The document provides an overview of Goods and Services Tax (GST) in India, including:

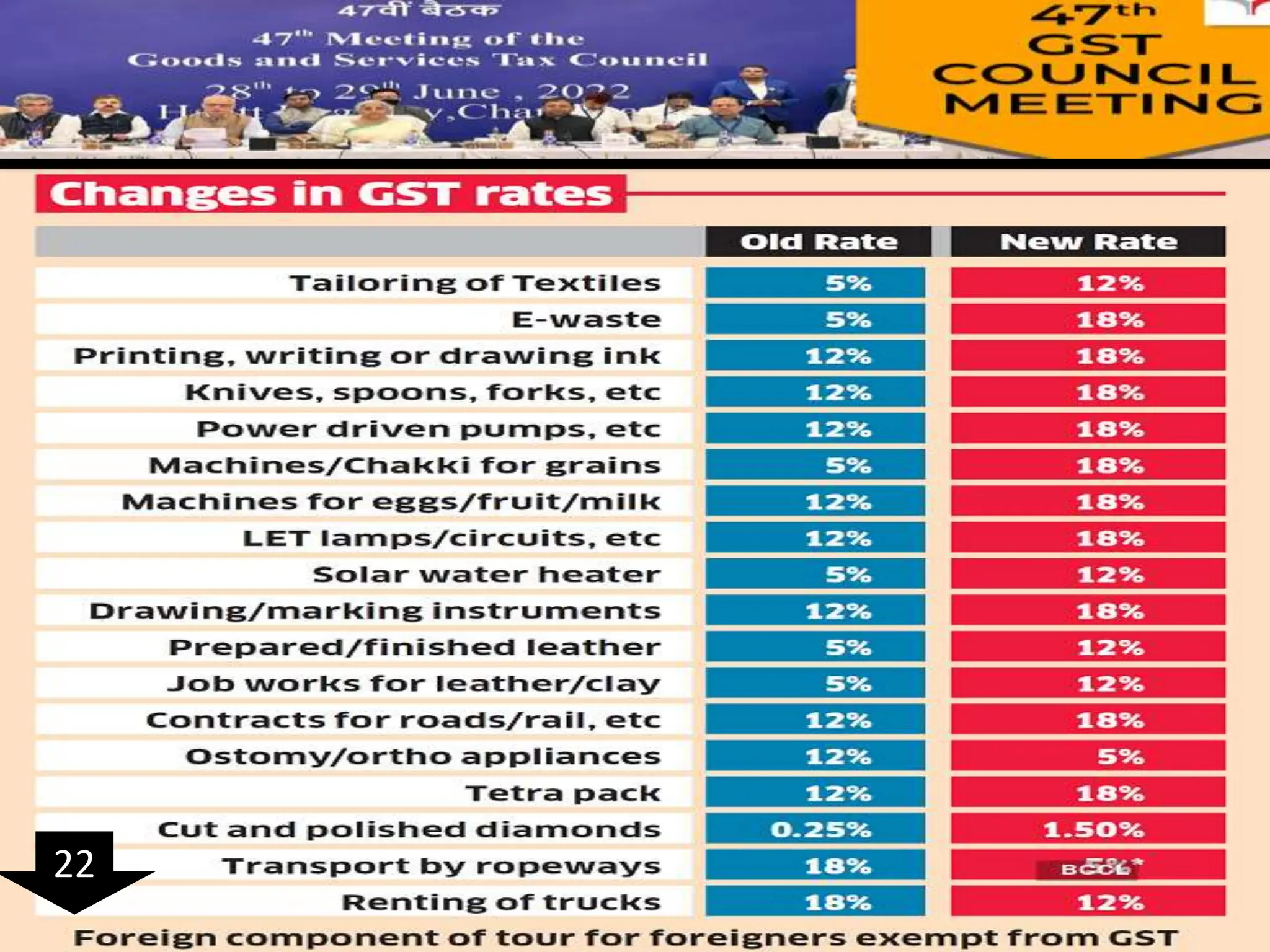

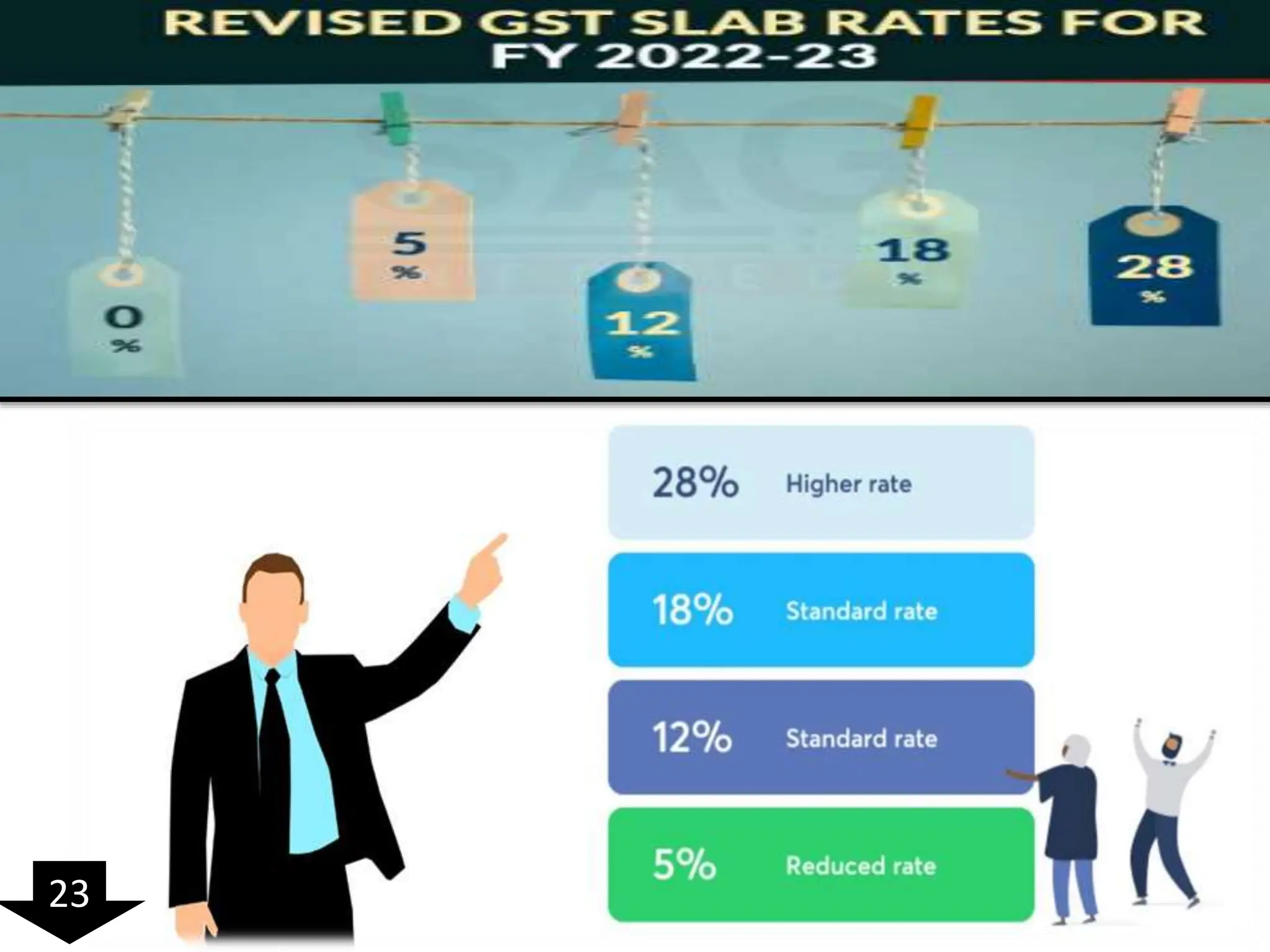

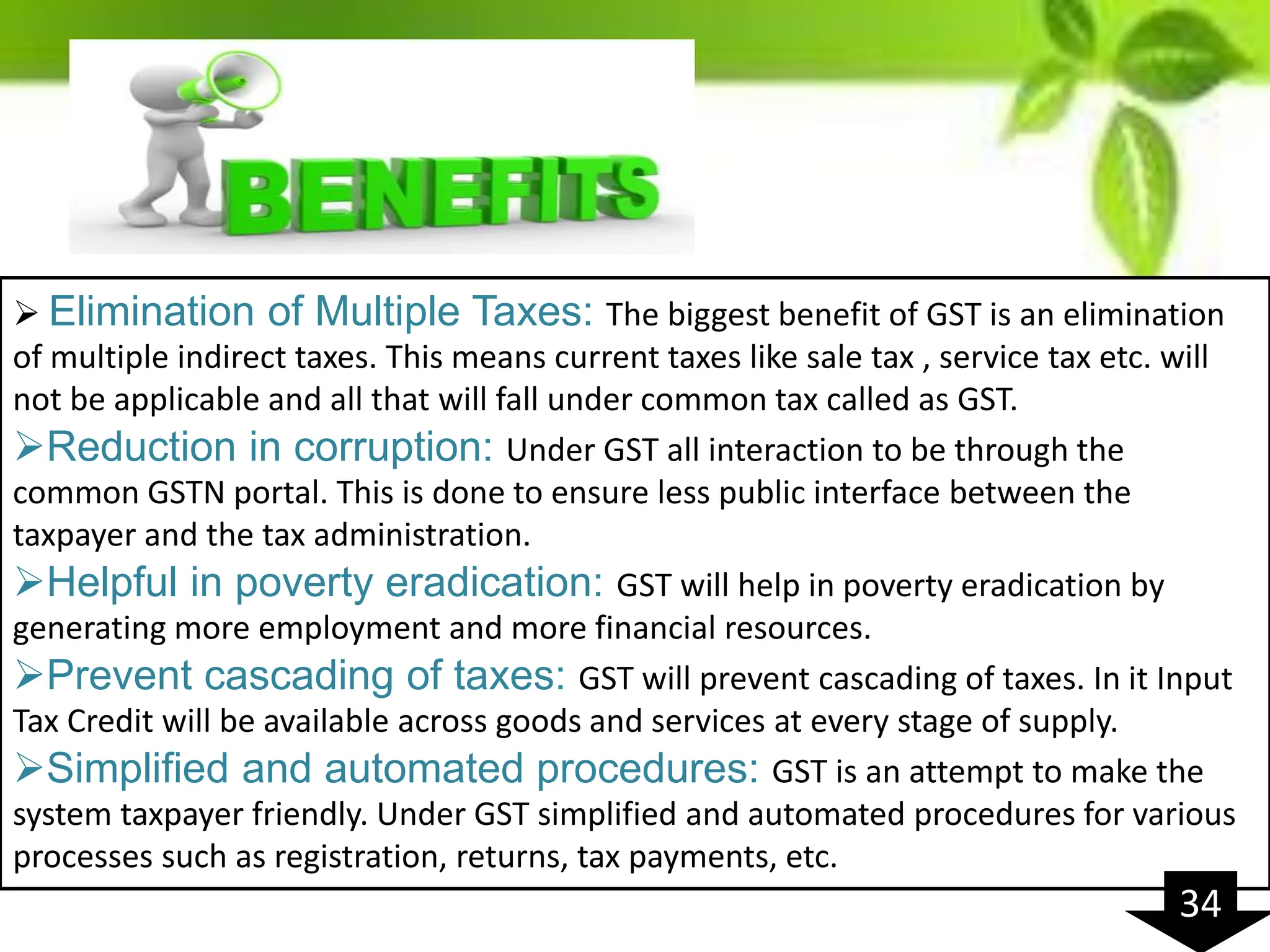

1) It discusses the tax structure in India before and after the implementation of GST, replacing multiple indirect taxes with a single tax at the national level.

2) GST is levied on the supply of goods and services, with taxpayers able to claim input tax credits.

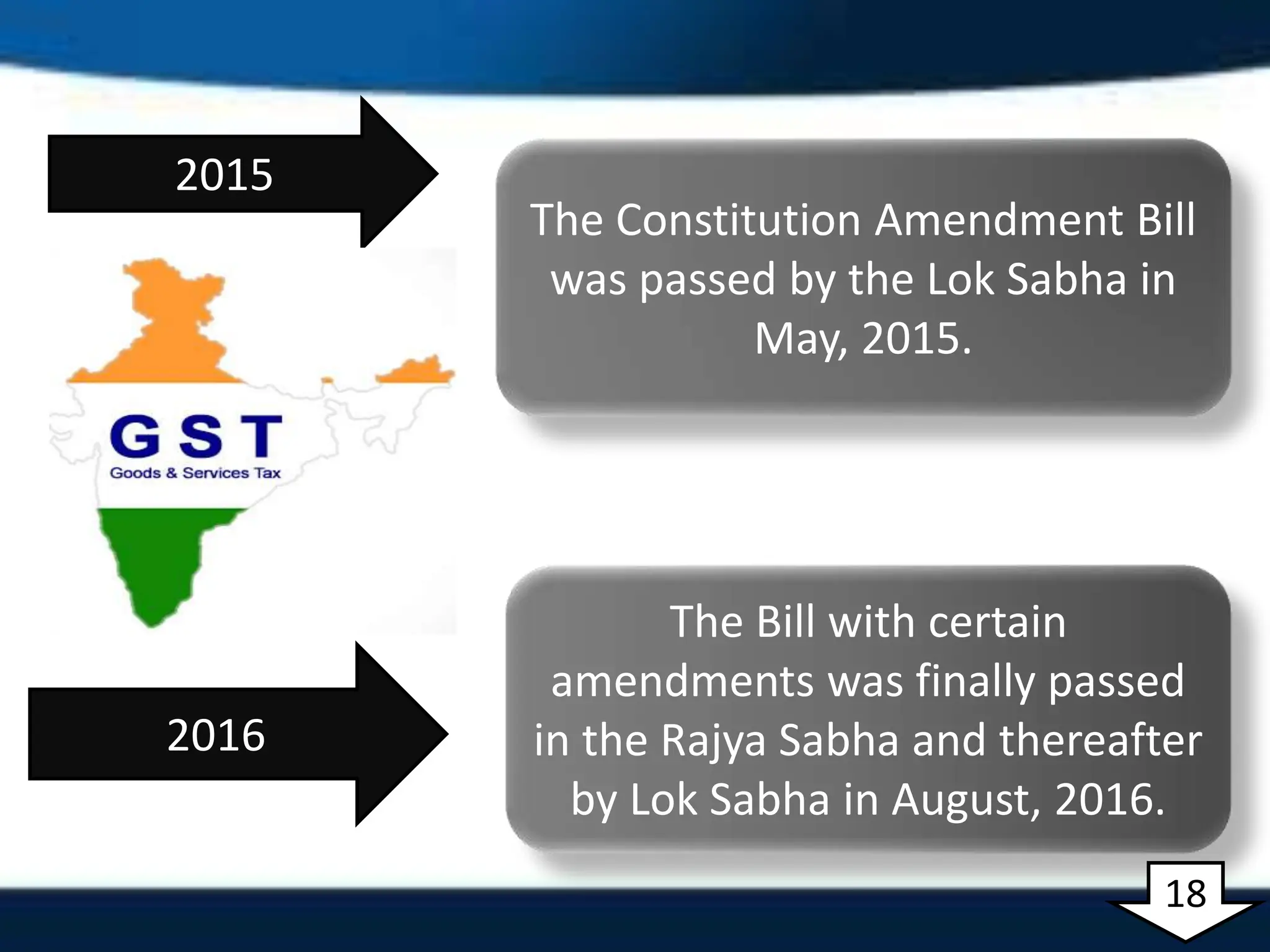

3) The genesis and development of GST in India and globally is outlined, with India establishing a GST Council to make recommendations.

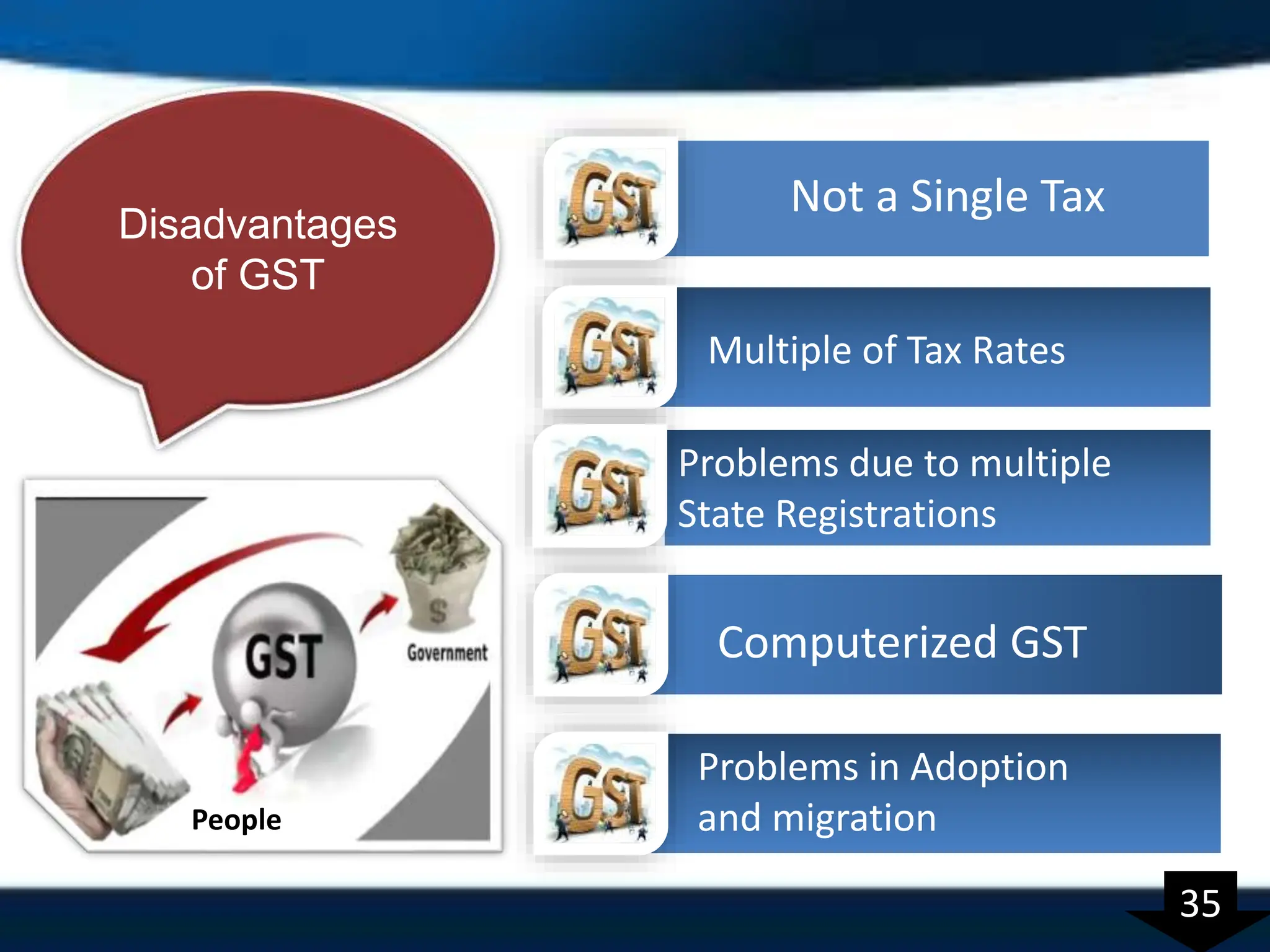

4) The document details the types of GST in India, registration requirements, and benefits and disadvantages of the new system.