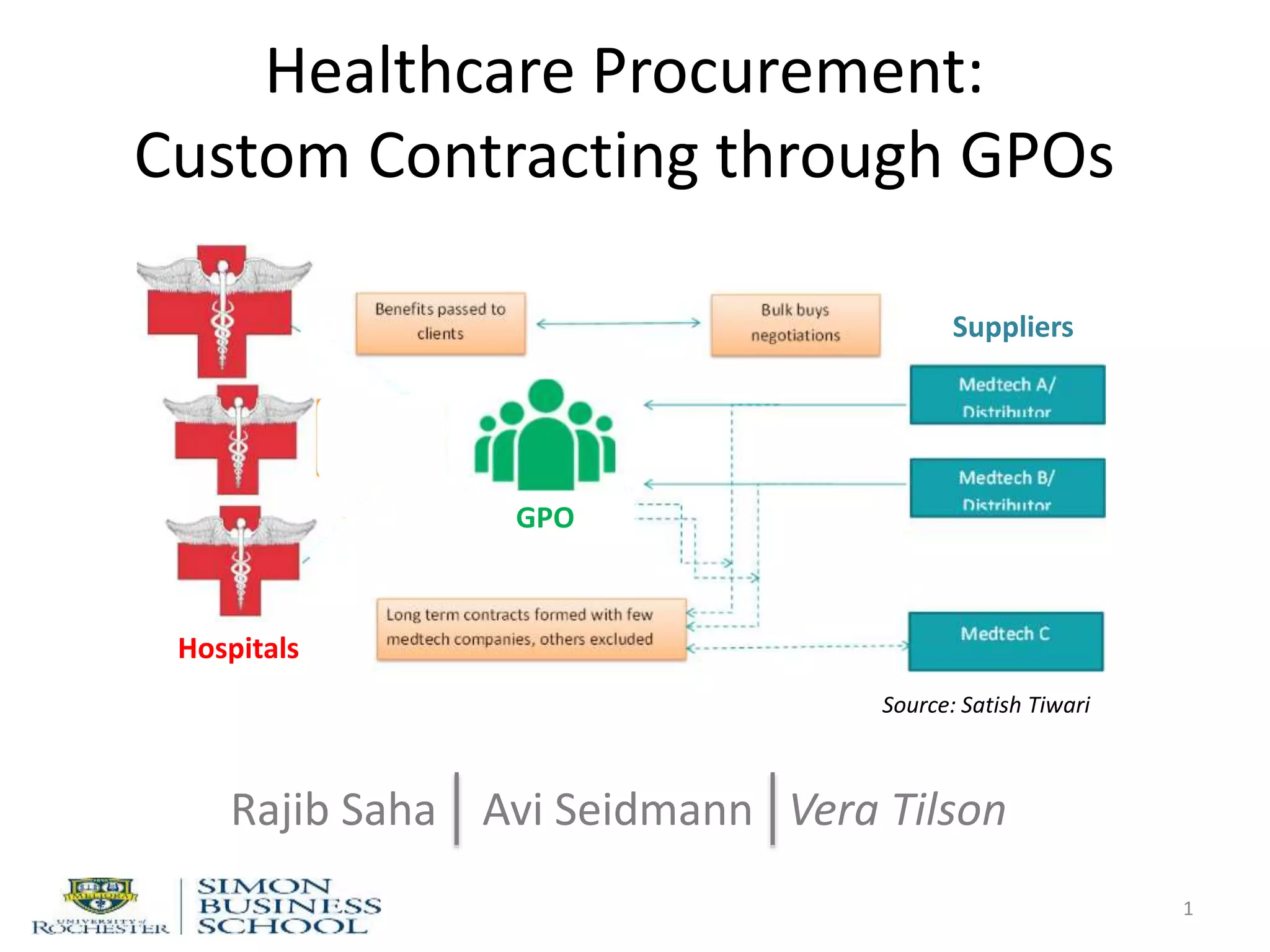

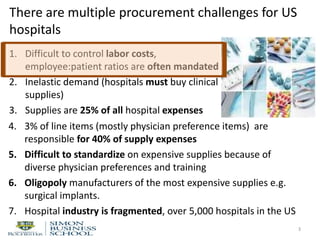

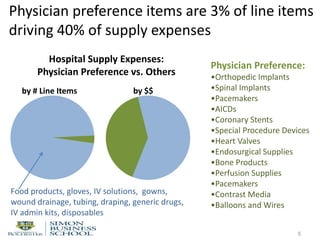

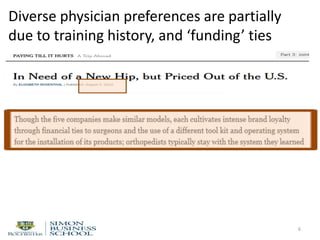

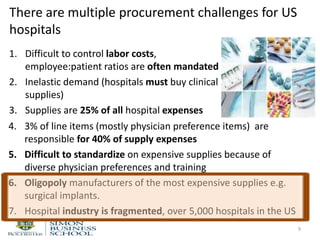

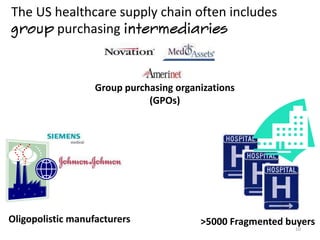

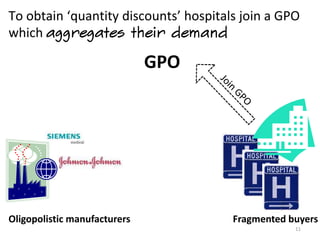

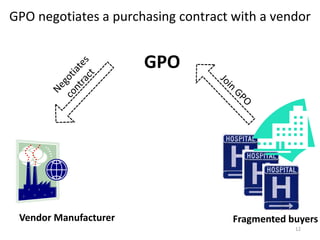

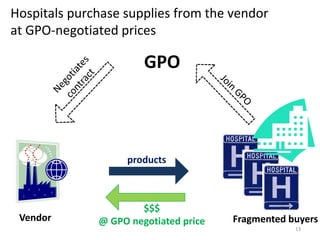

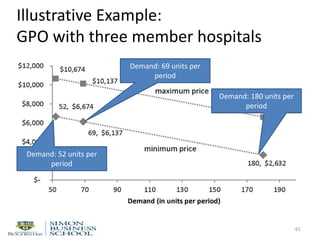

The document discusses procurement challenges faced by US hospitals, highlighting issues such as high labor costs, inelastic demand for clinical supplies, and the significant financial impact of physician preference items. It also outlines the role of group purchasing organizations (GPOs) in mitigating some of these challenges by negotiating better prices through aggregated demand, although GPO practices have faced scrutiny and calls for reform. The analysis includes exploration of custom contracting arrangements and their implications on cost-efficiency and relationships among hospitals, vendors, and GPOs.

![Assumption III: Price attainable through vendor-

hospital negotiations is random &

stochastically decreasing in demand

51

Upper limit on attainable

price

Lower limit on

attainable price

PurchasePrice,$/unit

Expected price

Hospitals’ purchase volume [units/period]](https://image.slidesharecdn.com/gpopresentation151019olin-151218175544/85/Healthcare-Procurement-Custom-Contracting-through-GPOs-51-320.jpg)

![Assumption IV: GPO member hospitals are

heterogeneous in terms of demand volume.

This distribution is known to the GPO vendor.

52

#ofmemberhospitals

Hospitals’ purchase volumes [units/period]](https://image.slidesharecdn.com/gpopresentation151019olin-151218175544/85/Healthcare-Procurement-Custom-Contracting-through-GPOs-52-320.jpg)

![Assumption V: Decision timing

53

TreePlan Trial Version, For Evaluation Only www.TreePlan.com

Hospital: don't negotiate

0

0 0

0.5

Negotiated price above GPO price

0

0 0

1

0 0 0 0.5

Negotiated price below GPO price

0

0 0

Hospital: negotiate 0.5

1 Negotiated price above GPO price

0 0 0

0 0

0 0 0.5

Negotiated price below GPO price

0

0 0

1

0 0 0.5

Negotiated price above GPO price

0

0 0

GPO vendor: participate

0.5

0 0 GPO vendor selected

0.5 0

0 0

0 0 0.5

GPO vendor not selected

0

0 0For Evaluation Only

GPO

vendor

set price

Pg

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

Hospital:invite GPO

vendor

Hospital: don't

invite GPO vendor

GPO vendor: don't

participate

Negotiated price

below GPO price

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

GPO vendor payoff Hospital cost

λ q P g q P g

λ q P g - k v q P g + c (k,1 )

GPO-selected vendor sets the

GPO-wide contract price for all

members](https://image.slidesharecdn.com/gpopresentation151019olin-151218175544/85/Healthcare-Procurement-Custom-Contracting-through-GPOs-53-320.jpg)

![Assumption V: Decision timing

54

TreePlan Trial Version, For Evaluation Only www.TreePlan.com

Hospital: don't negotiate

0

0 0

0.5

Negotiated price above GPO price

0

0 0

1

0 0 0 0.5

Negotiated price below GPO price

0

0 0

Hospital: negotiate 0.5

1 Negotiated price above GPO price

0 0 0

0 0

0 0 0.5

Negotiated price below GPO price

0

0 0

1

0 0 0.5

Negotiated price above GPO price

0

0 0

GPO vendor: participate

0.5

0 0 GPO vendor selected

0.5 0

0 0

0 0 0.5

GPO vendor not selected

0

0 0For Evaluation Only

GPO

vendor

set price

Pg

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

Hospital:invite GPO

vendor

Hospital: don't

invite GPO vendor

GPO vendor: don't

participate

Negotiated price

below GPO price

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

GPO vendor payoff Hospital cost

λ q P g q P g

λ q P g - k v q P g + c (k,1 )

Hospital decides whether to

purchase supplies at this price,

or to negotiate with other

vendors](https://image.slidesharecdn.com/gpopresentation151019olin-151218175544/85/Healthcare-Procurement-Custom-Contracting-through-GPOs-54-320.jpg)

![Assumption V: Decision timing

55

TreePlan Trial Version, For Evaluation Only www.TreePlan.com

Hospital: don't negotiate

0

0 0

0.5

Negotiated price above GPO price

0

0 0

1

0 0 0 0.5

Negotiated price below GPO price

0

0 0

Hospital: negotiate 0.5

1 Negotiated price above GPO price

0 0 0

0 0

0 0 0.5

Negotiated price below GPO price

0

0 0

1

0 0 0.5

Negotiated price above GPO price

0

0 0

GPO vendor: participate

0.5

0 0 GPO vendor selected

0.5 0

0 0

0 0 0.5

GPO vendor not selected

0

0 0For Evaluation Only

GPO

vendor

set price

Pg

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

Hospital:invite GPO

vendor

Hospital: don't

invite GPO vendor

GPO vendor: don't

participate

Negotiated price

below GPO price

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

GPO vendor payoff Hospital cost

λ q P g q P g

λ q P g - k v q P g + c (k,1 )

If the hospital is able to find a

lower price from another vendor,

it purchases supplies from that

vendor. Otherwise, from the GPO

vendor at the general price](https://image.slidesharecdn.com/gpopresentation151019olin-151218175544/85/Healthcare-Procurement-Custom-Contracting-through-GPOs-55-320.jpg)

![Assumption V: Decision timing

56

TreePlan Trial Version, For Evaluation Only www.TreePlan.com

Hospital: don't negotiate

0

0 0

0.5

Negotiated price above GPO price

0

0 0

1

0 0 0 0.5

Negotiated price below GPO price

0

0 0

Hospital: negotiate 0.5

1 Negotiated price above GPO price

0 0 0

0 0

0 0 0.5

Negotiated price below GPO price

0

0 0

1

0 0 0.5

Negotiated price above GPO price

0

0 0

GPO vendor: participate

0.5

0 0 GPO vendor selected

0.5 0

0 0

0 0 0.5

GPO vendor not selected

0

0 0For Evaluation Only

GPO

vendor

set price

Pg

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

Hospital:invite GPO

vendor

Hospital: don't

invite GPO vendor

GPO vendor: don't

participate

Negotiated price

below GPO price

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

GPO vendor payoff Hospital cost

λ q P g q P g

λ q P g - k v q P g + c (k,1 )

When custom contracting is

allowed, a hospital can invite

the GPO vendor to

participate in custom

negotiations](https://image.slidesharecdn.com/gpopresentation151019olin-151218175544/85/Healthcare-Procurement-Custom-Contracting-through-GPOs-56-320.jpg)

![Assumption V: Decision timing

57

TreePlan Trial Version, For Evaluation Only www.TreePlan.com

Hospital: don't negotiate

0

0 0

0.5

Negotiated price above GPO price

0

0 0

1

0 0 0 0.5

Negotiated price below GPO price

0

0 0

Hospital: negotiate 0.5

1 Negotiated price above GPO price

0 0 0

0 0

0 0 0.5

Negotiated price below GPO price

0

0 0

1

0 0 0.5

Negotiated price above GPO price

0

0 0

GPO vendor: participate

0.5

0 0 GPO vendor selected

0.5 0

0 0

0 0 0.5

GPO vendor not selected

0

0 0For Evaluation Only

GPO

vendor

set price

Pg

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

Hospital:invite GPO

vendor

Hospital: don't

invite GPO vendor

GPO vendor: don't

participate

Negotiated price

below GPO price

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

GPO vendor payoff Hospital cost

λ q P g q P g

λ q P g - k v q P g + c (k,1 )

The GPO vendor can choose

to participate or not to

participate](https://image.slidesharecdn.com/gpopresentation151019olin-151218175544/85/Healthcare-Procurement-Custom-Contracting-through-GPOs-57-320.jpg)

![Assumption V: Decision timing

58

TreePlan Trial Version, For Evaluation Only www.TreePlan.com

Hospital: don't negotiate

0

0 0

0.5

Negotiated price above GPO price

0

0 0

1

0 0 0 0.5

Negotiated price below GPO price

0

0 0

Hospital: negotiate 0.5

1 Negotiated price above GPO price

0 0 0

0 0

0 0 0.5

Negotiated price below GPO price

0

0 0

1

0 0 0.5

Negotiated price above GPO price

0

0 0

GPO vendor: participate

0.5

0 0 GPO vendor selected

0.5 0

0 0

0 0 0.5

GPO vendor not selected

0

0 0For Evaluation Only

GPO

vendor

set price

Pg

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

Hospital:invite GPO

vendor

Hospital: don't

invite GPO vendor

GPO vendor: don't

participate

Negotiated price

below GPO price

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

GPO vendor payoff Hospital cost

λ q P g q P g

λ q P g - k v q P g + c (k,1 )

The hospital will purchase

supplies at the lowest

negotiated price](https://image.slidesharecdn.com/gpopresentation151019olin-151218175544/85/Healthcare-Procurement-Custom-Contracting-through-GPOs-58-320.jpg)

![TreePlan Trial Version, For Evaluation Only www.TreePlan.com

Hospital: don't negotiate

0

0 0

0.5

Negotiated price above GPO price

0

0 0

1

0 0 0 0.5

Negotiated price below GPO price

0

0 0

Hospital: negotiate 0.5

1 Negotiated price above GPO price

0 0 0

0 0

0 0 0.5

Negotiated price below GPO price

0

0 0

1

0 0 0.5

Negotiated price above GPO price

0

0 0

GPO vendor: participate

0.5

0 0 GPO vendor selected

0.5 0

0 0

0 0 0.5

GPO vendor not selected

0

0 0For Evaluation Only

GPO

vendor

set price

Pg

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

Hospital:invite GPO

vendor

Hospital: don't

invite GPO vendor

GPO vendor: don't

participate

Negotiated price

below GPO price

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

GPO vendor payoff Hospital cost

λ q P g q P g

λ q P g - k v q P g + c (k,1 )

Result I: The GPO vendor is never worse off

with custom contracting

59

The GPO vendor can always

refuse to participate in

custom negotiations](https://image.slidesharecdn.com/gpopresentation151019olin-151218175544/85/Healthcare-Procurement-Custom-Contracting-through-GPOs-59-320.jpg)

![TreePlan Trial Version, For Evaluation Only www.TreePlan.com

Hospital: don't negotiate

0

0 0

0.5

Negotiated price above GPO price

0

0 0

1

0 0 0 0.5

Negotiated price below GPO price

0

0 0

Hospital: negotiate 0.5

1 Negotiated price above GPO price

0 0 0

0 0

0 0 0.5

Negotiated price below GPO price

0

0 0

1

0 0 0.5

Negotiated price above GPO price

0

0 0

GPO vendor: participate

0.5

0 0 GPO vendor selected

0.5 0

0 0

0 0 0.5

GPO vendor not selected

0

0 0For Evaluation Only

GPO

vendor

set price

Pg

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

Hospital:invite GPO

vendor

Hospital: don't

invite GPO vendor

GPO vendor: don't

participate

Negotiated price

below GPO price

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

GPO vendor payoff Hospital cost

λ q P g q P g

λ q P g - k v q P g + c (k,1 )

Result II: The GPO is never worse off with

custom contracting

60

If the GPO vendor agreed to

participate means that its

expected revenue is higher

than when it does not

participate](https://image.slidesharecdn.com/gpopresentation151019olin-151218175544/85/Healthcare-Procurement-Custom-Contracting-through-GPOs-60-320.jpg)

![TreePlan Trial Version, For Evaluation Only www.TreePlan.com

Hospital: don't negotiate

0

0 0

0.5

Negotiated price above GPO price

0

0 0

1

0 0 0 0.5

Negotiated price below GPO price

0

0 0

Hospital: negotiate 0.5

1 Negotiated price above GPO price

0 0 0

0 0

0 0 0.5

Negotiated price below GPO price

0

0 0

1

0 0 0.5

Negotiated price above GPO price

0

0 0

GPO vendor: participate

0.5

0 0 GPO vendor selected

0.5 0

0 0

0 0 0.5

GPO vendor not selected

0

0 0For Evaluation Only

GPO

vendor

set price

Pg

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

q P g - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

Hospital:invite GPO

vendor

Hospital: don't

invite GPO vendor

GPO vendor: don't

participate

Negotiated price

below GPO price

λ q P g q P g + c (k,0 )

0 q E [p (q,P g ,0 ) | p <P g ] + c (k,0 )

λ q E [p (q,P g ,1 ) | p <P g ] - k v q E [p (q,P g ,1 ) | p <P g ] + c (k,1 )

GPO vendor payoff Hospital cost

λ q P g q P g

λ q P g - k v q P g + c (k,1 )

Next, we take a closer look at custom contracting

81](https://image.slidesharecdn.com/gpopresentation151019olin-151218175544/85/Healthcare-Procurement-Custom-Contracting-through-GPOs-81-320.jpg)