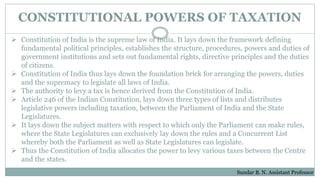

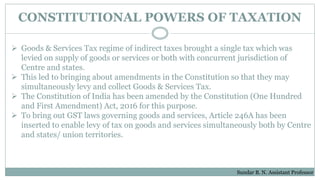

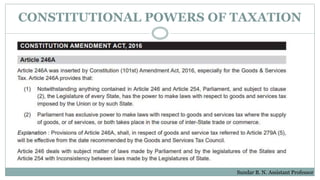

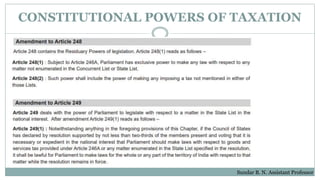

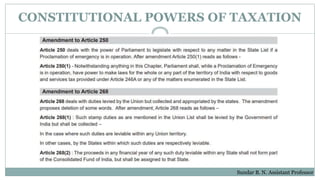

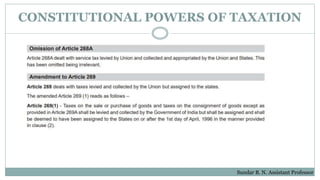

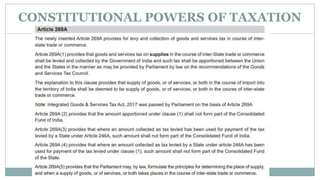

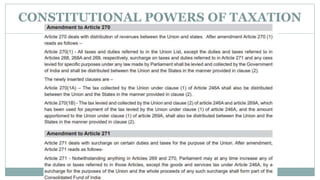

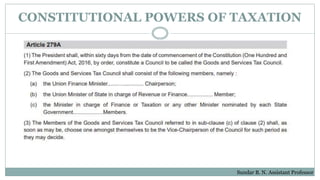

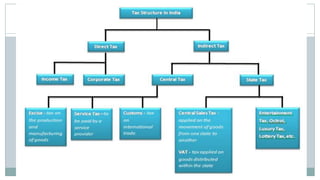

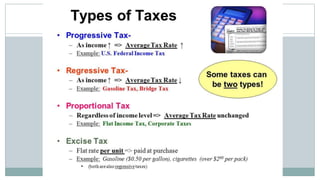

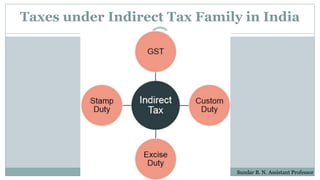

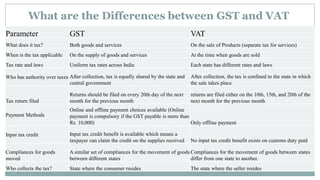

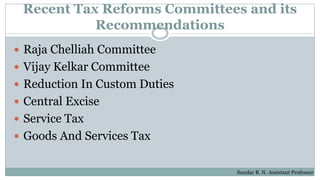

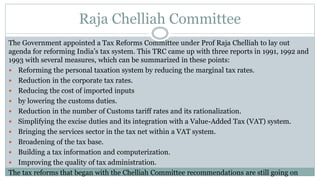

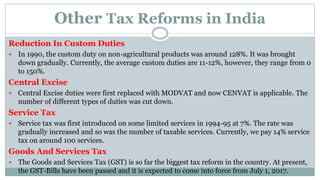

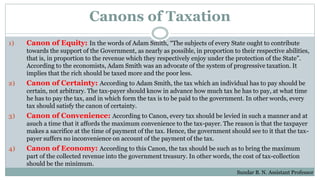

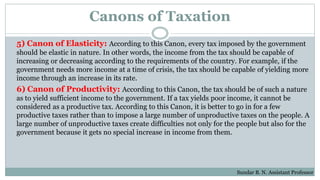

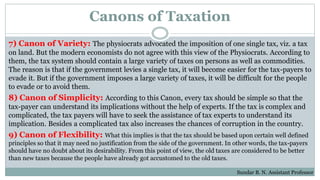

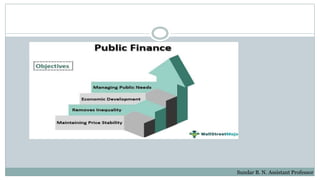

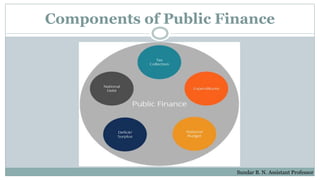

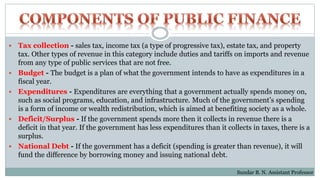

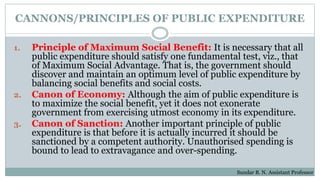

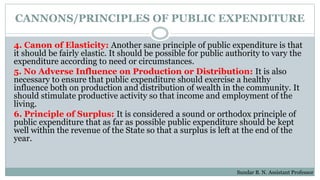

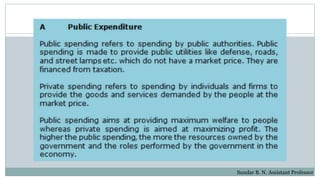

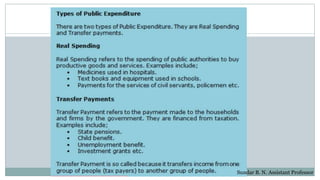

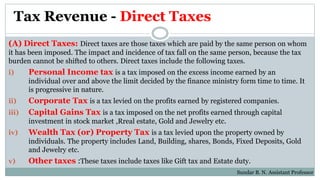

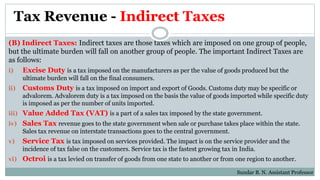

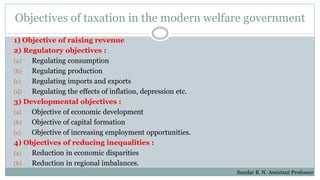

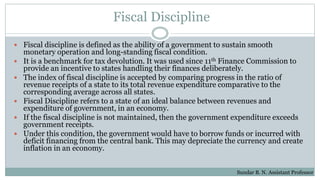

The document discusses the constitutional powers of taxation in India, detailing how the Constitution allocates tax levying authority between the central and state governments. It covers significant tax reforms and recommendations from committees, particularly focusing on the Goods and Services Tax (GST) that aims for simultaneous taxation by both levels of government. Additionally, it outlines principles of public finance, public expenditure, and various types of taxes within the Indian tax system.