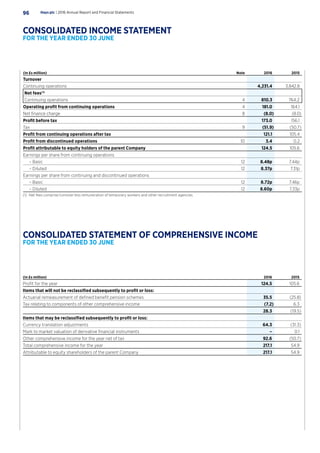

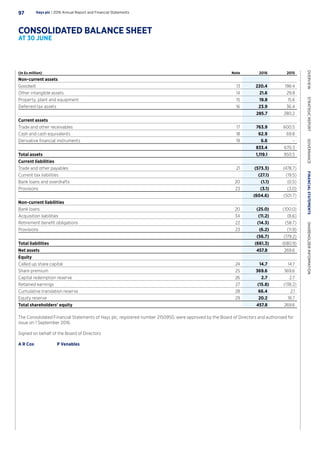

Hays plc's 2016 annual report highlights a strong financial performance with net fee income reaching £810.3 million, up 6% from the previous year, and operating profit increasing by 10% to £181 million. The report discusses the company's strategic focus on growth through capability expansion and productivity improvement while also achieving a debt-free status, allowing for enhanced shareholder returns. Hays continues to emphasize the recruitment of skilled professionals across various sectors, reflecting its commitment to transforming lives and meeting market demands globally.