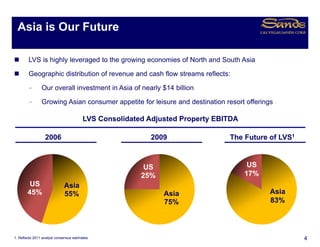

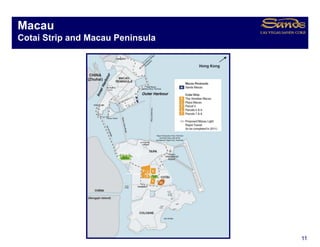

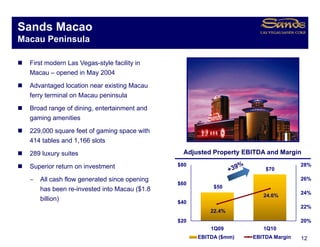

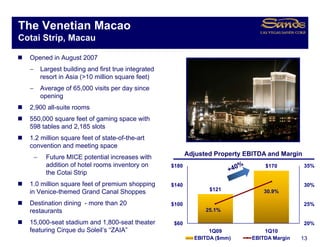

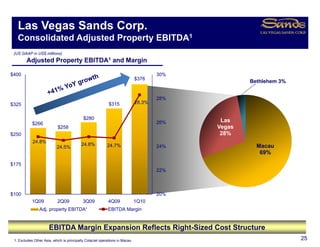

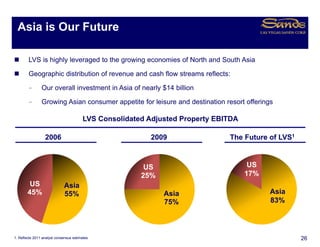

Goldman Sachs is hosting its 2010 Lodging, Gaming, Restaurant & Leisure Conference. Las Vegas Sands Corp presents an overview of its business. LVS is a leading global developer and operator of integrated resorts, with established market leadership in Las Vegas, Macau, and Singapore. Their footprint includes properties in Las Vegas, Bethlehem, Macau, and Singapore. Asia represents the future of LVS, with revenue and cash flow becoming increasingly concentrated there as their investments grow the region.