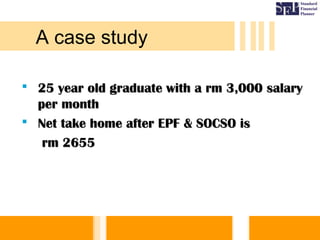

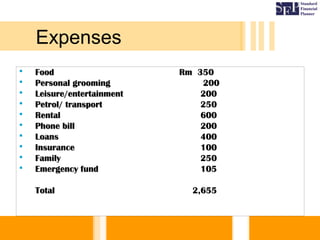

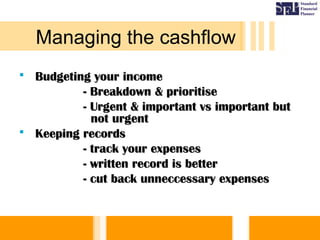

This document provides an overview of cashflow management and its importance for financial freedom. It discusses budgeting income and expenses, paying oneself first through savings, managing loans and credit cards, and starting the process through reviewing finances, prioritizing spending, and increasing financial knowledge over time. The goal of cashflow management is to live below one's means in order to achieve financial independence and security for retirement as costs rise over the decades.